Take care of the PUT holders who foolishly held on to their PUTS that will expire this week; then go after the CALL holders who think they were making a killing and greedily held on, and then what?

Down for a few days, I think, and up into FED meeting at end of July.

Then, down again.

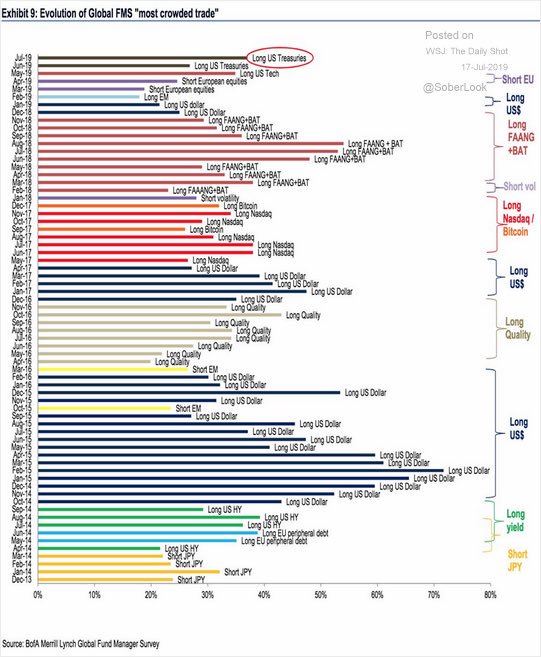

That FED minutes released today, two weeks before a 50bs cut, is about one of the top 5 strangest situation I have ever encountered in the markets during the past 30 years.

Labor shortage? good economy? record equity? and you want to CUT rates?

This will not end well after the initial post-cut melt-up.