So says Barrons

'

I will modify it to : Worry if the Trade War continues, if Mid East flares up....otherwise expect only a few % declline

FED can't save the markets all the time; it soon becomes pushing on a string as other factors become far more influential than the actions of the FED

The range is a great home for cowboys. It’s a frustrating one for the stock market.

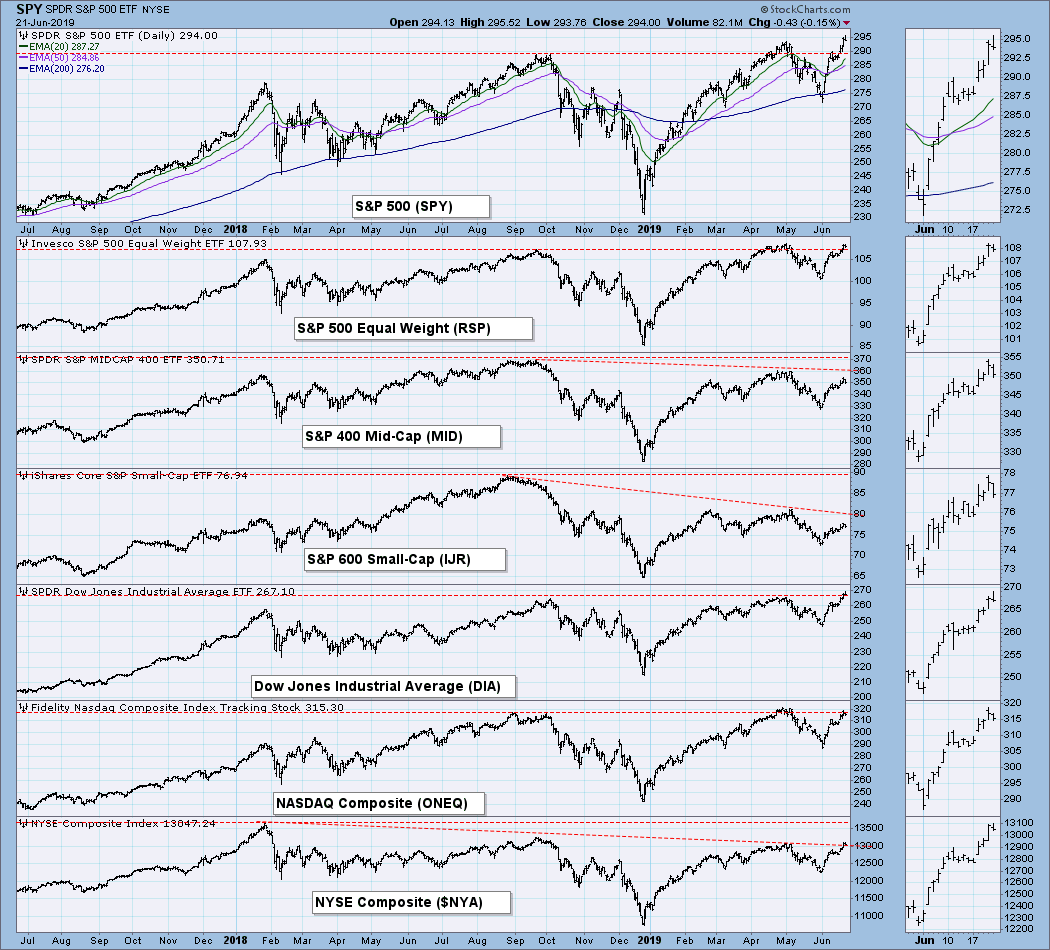

Yes, it’s tempting to ask what there is to be frustrated about, after the S&P 500index rose 2.2%, to 2950.46, this past week and even hit a new high on Thursday. The Dow Jones Industrial Average, meanwhile, gained 629.52 points, or 2.4%, to 26719.13, and the Nasdaq Composite climbed 3%, to 8031.71—just 0.4% and 1.6%, respectively, away from notching new highs of their own.

There was good reason to get excited. The Federal Reserve suggested strongly to investors that it could cut rates as early as its next meeting, in July. That’s usually great news for the stock market because lower rates generally mean higher valuations for equities, all else being equal.

