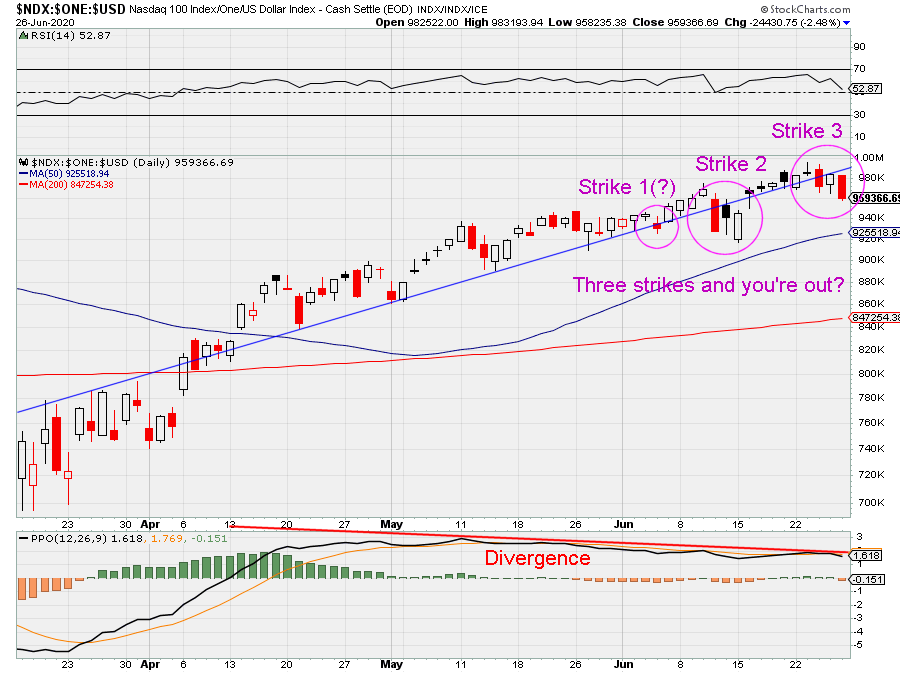

i read an article at CNBC with contribution from JPM, from March 14, they kept saying there had been bear markets outside the context of a recession. That is not the right question. The question is, has there ever been a recession that did not usher in a bear market, and I don't know of any. We've already had a 35% drawdown in stock prices, followed by the best recovery in stock market history, but we didn't get back to new highs. I think everyone believes we are in a recession, Q1 GDP was -5% and Q2 will be worse. Those numbers are artificially influenced, but its still a recession. You've got a recession, high unemployment, high stock market valuation, the IMF just came out and pegged global growth for 2020 at -4% and that won't help the US economy. It seems many are discounting the number of small business failures over the next six months, and think the economy will snap back quickly. I don't share that view. Luftansa announced 22,000 layoffs. I think you will see a massive layoff by US airlines in Oct., they are probably working on the plan now, unless there is another round of government bailout. Bankruptcies trickle in, like J Crew, Whiting Petroleum, Diamond Offshore, JC Penny, Gold's Gym, Neiman Marcus, Hertz, GNC, 24 Hour Fitness and Chucky Cheese. Granted there is plenty of fiscal and monetary support, but they have not convinced me that they are stronger than mother nature. If it looks like a duck, swims like a duck, and quacks like a duck, its probably a duck.