I think this is the more likely outcome.

Posted 10 December 2019 - 09:47 AM

I think this is the more likely outcome.

Posted 10 December 2019 - 09:54 AM

GLD needs to hold this back test of 138, or bulls may not have what it takes to climb out here....

Edited by K Wave, 10 December 2019 - 09:55 AM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 10 December 2019 - 10:14 AM

Next time over 27.10 on GDX is when I load the boat on 3x longs...

In the mean time, bulls with a fumble at the open....

PL suggesting bottom is near...just waiting on price action in Gold.Silver to confirm...

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 10 December 2019 - 10:22 AM

Next time over 27.10 on GDX is when I load the boat on 3x longs...

In the mean time, bulls with a fumble at the open....

PL suggesting bottom is near...just waiting on price action in Gold.Silver to confirm...

NUGT and AQG? This (v) looks very weak.

Posted 10 December 2019 - 12:16 PM

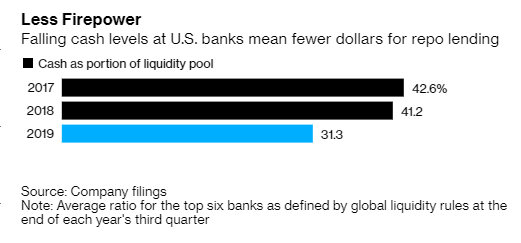

Repo crisis to happen again?

"The Repo crisis tells us a lot about current markets: Liquidity is much lower than estimated and leverage is much higher. The Repo Crisis Shows the Damage Done by Central Bank Policies"

https://twitter.com/...319115986587648

https://twitter.com/...383451949998081

Posted 10 December 2019 - 12:18 PM

interesting couple of pages on the thread

we are getting closer and closer to the breakout. the fed is tomorrow and sunday is the deadline to the hike in tariffs on china. what will trump do. then you have mike bloomberg waiting in the wings and he is china friendly by his own admission. then the divide will lead to the house pressing for impeachment . as the whole country is held hostage to political opposition. meanwhile that pile of debt just grows and grows. no candidate has mentioned cutting the debt or the size of government. so we can expect the growth of debt will continue. the debt can never be paid off. so the loss of pp will occur as the pace of debasement continues.

i am accumulating optionality plays, because i believe and my work shows we will move to breakout the strong resistance in the 1550 range. i dont rule out a move to say 1400 but the odds become less and less. essentially we are running out of time.

all the while the miners get more and more bids, my account is near its highs of september. "big money buys miners 1st then the underlying" james sinclair 1978 .if you think about that it makes perfect sense.

platinum in its relationship to gold is historically cheap. it will be a lead dog at some point. the correction in the sector is long in the tooth over 3months now. i think it will be a theme in 20 a run and then a consolidation. which serves to confound and confuse . we are some time away from the parabolic. the battle ranges on. i am very bullish . and see the tea leave signs of a bull market.

meanwhile nero fiddles

yup ryanoo. but its not qe 4 3 straight months of assent of the feds balance sheet. folks they are printing money. it will result in loss of pp and higher metal prices. interesting to me casey talked about the plague that is killing hogs in china. food prices will rise.

dharma

Posted 10 December 2019 - 01:00 PM

interesting couple of pages on the thread

we are getting closer and closer to the breakout. the fed is tomorrow and sunday is the deadline to the hike in tariffs on china. what will trump do. then you have mike bloomberg waiting in the wings and he is china friendly by his own admission. then the divide will lead to the house pressing for impeachment . as the whole country is held hostage to political opposition. meanwhile that pile of debt just grows and grows. no candidate has mentioned cutting the debt or the size of government. so we can expect the growth of debt will continue. the debt can never be paid off. so the loss of pp will occur as the pace of debasement continues.

i am accumulating optionality plays, because i believe and my work shows we will move to breakout the strong resistance in the 1550 range. i dont rule out a move to say 1400 but the odds become less and less. essentially we are running out of time.

all the while the miners get more and more bids, my account is near its highs of september. "big money buys miners 1st then the underlying" james sinclair 1978 .if you think about that it makes perfect sense.

platinum in its relationship to gold is historically cheap. it will be a lead dog at some point. the correction in the sector is long in the tooth over 3months now. i think it will be a theme in 20 a run and then a consolidation. which serves to confound and confuse . we are some time away from the parabolic. the battle ranges on. i am very bullish . and see the tea leave signs of a bull market.

meanwhile nero fiddles

yup ryanoo. but its not qe 4 3 straight months of assent of the feds balance sheet. folks they are printing money. it will result in loss of pp and higher metal prices. interesting to me casey talked about the plague that is killing hogs in china. food prices will rise.

dharma

agree, "maybe" one more marginal new low on this decline and maybe not, CRB on the verge of a key breakout, platinum up 3% today, oil has been strengthening, productivity had a quarterly decline for the first time since 2015. IMO not a time to be out of the metals sector - a time to be in and accumulating stuff you like. IMO silver will pop big and has limited downside intermediate/long term here (huge upside IMO) and is a no brainer if this sector moves. I choose not to be leveraged here and am about 60-65% long at this time which is about as long as I get. This time frame is also a classic time for a low, DSI numbers are where I would like to see them if looking for a key secondary bottom. As always no complacency but I like what I see here and the big picture risk/reward. For a spec play if you can accept political risk (Argentina's new gvt took power today) for their new Lindero mine IMO FSM is very cheap here and I am long and have accumulated recently on this decline, as always DYODD

Senor

Posted 10 December 2019 - 03:57 PM

Is DBC the ETF following $CRB? I was looking for an etf so to see CRB intraday.

It seems poised to break out.

https://c.stockchart...r=1576011227790

Edit: click "Reload" button, then it works.

Edited by ryanoo, 10 December 2019 - 04:00 PM.

Posted 11 December 2019 - 07:33 AM

Getting closer to the Bottom?

Posted 11 December 2019 - 07:38 AM

Today could be D Day for Gold Bulls.

IF GC can take out 1472 and holds above that level after Fed, then bears are likely about to be overrun...

And if not, then back to the waiting game.

Liking the action in PL so far after the breakout....

Edited by K Wave, 11 December 2019 - 07:38 AM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy