Transports show 'three rivers evening star',

and precious metals seem to show the opposite.

Posted 26 September 2020 - 09:27 AM

Posted 26 September 2020 - 09:33 AM

JPM is shorting the paper etf's, driving down the price, buying and stashing away the physicals at lower prices for an enormous future profit, and profiting simultaneously from the falling prices with PUTs, and got fined for price manipulation at 1B$ which is peanut compared to their enormous potential profit. did I not get this right? so when will the short squeeze start?

Posted 26 September 2020 - 11:17 AM

Monthly gold chart not looking bullish at all, that huge up candle in July can slide right down again.

yep 1780 area is a reasonable target seems like too easy

The futures gold daily chart's channel is showing even down into the 1500's is 'possible' by late Nov. but 1700's is highly likely, markets tend to go farther than expect both on the upside and downside. If Trump wins again that could be the catalyst to drive gold down. The computer drew the main trendline and I confirmed it on several time frames, so I think this is quite likely to be correct.

Posted 26 September 2020 - 04:08 PM

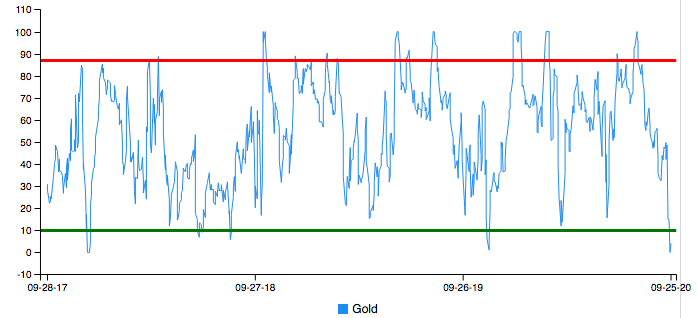

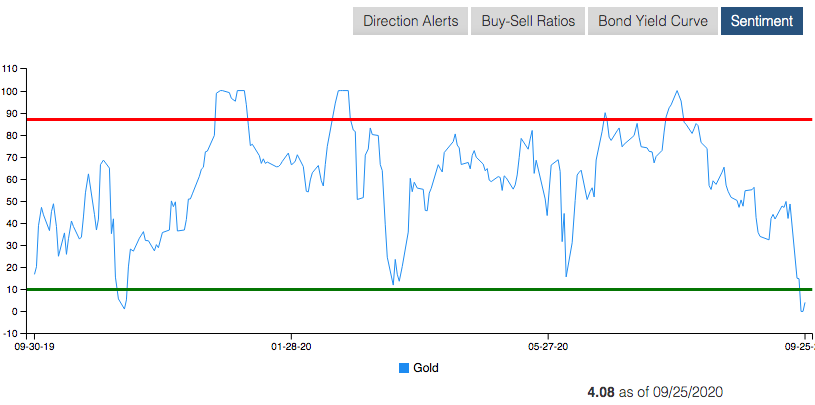

gold daily sentiment

Posted 26 September 2020 - 06:01 PM

Posted 26 September 2020 - 06:37 PM

Hey Russ.

Any chance you see one to TWO years down for the gold price and mining sector in a deflationary meltdown ?

Armstrong stance is right now I believe equities go down into 2022 in a deflationary meltdown. (US dollar up)

An if we look at the yearly candlestick DXY chart we see that dollar could be poised for a cup and handle breakout north, possibly for TWO years. Comments ?

Monthly gold chart not looking bullish at all, that huge up candle in July can slide right down again.

yep 1780 area is a reasonable target seems like too easy

The futures gold daily chart's channel is showing even down into the 1500's is 'possible' by late Nov. but 1700's is highly likely, markets tend to go farther than expect both on the upside and downside. If Trump wins again that could be the catalyst to drive gold down. The computer drew the main trendline and I confirmed it on several time frames, so I think this is quite likely to be correct.

Posted 26 September 2020 - 11:06 PM

i like the beearsihness creeping in here.

Posted 27 September 2020 - 08:10 AM

sentiment is very bearish

Posted 27 September 2020 - 08:32 PM

bounce soon seems to be the best guess. bounce is all IMO