FED pumping serious money into the system... WHY?

FED meeting soon

Logically, the explosive move should be UP....

I will take the other side of this move when it happens

Posted 23 October 2019 - 04:08 PM

FED pumping serious money into the system... WHY?

FED meeting soon

Logically, the explosive move should be UP....

I will take the other side of this move when it happens

Posted 23 October 2019 - 04:10 PM

And I'll tell you another thing. I remember the days when markets freaked out anytime the Fed did inter-meeting monetary policy. Surprises in the past crushed stocks and launched bonds.

Posted 23 October 2019 - 05:15 PM

Dave Collum Retweeted New York Fed

Translation: We have created an emergent, metastable banking system that is so dangerous that all we can do at this point is print gobs of fng money...

Dave Collum added,

The average person on the street probably doesn't realize that the Fed is responding to smoke coming out of the banking systems tailpipe, flames shooting out of the hood, and every warning light flashing bright red. Repo rates spiking to 10%? Nooo problem. We'll print.

Posted 23 October 2019 - 05:36 PM

REPO is a hot topic

Printing money to buy stocks and inject money into the repo market, because banks believe that banks they loan to overnight have a high likelihood of collapsing *overnight* isn't bearish?

Making this a telegraphed, ongoing operation was supposed to shore up confidence and make this repo mess go away. It's only gotten worse. The banks knows that where there's smoke, there's fire, and are not lending to each other even with the Fed backstop..?

Posted 23 October 2019 - 05:41 PM

Enough REPO for now.....but tons of talk about it

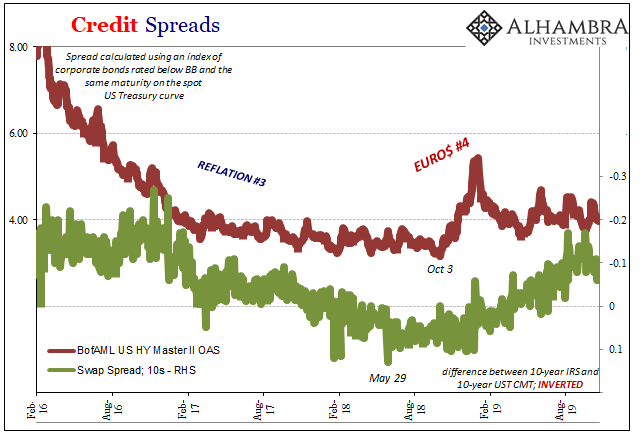

Part of it has to do with the way credit markets work and liquidity within them - all the parts. There are crossover functions and dealers in money mkts are the same dealers in credit mkts. If you see shyness in repo, then you have to assume a problem in credit liquidity, too.

Posted 24 October 2019 - 05:36 AM

REPO mania, hundreds of billions or even up to a trillion and more to be pumped into the system, China and others are also doing it,

do not fight the PUMP, go with it, ride the bull move, and be prepared to dump the pump later

The Fed pumped $100b into the repo market in just one day this week. China is pumping half a trillion Yuan into it's banking system to prop up the economy.

Posted 24 October 2019 - 05:37 AM

Is everything ok with the #banks? The @federalreserve expands its balance sheet again. $49.9Bn in #Repo Purchases on 23 October with only $18.3Bn in reverse repo operations. https://apps.newyorkfed.org/markets/autorates/tomo-results-display?SHOWMORE=TRUE&startDate=01/01/2000&enddate=01/01/2000 …

Posted 24 October 2019 - 06:34 AM

Can't stop the REPO twitter talk unless I filter it; my basic analysis tells me that equity markets will not go down if the FED pups more than a trillion into the system during the next few weeks.,,, UNLESS there is a very serious problem that may not be easily solved with a trillion$

Is everything ok with the #banks? The @federalreserve expands its balance sheet again. $49.9Bn in #Repo Purchases on 23 October with only $18.3Bn in reverse repo operations. https://apps.newyorkfed.org/markets/autorates/tomo-results-display?SHOWMORE=TRUE&startDate=01/01/2000&enddate=01/01/2000 …

202 Billion into Repo market 40% of companies can't afford the interest on their loans from their free cash flows Central banks buying Gold at record levels Nothing to see here, Everything is good.

Yes! It is the end of the recession story! Hold on one second, I was in the middle of reading an article about how the Fed is doubling their repo operations

Posted 24 October 2019 - 09:19 AM

Judging by the "Actual Position and Market Opinion Poll for Thursday 10/17/19" There's just one very happy person other than myself here. Interesting how many were bearish but didn't commit. I just cashed out.

Posted 24 October 2019 - 09:50 AM

You may know better than those who lend money to the Financial's ST, but Financial Commercial Paper is yielding only slightly more than non-Financial, and is just 6bp off it's low. Waaaayyyy down from a year ago and way down from 6 months ago.

Those who lend money to Financial companies aren't demanding any sort of a risk premium. They aren't worried.

M

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter