CNBC:

Morgan Stanley economic indicator just suffered a record collapse

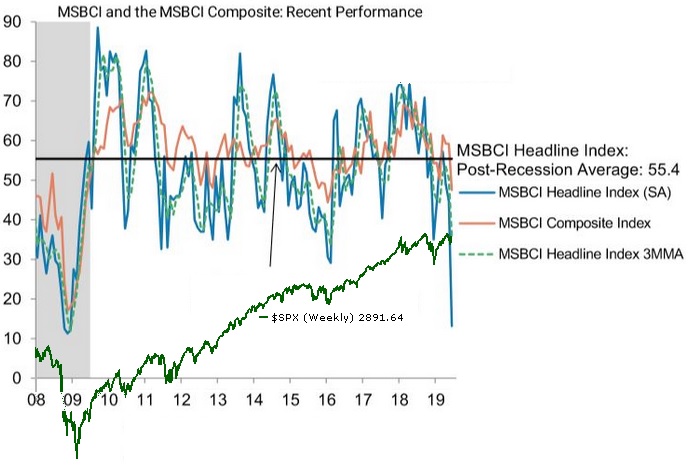

The Morgan Stanley Business Conditions Index fell by 32 points in June, to a level of 13 from a level of 45 in May. This drop is the largest one-month decline on record.

The 2008 SPX decline seemed to lag this indicator:

Rogerdodger Posted 04 June 2019

Edited by Rogerdodger, 13 June 2019 - 10:52 PM.