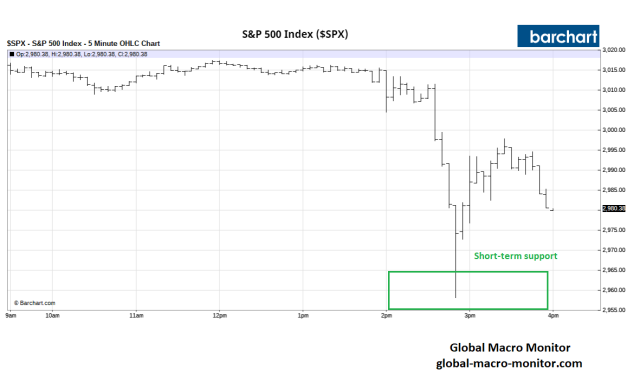

It is more about the Trade Talks collapsing rather than the FED miserly 25bps and relatively hawkish FED talk.

I do not see a steep decline but lots of back & filling with a general IT down trend during the next few weeks.

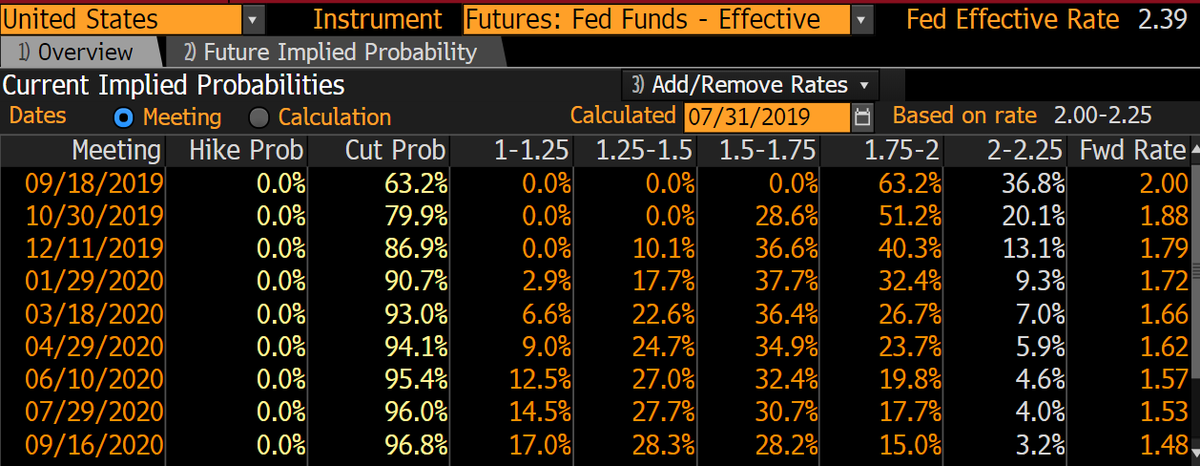

All this can change with a few words from the FED via Powell and other FED members.

But, August may be a dull boring low-volume trading month, good time to rest & recover for the September to December period.

Dow drops 330 points in worst day since May after Powell hints rate cut not the start of a trend

https://www.cnbc.com...n-a-decade.html