"...So, is it fire or ice? If the Federal Reserve is casting a big chill by holding its federal-funds target rate (just lowered by 25 basis points to 2%-2.25%) above the policy rates in the rest of the world and most of the Treasury yield curve, it could imply that a recessionary winter is coming. But the risk of a downturn arguably comes more from the administration’s trade and currency policies, as Thursday’s Wall Street Journal editorial pagecontended.

"When the Fed eased in 1998—in reaction to financial and economic problems abroad and while the U.S. economy was growing nicely—it wound up heating up asset markets and helping to inflate the dot-com bubble. Valuations generally aren’t as egregious as in that era, but cheap capital still is continuing to provide funding to money-losing companies with dubious chances for profitability. And while various economic indicators denote a slowing, new claims for unemployment insurance—a leading indicator of the labor market—remain at a historic low. That feels more toasty than chilly."

Some say the world will end in fire,

Some say in ice.

From what I’ve tasted of desire

I hold with those who favor fire.

But if it had to perish twice,

I think I know enough of hate

To say that for destruction ice

Is also great

And would suffice.

Financial markets were probably furthest from the mind of Robert Frost when he penned his famous verse almost a century ago, but it resonates in recent events.

The collapse of interest rates worldwide to zero and below suggests a financial world that is dark and cold, frozen and lifeless. Yet the plunge in bond yields to historic lows correspondingly results in high values for assets from residential and commercial real estate, speculative-grade debt, and especially common stocks, which surely makes for a warm feeling for owners of those assets.

This past week’s bipolar market action makes the question more than an intellectual conundrum; it affects practical investing decisions to meet goals for retirement, education, or future generations. Interest links the present with the future. Savers reap the reward for the restraint of their present appetites, while borrowers are able to bring forward either spending or investments that will pay off later. Interest always has been greater than zero, given that humans would rather have something sooner rather than later and have to be bribed to wait.

But why should savers always expect interest on money they set aside? That’s what Robert Kessler, who heads Kessler Investment Advisors, a Denver-based firm that specializes in managing Treasury portfolios, provocatively asks. In Germany, investors pay 50 basis points (one-half of a percentage point) to guarantee the safe return of their money.

A negative interest rate might actually be an outgrowth of demographics and technology, writes Joachim Fels, global economic advisor at Pimco, the big bond manager. That’s contrary to the typical view that negative rates are an unnatural state of affairs imposed by the European Central Bank, the Swiss National Bank, the Bank of Japan, and others.

But rising life expectancy increases desired savings, Fels continues. People may no longer value present consumption over future consumption, as in past generations, when they often died before they retired and struggled to meet current needs. To transfer purchasing power to the future, they may accept a negative interest rate and save more. New technologies also reduce the need for capital and are becoming cheaper, cutting the demand for investment, he adds, which also lowers the floor on interest rates.

As European investors rushed to secure their savings, all maturities of German Bunds—the benchmark for euro-denominated bonds—sank below zero percent. So investors who held a 10-year Bund would realize an annual loss of 0.56% if held to maturity. But they might eke out a positive return over a shorter time horizon.

Assume that you bought a 10-year Bund at the then-prevailing yield of minus 0.40%, to use an example from DWS Group. Assume also that you were to hold it for a year and the yield curve remained unchanged. You then would have a nine-year bond with a lower yield of minus 0.49%. That lower yield would result in a price gain and a positive total return, according to DWS’ calculations.

That theoretical example is borne out by the 0.46% positive total return on seven-to-10-year Japanese government bonds since their yields first fell into negative territory in February 2016. It’s not much, but it’s still positive

Yet there is no doubt that the negative-interest-rate policies of the ECB, SNB, and BOJ are part of their efforts to revive growth, along with other unconventional ones involving purchases of all manner of assets, extending from government securities to corporate debt and even equities. Those efforts have succeeded more in pumping liquidity into the financial system than in reviving growth.

That so-called quantitative easing was only partially undertaken to boost their economies. To Mark Grant, chief global strategist at B. Riley FBR, this “money for nothing” was printed to cover government budgets. Otherwise, tax increases or spending cuts would be needed, which would mean the ouster of the politicians in power.

The U.S. has no trouble financing its budget deficit running at an annual rate of $1 trillion, in part due to the “exorbitant privilege” resulting from the dollar’s status as the main reserve currency. Indeed, President Donald Trump complains continually about the strength of the greenback, owing to the attractiveness of U.S. investments, which stems from offering some of the highest yields on the planet along with unmatched liquidity and safety.

Despite this sunny-side-up view, Kessler predicted here almost exactly a year ago that the 10-year Treasury yield would head toward 1% in the next recession. That was contrary to the predictions of other high-profile seers who contended that the benchmark note was headed to 4% or higher. In recent days, however, more than a few have predicted that U.S. interest rates could follow those abroad to zero, or below, along with the resumption of quantitative easing, including Pimco’s Fels, among others.

The question is whether such a collapse toward the zero bound would occur in a recessionary plunge in markets for stocks and other risk assets—in an economic and financial Ice Age, as Société Générale’s Albert Edwards has long predicted.

Grant, by contrast, expects that a drop in U.S. interest rates to new lows will light a fire under prices of assets from stocks to corporate bonds to real estate. Lower interest rates should spur a new round of borrowing, allowing borrowers to refinance debts at reduced costs. Lower risk-free rates then would make returns on other assets relatively more attractive. But, he adds, once rates get close to zero, diminishing returns from cheap credit will set in.

Or the heat from still-lower yields could produce a lukewarm result, merely staving off a deep freeze. Lots of cheap credit will impede, but not halt, a global weakening, writes David Levy, head of the Jerome Levy Forecasting Center.

“Companies in dubious financial positions have been able to roll over loans, fill holes in their cash flow, and postpone cutbacks,” he writes in the advisory firm’s latest report. Governments in dicey shape also have been able to fund deficits with remarkable ease. All of this has slowed, but not eliminated, the erosion of profitability and growth.

So, is it fire or ice? If the Federal Reserve is casting a big chill by holding its federal-funds target rate (just lowered by 25 basis points to 2%-2.25%) above the policy rates in the rest of the world and most of the Treasury yield curve, it could imply that a recessionary winter is coming. But the risk of a downturn arguably comes more from the administration’s trade and currency policies, as Thursday’s Wall Street Journal editorial pagecontended.

When the Fed eased in 1998—in reaction to financial and economic problems abroad and while the U.S. economy was growing nicely—it wound up heating up asset markets and helping to inflate the dot-com bubble. Valuations generally aren’t as egregious as in that era, but cheap capital still is continuing to provide funding to money-losing companies with dubious chances for profitability. And while various economic indicators denote a slowing, new claims for unemployment insurance—a leading indicator of the labor market—remain at a historic low. That feels more toasty than chilly.

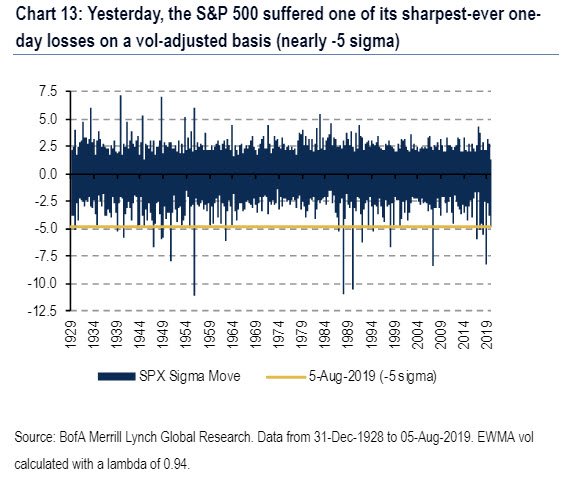

Last week’s column’s shark theme carried over as beaches in Nantucket, one of Wall Street’s favored vacation spots, were closed because of shark sightings, Peter Tchir, head of macro strategies at Academy Securities helpfully reports. The Dow Jones Industrial Average wound up with a loss of 0.75%, the net result of a wild week that started with a 2.9% plunge, the biggest of the year, followed by 1%-plus gains Tuesday and Thursday, while small net dips Wednesday and Friday masked larger intraday swings.

The preceding week’s treacherous action, which followed the escalation of trade tensions from the announcement of a 10% U.S. tariff on Chinese goods, left the stock market at a tipping point, Louise Yamada, who heads the market advisory bearing her name, advised her clients in her monthly report published Aug. 3.

As for which way it could tip after this latest week, she said Friday the lack of a follow-through indicates it may take some time for the market’s direction to play out. Her indicators “are still fragile” in sending a buy signal, which would reverse the sell signals registered last October, when the Dow was roughly at current levels.

Gold, by contrast, is in the early stages of a bull breakout from its six-year base. During that period, the Dow had outperformed the precious metal, but a reversal of that relationship appears to be developing, Yamada added. Gold has moved up from $1,300 an ounce in late May to over $1,500, while the dollar has held relatively steady, and it could reach $1,800, she indicated.

Yamada likes both bullion via an exchange-traded fund such as SPDR Gold Shares (ticker: GLD) and mining stocks though an ETF such as VanEck Vectors Gold Miners (GDX), although she leans slightly toward the metal itself. Another thing to ponder: For the first time in history, gold actually provides a better yield than currencies that sport negative interest rates.

Write to Randall W. Forsyth at randall.forsyth@barrons.com

https://www.barrons....end-51565369599