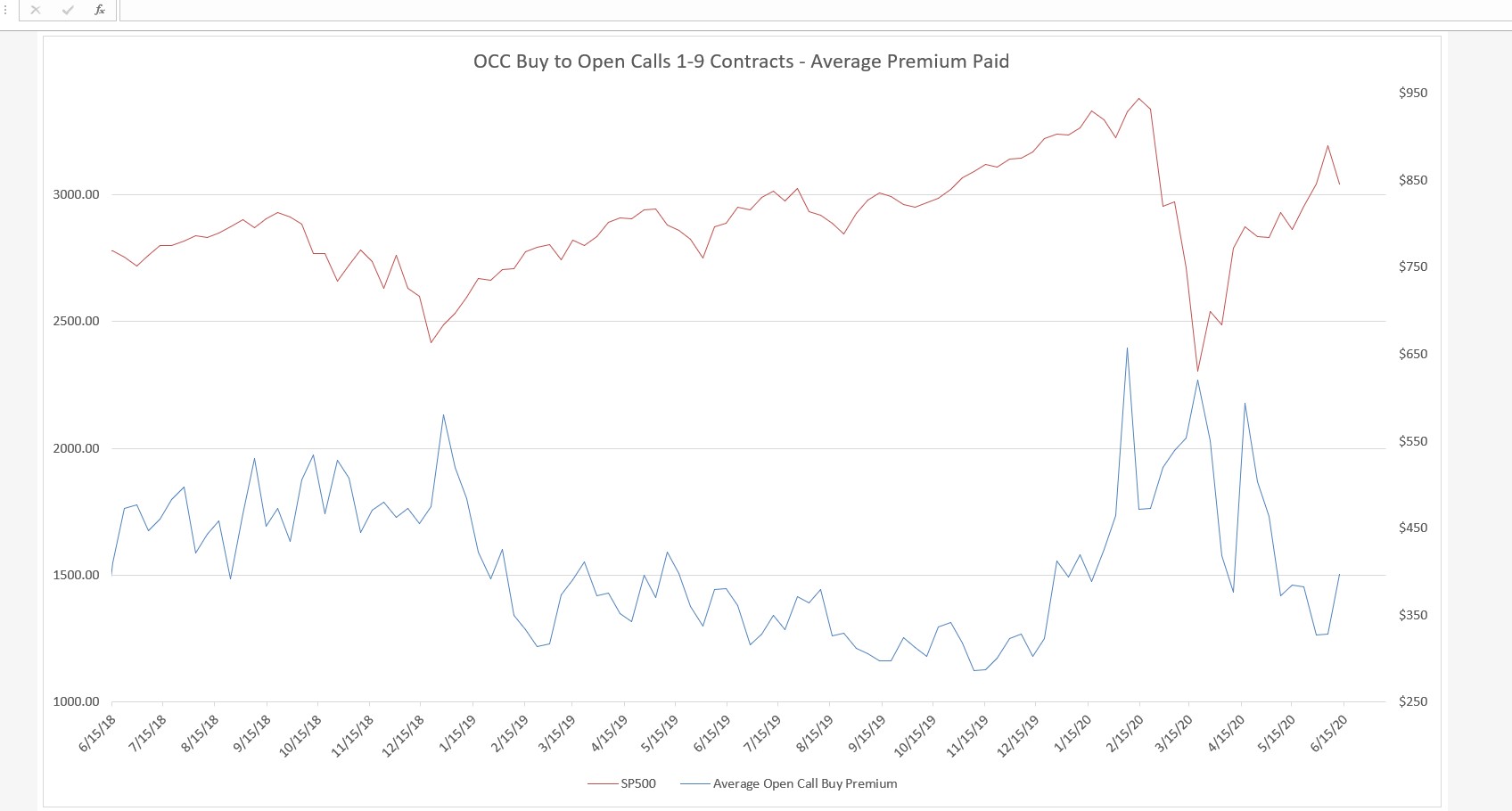

That was Round 2 last week as the Wall St Pros (WSP) waited for the best times to pounce and pulled the rug from under the

Robin-Hooders who won the opening round with a record rally.

Where does the market go from here? A retest of that low last week and then below SPX 2900.

Or, the FED could offer soothing words that do no necessarily invalidate their comments last week but soften their dovish

stance and promise more $$. If so, expect SPX 3200 in a few days in OPEX week.

https://www.marketwa...-the-stock-market-with-the-get-rich-crowd-vs-wall-st-pros-but-its-too-easy-to-blame-retail-investors-for-rampant-speculation-2020-06-13?mod=home-page