As foretasted yesterday, the bounce is on, and may last for some time on an IT basis.

I am off on vacation from tomorrow, to rest and recuperate, ready for the final 4 months that could be extremely volatile.

My FF is for a generally up market until the end of September, with a few spikes down in August, even as low as SPX 2750 or lower, but the markets will be pricing in the big 50bps cut in Sep as well as full-fledged QE.

In addition, Trump will finesse the Trade War with a minor deal that will be declared victory but that is politics and they all do that.

So, with the above, the markets will melt-up until late September or early October, ad then collapse to test the December 2018 lows.

Expect SPX 3150 to 3200 highs then the drop.

Do not fight the FED and the power of politicians.

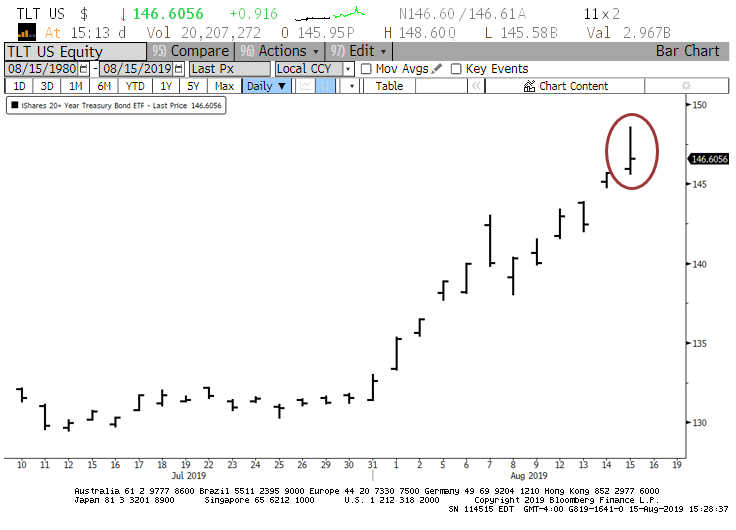

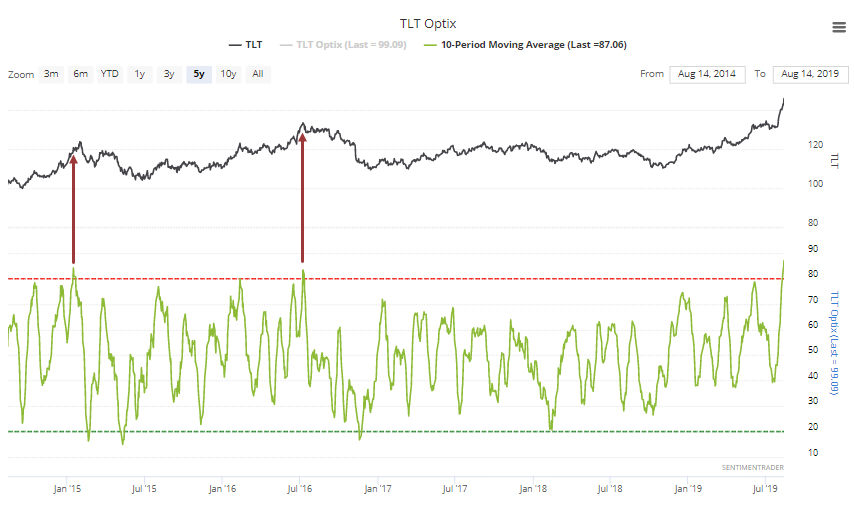

I hold QQQ calls, XLF, and TLT short

Will add a few more calls and also a few bank & tech stocks to my LT portfolio but will close these by end of Sep or earlier.

Of course, I will monitor the markets and trade accordingly.

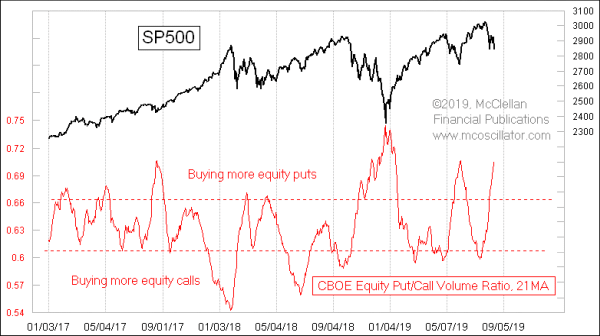

My latest Chart In Focus article, "Equity Put/Call Volume Ratio’s 21-Day MA", is posted at https://www.mcoscillator.com/learning_center/weekly_chart/equity_put_call_volume_ratios_21-day_ma/ …