It's been a really long time since I have seen anyone mention it, but this is not just anyone but Sentiment Trader.

Anyway, this was one of those top 10 trading days for daytraders when the market had a realtively long range with the bulls coming back from down there to SPX 3K.

Still, I am bearish and will be so unless there is a new SPX high.

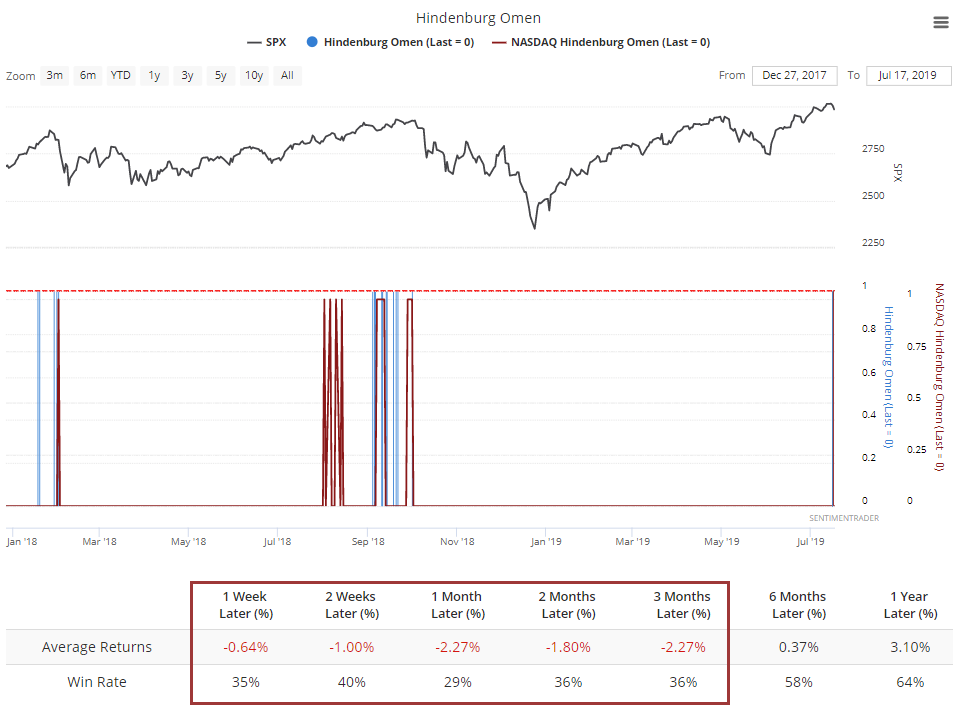

Skeptics cue the  , but today was the first time since early last October when both the NYSE and Nasdaq triggered Hindenburg Omens. There have been 199 signals since 1962. Future returns were

, but today was the first time since early last October when both the NYSE and Nasdaq triggered Hindenburg Omens. There have been 199 signals since 1962. Future returns were