Just because day traders are getting trades right, doesn't mean they are exceptional on the intermediate term trend.

They do not have to be.

F&D

Posted 05 July 2020 - 09:25 AM

Just because day traders are getting trades right, doesn't mean they are exceptional on the intermediate term trend.

They do not have to be.

F&D

Posted 05 July 2020 - 01:48 PM

Just because day traders are getting trades right, doesn't mean they are exceptional on the intermediate term trend.

Yep, Guilty here. I generally have a MUCH better grasp of the shorter term stuff than the longer stuff.

But when the longer stuff is pointing a certain direction, it makes timing the shorter trades a heckuva lot easier.

Right now there are so many cross currents in the the shorter to intermediate stuff that is is not real easy at this juncture to be real confident on either direction right now for the next BIG swing move.

I do think think those cross currents are real close to being resolved, and that it will be pretty clear which way the intermediate currents are flowing as soon as next week.

With the virus on its last legs of this wave (see huge drop in Sweden last week, and Houston looking like it has peaked out), my guess is we break out to the upside starting on Monday.

What it generally looks like to me is that NAZ and SPX are leading the way up, but still waiting on RUT, DOW, NYA, and Trannies to break their downtrends, and get everything thing back in sync upside.

But if that does not materialize, then not the time to overly complacent on the long side...for a least a number of weeks anyway, as it could be the laggards are telling a more powerful story right now than the leaders. (I am still open to the possibility of a 1962 style 2nd higher low maybe in August)

Bottom line: As long as SPX continues to hold above 3K, Bulls have huge benefit of doubt. Back below that, then some sort of retest of the March lows become much more likely.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 05 July 2020 - 02:38 PM

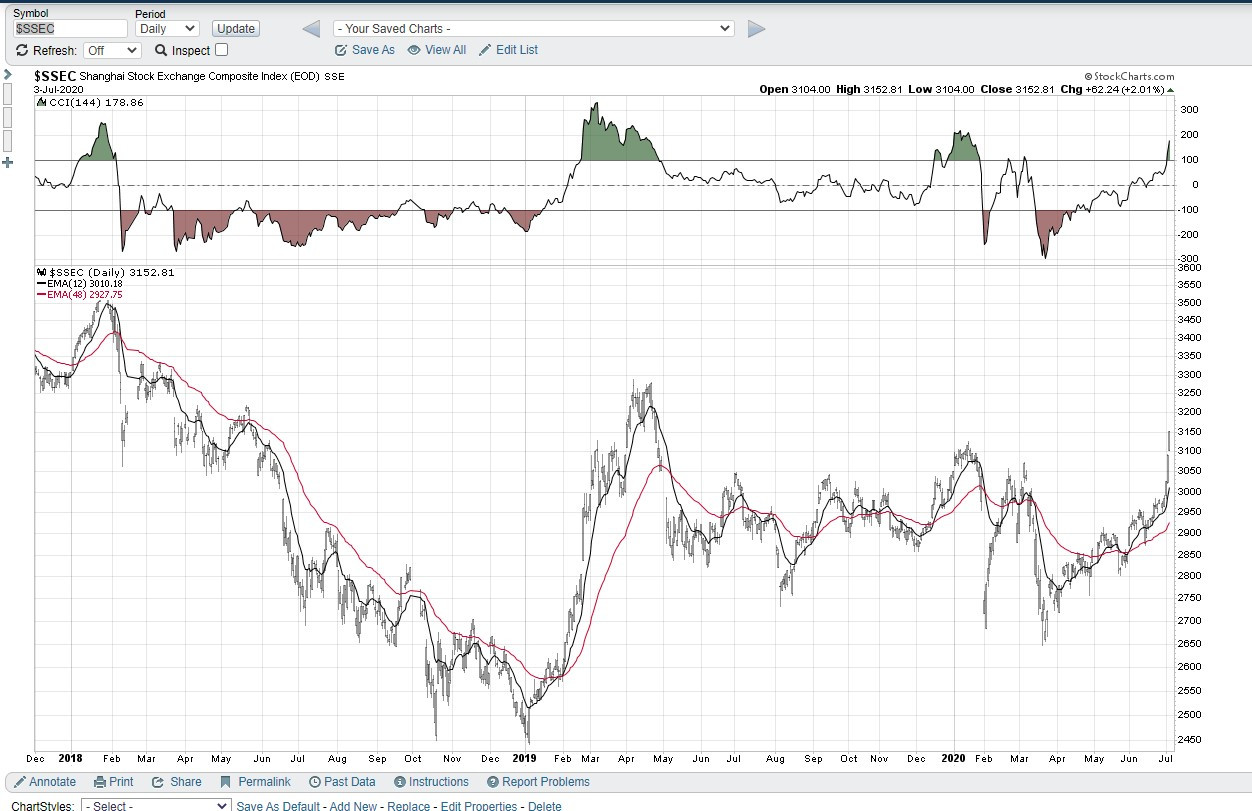

Shanghai Composite Index ($CHSC) took out the mid January 2020 high last night and closed at 3152, so the downtrend line from Jan 2018 at 3600 peak, and when the Trade War stuff started, has been broken to the upside this week.

I have had my eye on that one as well...may be just about time to get very bullish on China

Looks like it has just started to emerge from a long base building process on weekly chart.

Perhaps a pullback is needed first:

Posted 05 July 2020 - 03:10 PM

Shanghai Composite Index ($CHSC) took out the mid January 2020 high last night and closed at 3152, so the downtrend line from Jan 2018 at 3600 peak, and when the Trade War stuff started, has been broken to the upside this week.

I have had my eye on that one as well...may be just about time to get very bullish on China

Looks like it has just started to emerge from a long base building process on weekly chart.

Perhaps a pullback is needed first:

*CYCLES: I’ve had July 15th marked on my cycles calendar for over six weeks as a significant turn, my bet is that it’s the low before a big move up into August.

Posted 05 July 2020 - 04:23 PM

Great analogy of the race track F&D!! There has been a tremendous amount of sharing here at TT over the last 25 years. Mark was a pioneer in pooling together relevant trading information and folks to talk about it. Readers should be able to determine if the content is something they should pay attn too, fade, or ignore, otherwise they may need to study a bit more or find a mentor. Every person has to decide for themselves how they want to bet the market, and that usually comes down to time frame. Multi day swing trading seems to be the most lucrative right now since the algos seem to only stair step higher and then flip the switch for the elevator drop.

In the stock market all that matters is making the bet because if you do not have any skin in the game it does not matter if you were right or wrong. "How we decide" By Jonah Lehrer is the best book to read if you need to figure out what makes you "pull the trigger" or not.

Posted 05 July 2020 - 05:11 PM

Using the Daily CCI 144 period above +100 seems to track the trend a bit better than the monthly CCI-34. FWIW

Posted 05 July 2020 - 05:32 PM

my guess is we break out to the upside starting on Monday.

Good start so far Sunday evening here, so watching the ES take out R1 at 3134 and moving even higher towards 3150 (R2=3153) between 8:00pm-9:30pm EST after SPY and other ETFs open for Sunday night trading, the overnight might just yield the gap and go for Monday. The gap and crap Thursday, and drift down on Friday futures reset the short term rather nicely for basically a gap fill near the Friday 3106 print. Rather interesting since we already have 4 consecutive up days for NDX and SPX last week.

Posted 05 July 2020 - 05:39 PM

I went long at 3130.5. Wide stop.

Posted 05 July 2020 - 05:44 PM

I've seen ES gap ups take as long as 2-3 months to fill.