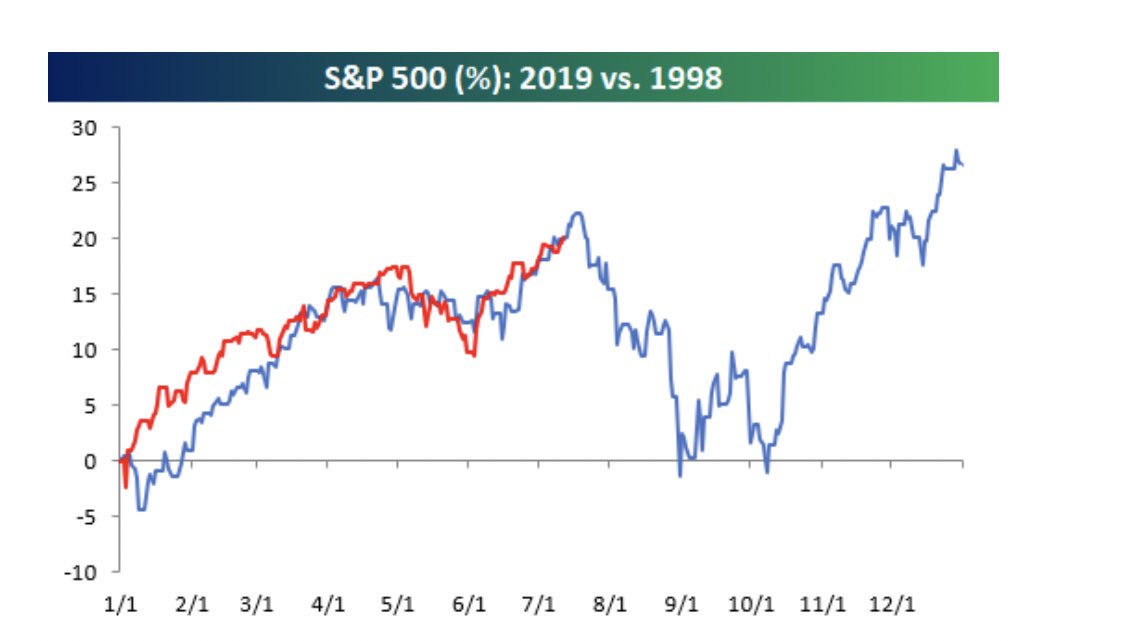

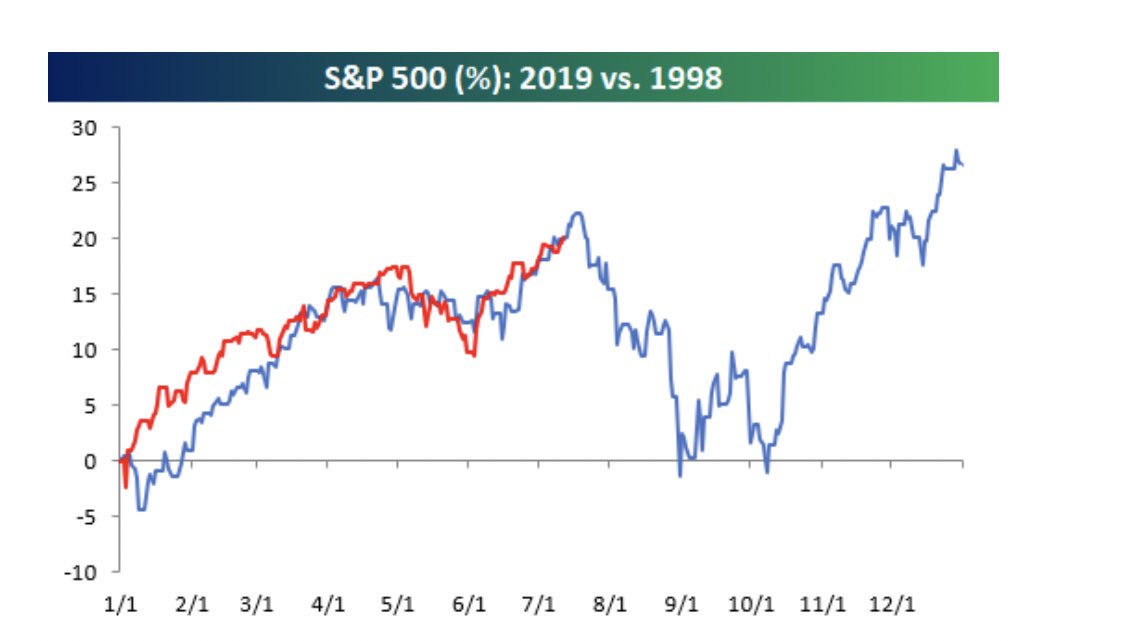

This would make for a wild & exciting, and very profitable, year!

The S&P 500′s performance so far this year has an “uncanny” resemblance to the index’s showing in 1998, and if history is any guide, the rest of the year could be a roller coaster for stocks.

Source: Bespoke

The S&P 500 has soared in 2019, with the index up nearly 20% since the start of the year. It hit an all-time intraday high at 3,017.80, and record close of 3,014.30 on Monday, marking the ninth all-time intraday high and and 11th record close of the year. The benchmark slipped slightly Wednesday.

Bespoke Investment Group screened the nine times in the index’s history that the S&P 500 was up more than 20% at this point in the year and the firm found a striking resemblance to the last time this was the case, in 1998.

In 1998, the S&P 500 peaked in late July around 1,184 but by the start of September, the index gave up all of its year-to-date gains because of the Russian debt crisis and the blow-up of hedge fund Long Term Capital Management, Bespoke said.

In the subsequent month after reaching its high in July, the S&P 500 lost nearly 8%, in the subsequent three months the index lost more than 15%.

The S&P 500 continued to sell off and hit a low in October of around 959.

However, once the debt crisis was over, the S&P 500 surged more than 25% from mid-October until the end of the year. The index ended the year up more than 4% since its earlier high in July around 1,229 and up more than 26% for the year.

Near-term threats that could send stocks tanking, like they did in July 1998, include a further breakdown in the U.S.-China trade war and a more severe economic slowdown.

https://www.cnbc.com...f-the-year.html

Meanwhile, on the trade front: a phone call to arrange resumpttion of talks

https://www.cnbc.com...r-thursday.html