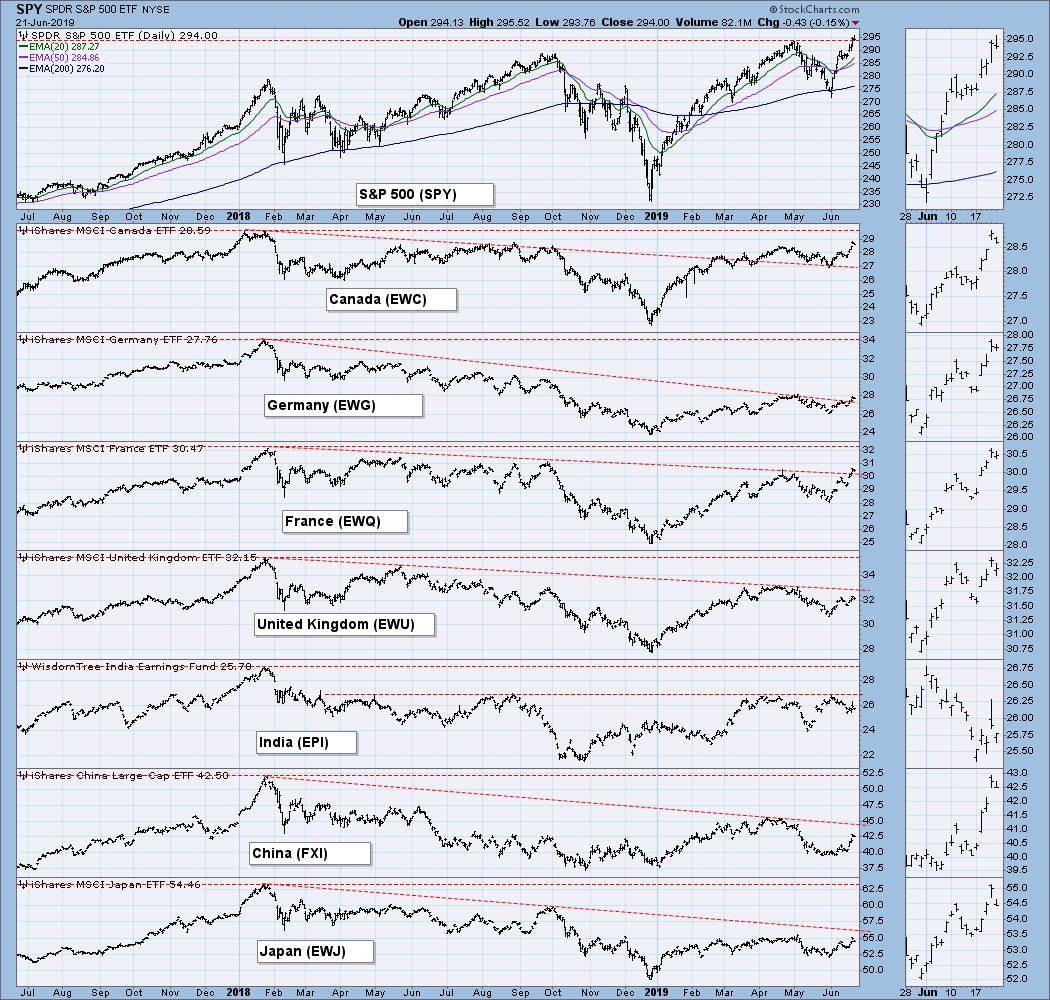

At the same time, tensions between the U.S. and China appear to be ebbing, and prospects for some sort of trade deal—or at least no new tariffs—look better than they have since early May. Not even a flare-up in tensions between the U.S. and Iran could dampen the fun all that much.

