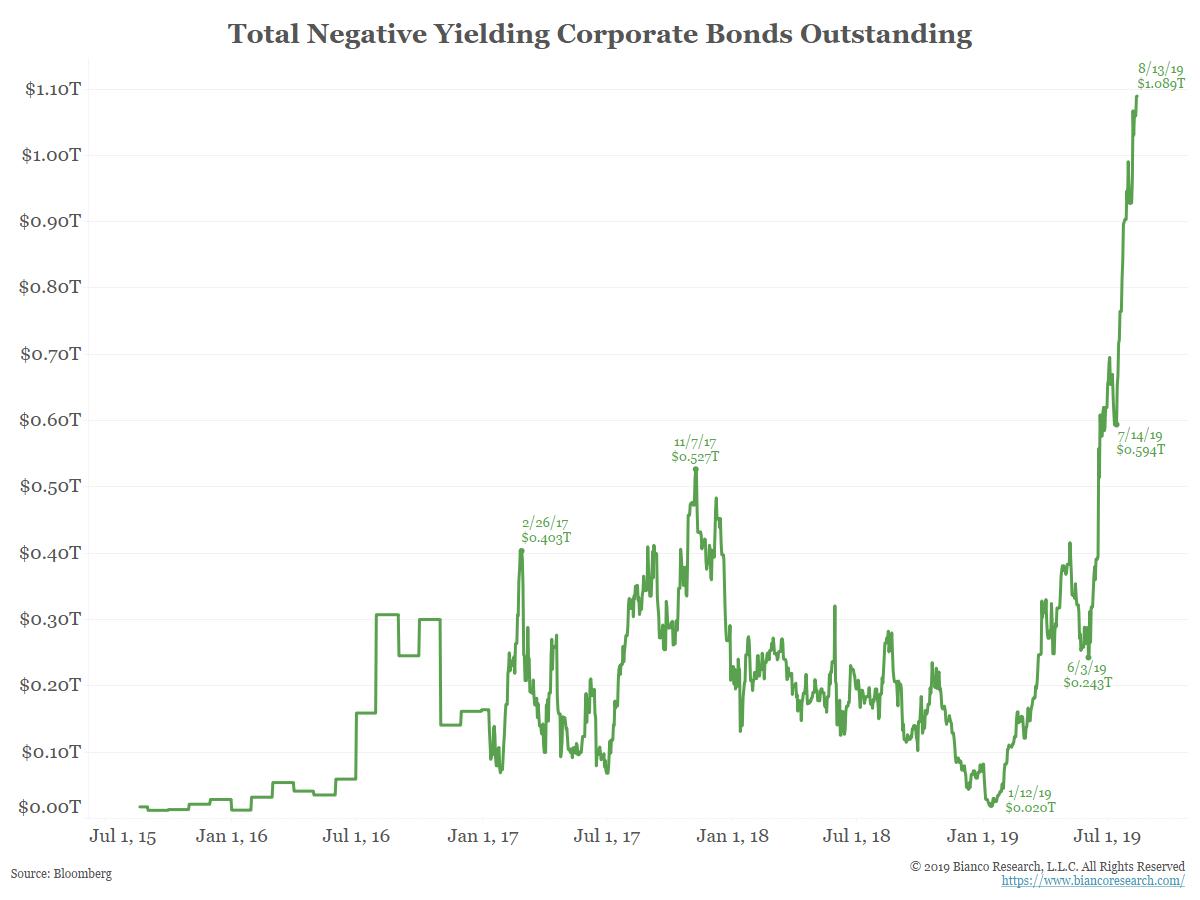

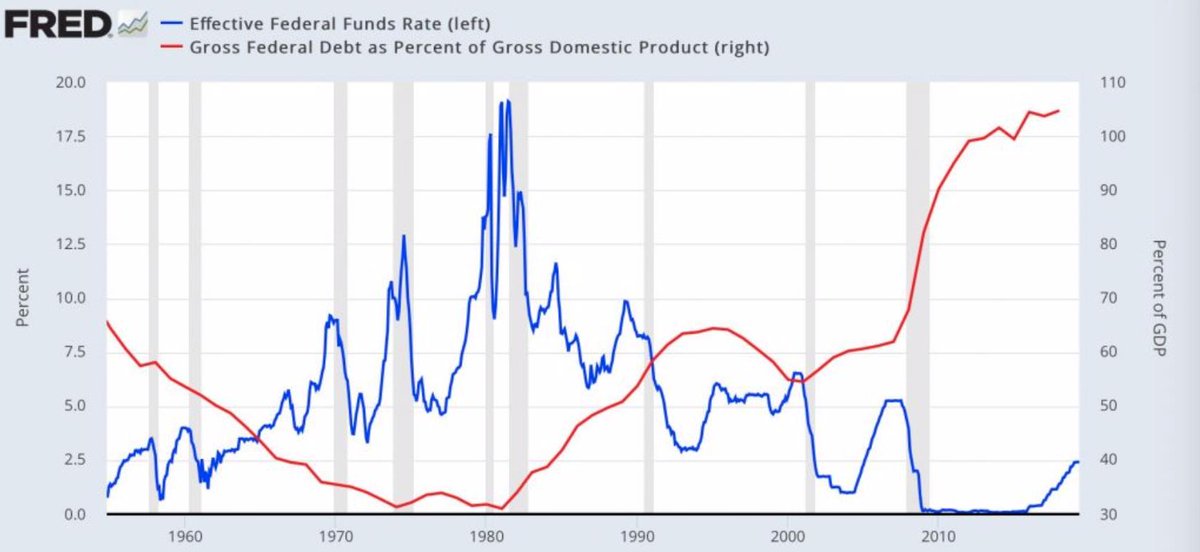

We've never faced a recession with so much debt and so little Fed ammunition available and with negative rates still in effect in many places There's no playbook for this. Historic data will be of little use.

4:45 AM - 14 Aug 2019

Loved Art Cashins comment last week!! "It really is different this time because we've never been here before"!!