Market choppy and aimless but I expect it to get more active soon

NO trade during the past 30 minutes

tell that to the sp500 up 15.10 the equivalent of 150 dow pts.....

Posted 26 July 2019 - 10:06 AM

Market choppy and aimless but I expect it to get more active soon

NO trade during the past 30 minutes

tell that to the sp500 up 15.10 the equivalent of 150 dow pts.....

Posted 26 July 2019 - 10:15 AM

My read says SPX 2987 early Monday on a gap down then 3041/42 by Friday next week, a topping process or double top on August 14 and then down hard, about 20% into early November. The Dow 30 will play catch up fast after Monday. I will explain more with graphs in my blog this weekend.

Posted 26 July 2019 - 02:34 PM

where are the bulls eh....:>)

Well, at NAAIM 75% of those traders are 90% or more long. It can get more excessive, but it usually doesn't before a correction. Obviously, the end of Bull isn't likely to be any time soon with such AAII readings, but there are at least some excessively Bullish players.

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

Posted 26 July 2019 - 02:44 PM

where are the bulls eh....:>)

Well, at NAAIM 75% of those traders are 90% or more long. It can get more excessive, but it usually doesn't before a correction. Obviously, the end of Bull isn't likely to be any time soon with such AAII readings, but there are at least some excessively Bullish players.

ya....me n u....snorrt

Posted 26 July 2019 - 05:08 PM

for sure when the stock market is going to start a big drop, you don' t find in the media any article such this one, simply because no one ring the bell before the stock market crashes. The herd might run away.......

forever and only a V-E-N-E-T-K-E-N - langbard

Posted 26 July 2019 - 05:24 PM

MANY traders doing this but it could become too crowded and send VIX down to 9 or 8

That would be the SHORT QQQ & SPY OF THE CENTURY!

A trader is making a big bet on a scary market downturn in the next four weeks

https://www.cnbc.com...ce=twitter|main

well, I' m making a big bet that next Sunday evening I will be playing tennis on clay court. Don' t know if the media are interested in publishing this important new...

forever and only a V-E-N-E-T-K-E-N - langbard

Posted 26 July 2019 - 07:53 PM

Excellent vid

https://www.youtube....e=youtu.be&t=61

Edited by tradesurfer, 26 July 2019 - 07:54 PM.

Posted 26 July 2019 - 08:23 PM

for sure when the stock market is going to start a big drop, you don' t find in the media any article such this one, simply because no one ring the bell before the stock market crashes. The herd might run away.......

in 0ct 2018 the government sent a bell ringing test to everyones cell fone......bells rang on the day of the hi

Posted 27 July 2019 - 08:43 AM

My read says SPX 2987 early Monday on a gap down then 3041/42 by Friday next week, a topping process or double top on August 14 and then down hard, about 20% into early November. The Dow 30 will play catch up fast after Monday. I will explain more with graphs in my blog this weekend.

I'm looking for a setup to trade some VXX again....We shall see how this plays out.... I'm still trading VXF from the long side (daily data) , but using a much smaller position now.... VST trading both ways....

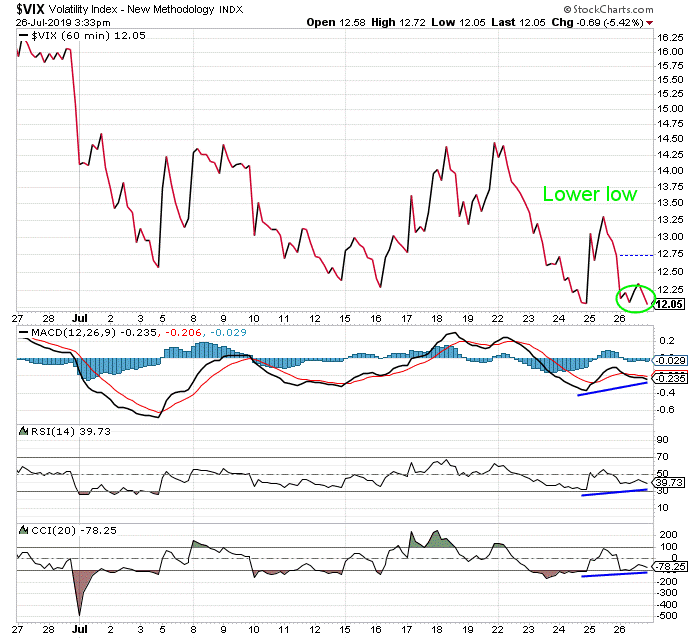

https://stockcharts....164&a=678106938

Today I’m featuring another essay from my friend and managing editor, Mike Merson.

While the market screamed higher yesterday, Mike had his eyes glued to the Volatility Index. And what he spotted is right in line with my thinking.

Read on to see how you should prepare for the week ahead…

You’d be forgiven for not watching the CBOE Volatility Index (VIX) yesterday…

The S&P 500 ripped about 10 points higher on the open, and just kept going. By the close, the index had set a new all-time high of 3025.

Meanwhile, the VIX – a measure of investor fear in the market – closed at 12.13… almost 5% lower than the previous day. At that level, volatility is near its lowest point of the year.

But it won’t be for long…

Let’s take a look at the hourly VIX chart…

The S&P 500 is forming a short-term bearish rising wedge pattern. These patterns tend to resolve to the downside.

We can also see modest declines in the various momentum indicators. That tells us there was lower momentum behind last week’s bullish move – the exact opposite of what’s happening with the VIX.

Once the S&P breaks down from this pattern, it could fall all the way to its major support at the most recent low of 2975. From yesterday’s closing price, that would be a loss of about 1.6%. If it breaks that level, we could see the S&P spill all the way to its next support at 2915 – a 3.6% loss.

Like we’ve been saying all through the last hurrah of this bull market, investors should use any strength this week to take some gains off the table.

The bullish move since the start of July could soon be erased.

Regards,

Mike Merson

Managing Editor, Market Minute

Edited by robo, 27 July 2019 - 08:50 AM.

" “There is only one side to the stock market; and it is not the bull side or the bear side, but the right side” Jesse L. Livermore