Latest from MA indicating we are headed for a wild ride in the markets, da_cheif mocked me for saying the markets are doing a retracement and I predicted the spx etc would peak mid June but it looks like Armstrong sees things in a similar way, I am not saying new highs won't be seen eventually but it looks like test of support is probably coming at least, see below.... "This cycle will be on the back of shortages in commodities. This has been what the computer is forecasting all along. We have been witnessing shortages in food. But this coronavirus has also disrupted the supply chain in may areas. Then we have the Monetary Crisis Cycle coming for 2021 into 2022. With Europe planning to cancel its paper currency and try to force everyone into banks, you have the punters looking at this as bullish short-term for a trade.

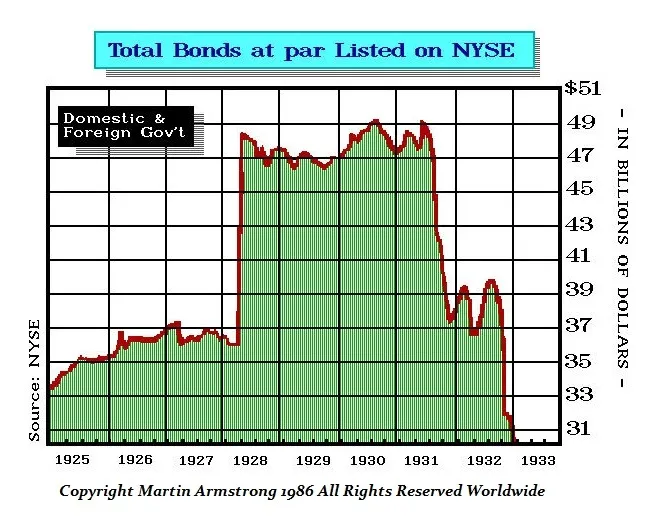

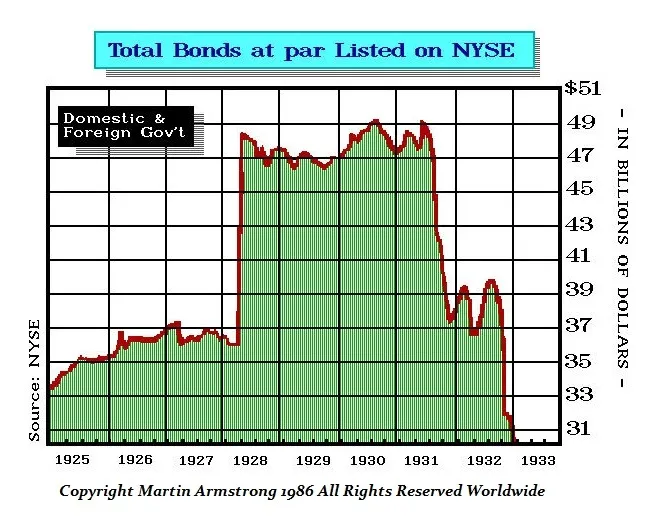

The European and Japanese Governments will have little choice moving forward for they have destroyed their bond markets and are UNABLE to issue bonds that institutions will buy at these crazy rates. It is more than a simplistic printing of money. We are looking at the bond market is collapsing. This is the DESTRUCTION of Capital Formation so in the end, capital must flee anything connected with governments and seek shelter in primarily the stock markets.

So far, we are into a 3-month reactionary bounce with the NASDAQ taking the lead and the Dow lagging. This is very disquieting for it warns we are going to see much higher volatility into the next two years perhaps more so than anyone has ever witnessed in their life or for the past 300 years."

Edited by Russ, 04 June 2020 - 02:39 AM.

"Nulla tenaci invia est via" - Latin for "For the tenacious, no road is impossible".

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/