If you buy the Austrian 100Y bond today at 200 cents, at maturity in 2117 you will get half your money back. You will also be dead

Posted 15 August 2019 - 05:58 AM

If you buy the Austrian 100Y bond today at 200 cents, at maturity in 2117 you will get half your money back. You will also be dead

Posted 15 August 2019 - 05:59 AM

Gallows humour.

But, seriously: no, it is not the end !

"Thank you for calling the Plunge Protection Team. We are currently experiencing unusually heavy call volume, but your call is important to us..."

Edited by dTraderB, 15 August 2019 - 06:01 AM.

Posted 15 August 2019 - 06:02 AM

2822 SPX swing test first thing. Futures were down 35 points in AH at 2822, so more like 2790......

Posted 15 August 2019 - 06:03 AM

TRIN - WOW - 3.6 at the close - Selling and short selling gone wild. This means that sellers are all gone, so expect futures to be way UP at the open... That's all. After the gap up, then the Bear Bull deal begins. Possible shorting opportunity.

SPX Volume Advance and Decline Percent - went to a sell yesterday. Needs some follow through for verification.

QQQ and Breadth - on a sell signal

NASDAQ - Breadth on sell signals - the question is whether AAPL and MSFT can hold up this monster.

Basic Material - Being a material guy was cool for awhile - now the Material Girl looks like it is folding

Posted 15 August 2019 - 06:22 AM

Nice rally but on very low volume....

Still, it's up on Walmart news but more bad news from :

GE FALLS AS MUCH AS 7% PRE-MARKET ON MARKOPOLOS ALLEGATIONS

CISCO SLUMPS 9%; POISED TO OPEN AT LOWEST SINCE JANUARY

Posted 15 August 2019 - 06:35 AM

crazy market, 20-point ES one-minute bar

ST low may be in place as China puts out soothing words

Posted 15 August 2019 - 07:06 AM

It will take a lot to convince many of the experienced traders that there is massive manipulation of markets, especially in recent times!

That's why I daytrade

This:

US Futures Slide, Yields Plunge After China Spurn Trump, Vows Retaliation

Followed by this:

Why futures just exploded higher: CHINA HOPES U.S. CAN MEET HALF WAY WITH IT ON TRADE ISSUE: HUA

Posted 15 August 2019 - 07:26 AM

Exciting times ahead:

zerohedge Retweeted Hu Xijin 胡锡进

Global Times troll now daring Trump. This won't end well

zerohedge added,

Posted 15 August 2019 - 07:30 AM

Bring it on!

'Hindenburg Omens' & "Titanic Syndromes'

"For one thing, there has been a cluster of “Hindenburg Omens” and “Titanic Syndromes” recently. Both are indicative of a growing lack of trend uniformity and weakening market internals. A brief explanation: the Hindenburg Omen is a sell signal that occurs when new highs and new lows each exceed 2.8% of advances plus declines on the same day. The Titanic Syndrome is triggered when 52-week lows outnumber 52-week highs within seven days of an all-time high in the index concerned."

https://www.zerohedg...tanic-syndromes

Posted 15 August 2019 - 10:07 AM

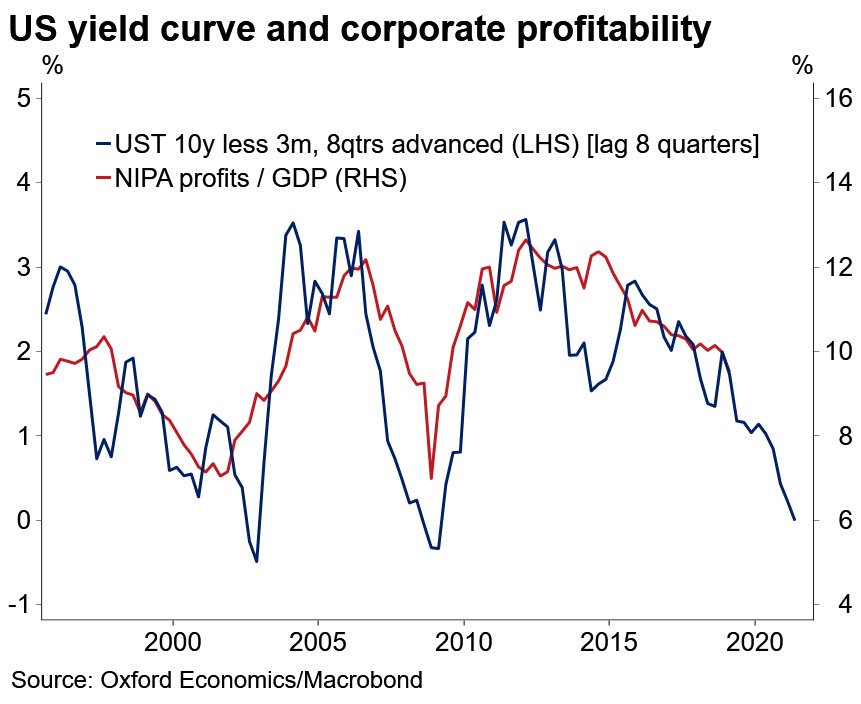

Is a global recession knocking at the door? Don't think so but conditions are ideal for such a few months ahead. Central Banks still have time but will the politicians cooperate?

Oops! US 30y yields drop below 2% for first time in history as bond mkts scream recession.

10:28 PM - 14 Aug 2019