FROM THE LINK:

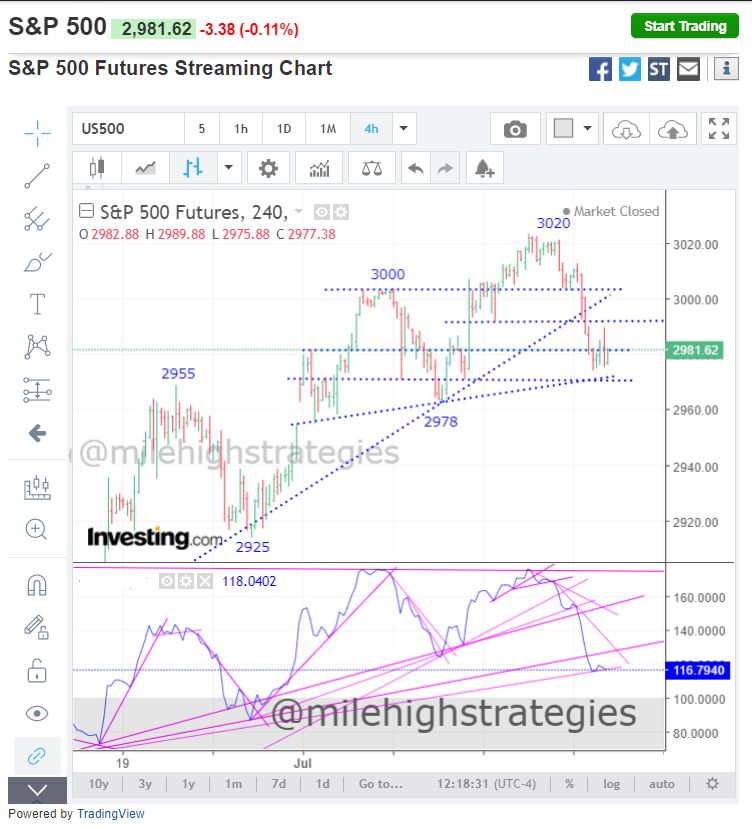

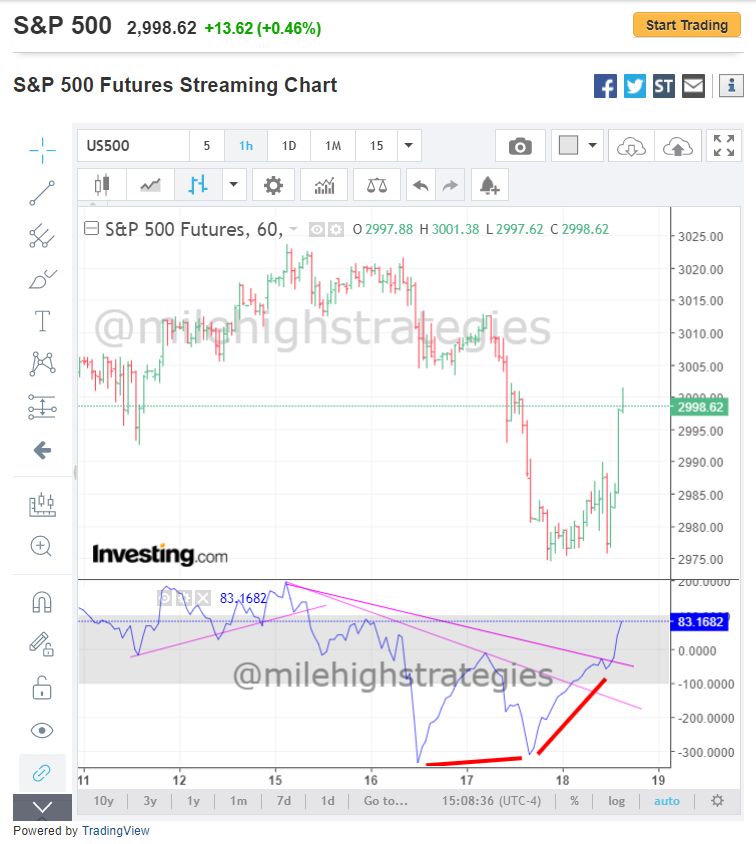

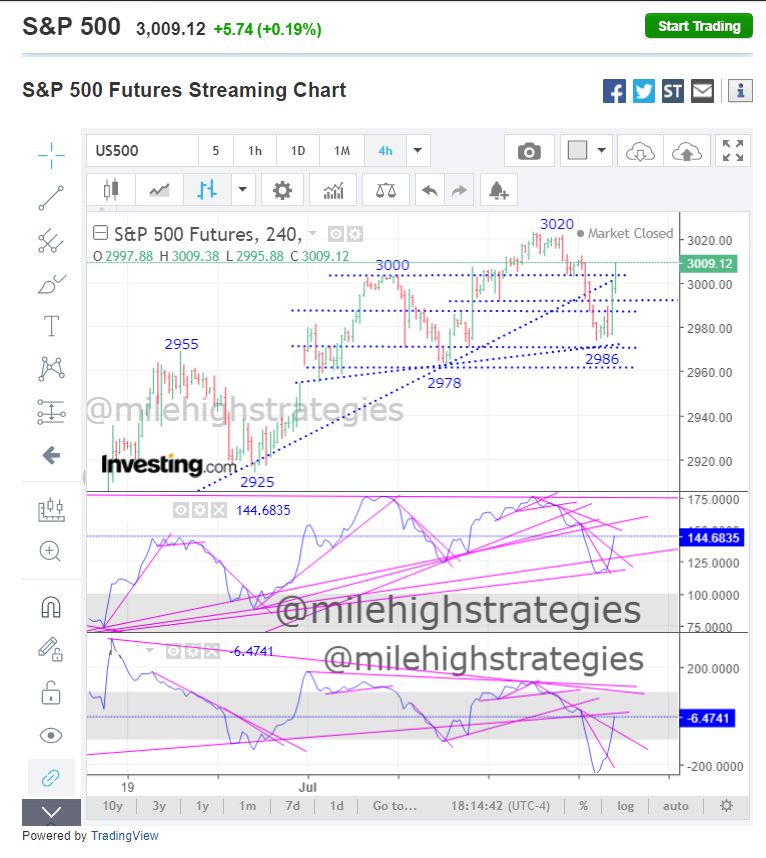

With the NYSI declining, one can only assume swing traders will be looking for short entries, options traders playing puts predominantly (see the post below), and long-term investors should tighten stops to their individual risk tolerance or just hold their breath and hope not to die.

Of note: NFLX after the bell reported earnings, a shortfall in expected subscriptions, and is getting clobbered in overnight trading. That may set a tone for trading tomorrow. Intriguing how often news comes along from somewhere to agree with the NYMO/NYSI breadth indicators.

FOR THE STORY AND THE FEAR-AND-GREED CHART