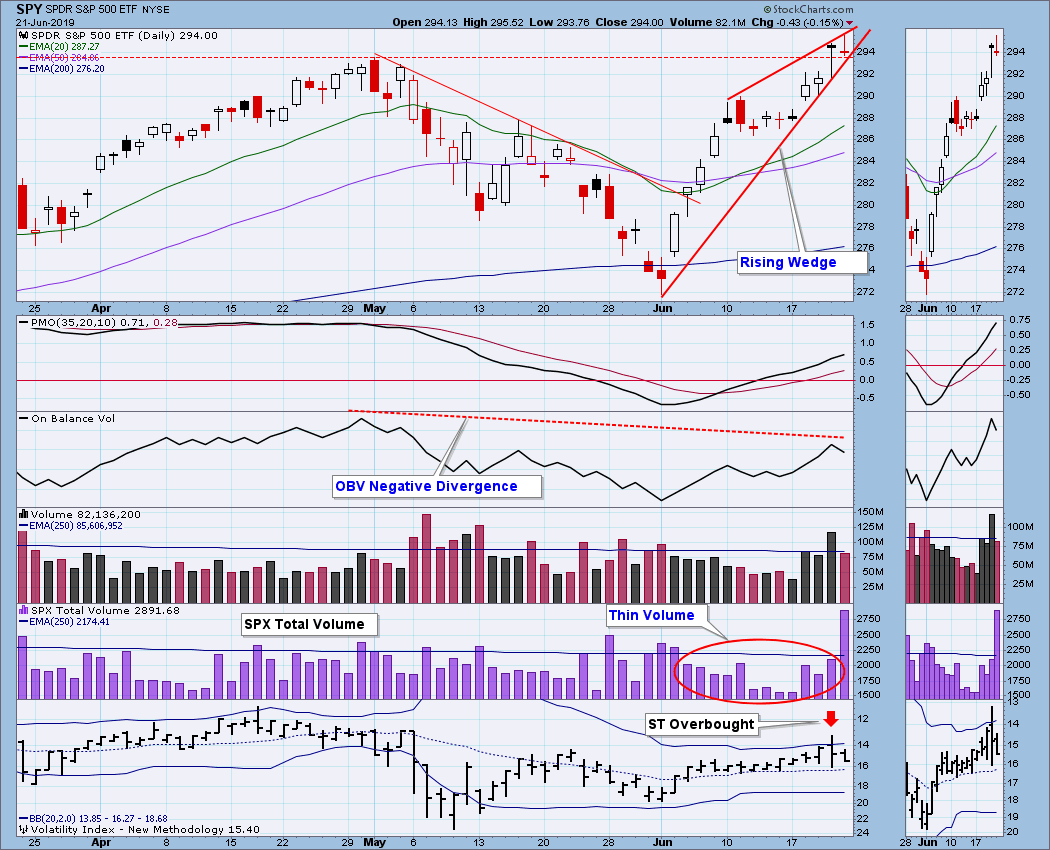

Yet we must admit that the S&P 500’s new high isn’t all that. For starters, its record close of 2954.18 was just 0.3% higher than its old one of 2945.83, hit in April, and the index followed that up with a drop of 0.1%, not another gain. It also looks like the S&P 500 might be repeating a previous pattern of touching a new high—barely—before sliding back: Its last record high in April was just 0.5% higher than its September 2018 high of 2930.75. If the S&P 500 can’t break out, then it is, by definition, stuck in a range.

Though the Fed could cut interest rates as soon as July, there’s evidence that the stock market already reflects that possibility, argues UBS strategist Keith Parker. The S&P 500, after all, now trades at 17.3 times 12-month forward earnings forecasts, according to Bloomberg data, not far off its September peak of 17.34 times.

“U.S. valuations have moved back to the highs of last fall, suggesting lower rates are priced [in],” Parker writes.

That makes the G20 gathering on June 27-28, where U.S. President Donald Trump and Chinese President Xi Jinping are supposed to meet, all the more important, says Dave Donabedian, chief investment officer at CIBC Private Wealth Management.

The trade war has already had an impact on manufacturing activity—the Empire State Manufacturing index suffered its largest tumble on record in May—but far less of an impact on consumers, who continue to spend. A détente in the trade war could help give manufacturing a boost, but another round of tariffs could cause consumers to finally throw in the towel. “The divergence won’t last forever,” Donabedian says. “The trade issue is very critical here.”

The market appears optimistic that everything will work out just fine. MKM strategist Michael Darda can’t help thinking back to the selloff in the last quarter of 2018. Back then, the S&P 500 tumbled nearly 20%, and investors were worried about a recession despite little evidence that one was on the way.

Now, the S&P 500 is trading near its all-time high, even as the yield curve—one of the most reliable predictors of a recession—has been inverted for weeks.

“It’s the inverse setup of late last year,” Darda says. “Why not be a little more defensive here?”

Why not, indeed.

Write to Ben Levisohn at Ben.Levisohn@barrons.com