According to my risk summation system, the days next week with the highest risk of a turn or acceleration of the current trend are Monday the 11th, Wednesday the 13th and Friday the 15th. Of those three days Monday has the highest number of risk cycle turns, and Wednesday has the least, but all three have enough to make the grade for elevated risk.

Last week the Monday the 4th risk window tagged the low for the week, but the Thursday the 7th risk window missed the corrective low in the DJIA by one hour at the close on the 6th, so the Thursday risk window must, by the narrowest of margins, be labelled a dud.

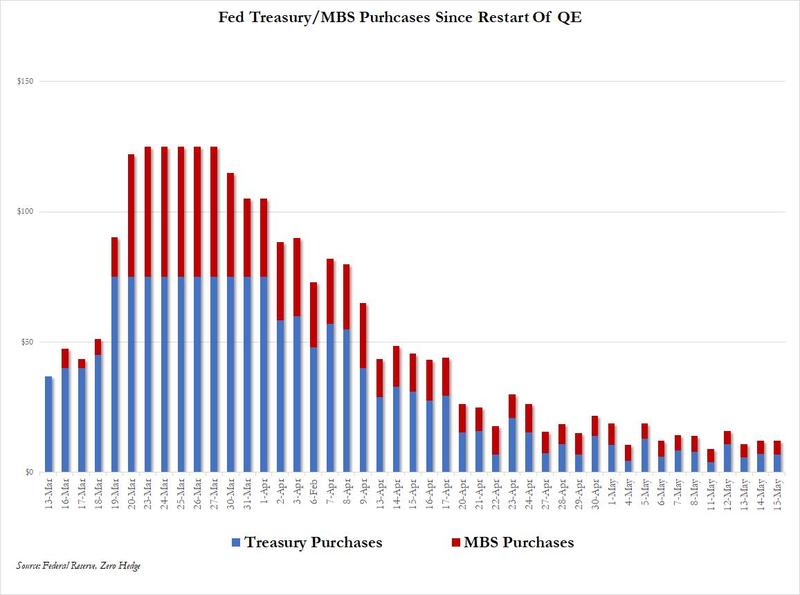

I was obviously wrong yet again with my assertion that last week would be "pivotal". My better judgement is being clouded by what has been a pretty reliable long cycle low which should occur near the end of May or very early June. The last low in this cycle did not form properly which I just put down to the FED money flood occurring at that time. It's starting to look at lot like the low that I have been rabbiting on about may be a case of those who fail to learn from history are doomed to repeat it. The FED again has been printing an absolute flood of funny money which may yet again kill this cycle. I won't throw in the towel on this cycle until early June, but it's round 7 and so far the cycle hasn't laid a glove on the market. Cassius Clay Powell has been beating the bear senseless. Just to add salt to the bear's wounds, the FED open mouth committee will be out in full force Tuesday, Wednesday and Thursday this week making speeches trying to keep the market kite flying high up in the clouds.

Regards,

Douglas