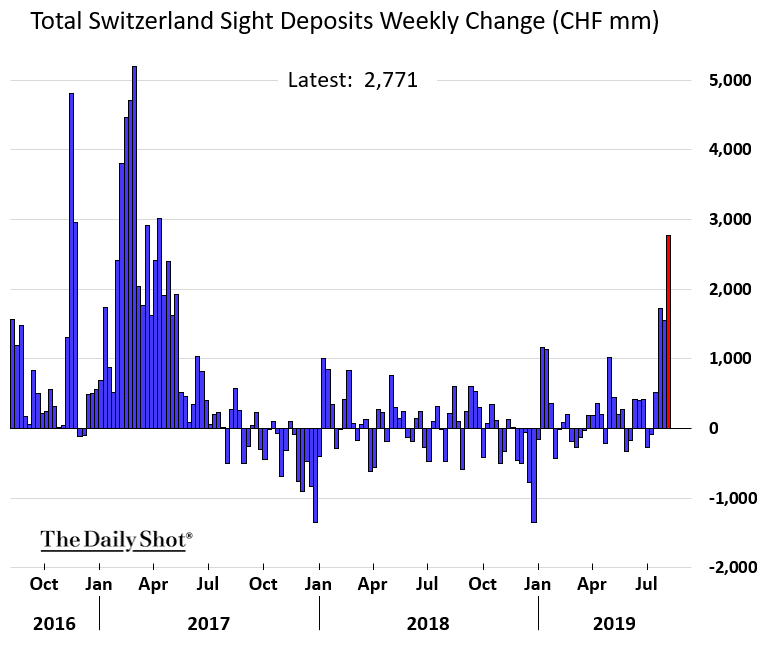

Alexandra Scaggs covered bond investors' flight to safety in the latest issue of Barron's. She wrote:

Something is gnawing at the market—fears of a looming recession, perhaps, or an escalation of the trade spat between the U.S. and China, or even a Chinese military response to the weeks-long protests in Hong Kong that could spark a regional conflict and draw in other countries. Global markets are 'expecting Armageddon,' as one trader wrote in a note to clients on Wednesday.

Around the world, even the safest bond markets are priced for bad outcomes, and fixed-income investors should prepare for a bumpy ride. The amount of debt with negative yields topped $15 trillion last week for the first time, according to the Bloomberg Barclays index.

That investor caution has been good for the price of gold as well, which rose 0.6% today, to $1,505.30 an ounce. It's now up 17.8% year-to-date. The metal acts as a safe haven for investors when riskier assets like stocks decline. Lower interest rates also reduce the opportunity cost of holding gold, which doesn't pay any yield.