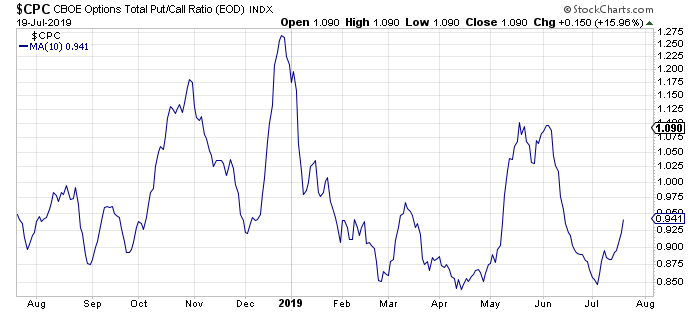

Daily higher high, Weekly higher high.... Wheres the confusion? The market sold off because of the correction by the fed made on Thursday eluding to there would be a 50 BP drop... Now they said only .25 thus the reversal of thursday on friday.

So would you have went long on thursday at support?

KISS