The fun, fear, and excitement - and risk - of NQ 12-lot trading in pre-cash session.

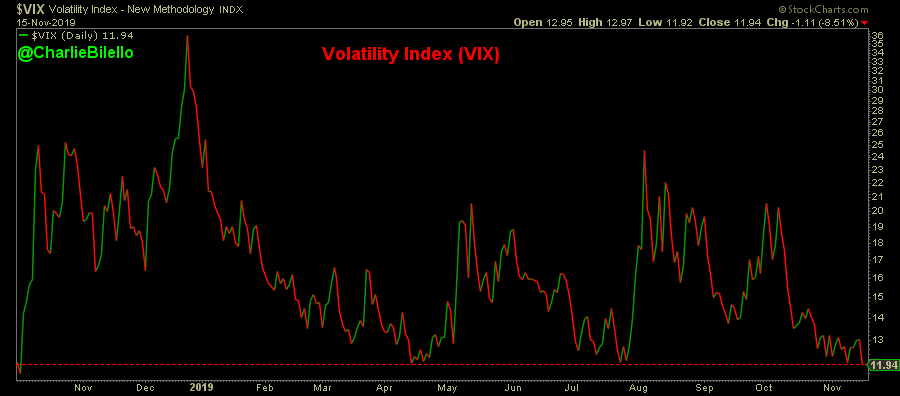

"Euphoria" seems to be a popular word this morning.

And, a few are calling for pullback etc

This will be a big week leading into the holiday next week.

Mood in Beijing about #trade deal is pessimistic, government source tells me. #China troubled after Trump said no tariff rollback. (China thought both had agreed in principle.) Strategy now to talk but wait due to impeachment, US election. Also prioritize China economic support.