JP Morgan ......The time has come to put our money where our mouth is. We are downgrading our allocation to global equities from equal-weight to underweight. The reason for this shift is simple, we project poor returns: Over the next 12 months there is now just 1% average upside

Here rests the Last BEAR, killed by doves... market then crashed!

#21

Posted 08 July 2019 - 05:44 AM

#22

Posted 08 July 2019 - 08:50 AM

Strong dip buying this morning

I want to see volatility spiking upwards before building any major SHORT position in anything

Still holding 9 QQQ puts (in the green today) and a small short TLT position but my main trading profits past two weeks have been in NQ daytrading.

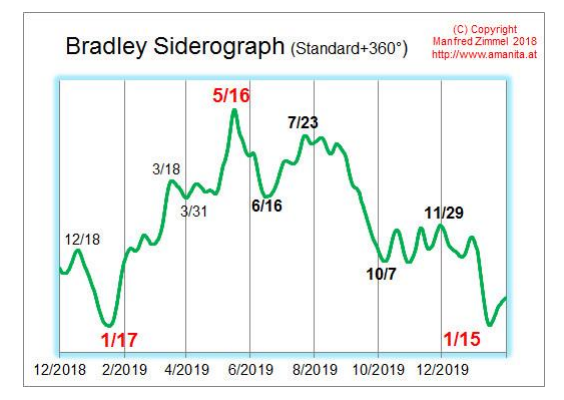

Not a fan of this BRADLEY thing, but many people are:

There is a bolded Bradley date coming on 7/23.

#23

Posted 08 July 2019 - 12:03 PM

that SPX 2940/45 zone represents strong support.

Market could find support there and then zoom ahead after this current pullback

BUT, it is more likely SPX trades with a 2800 handle before any major UP move.

This not been a strong selling day, there is dip-buying, and so far we have not seen any indication of BEARS seizing control; hence, do not be surprised if the market roars ahead to wipe out today's losses.

#24

Posted 08 July 2019 - 01:23 PM

Dip buyers will keep this market floated until the Fed day late this month......................

#25

Posted 08 July 2019 - 03:39 PM

FED will be getting increasingly hawkish as they try to tamp down the insatiable appetite for rate cuts from a market behaving like a spoiled brat that is ready to throw tantrums if they don't get its way.

So, expect a 25bps rate cut and hawkish comments/commentary/press conference on the same day.

Here, market, take a bone, and now go out and play in the yard, we got no more for you until way down the line, if there is any at all.

So how does the market force the FED's hand for more rate cuts? Simple, easy: crash the market to SPX 2700 or lower and you will get a slew of rate cuts! But, we do not want the markets down while we want rate cuts to take it higher!

No, you can't have BOTH.

"it becomes much harder for the Fed to justify cutting rates. It seems the market has to be prepared for a Fed meaningfully more hawkish at its July 31st meeting than currently priced in." - BofA