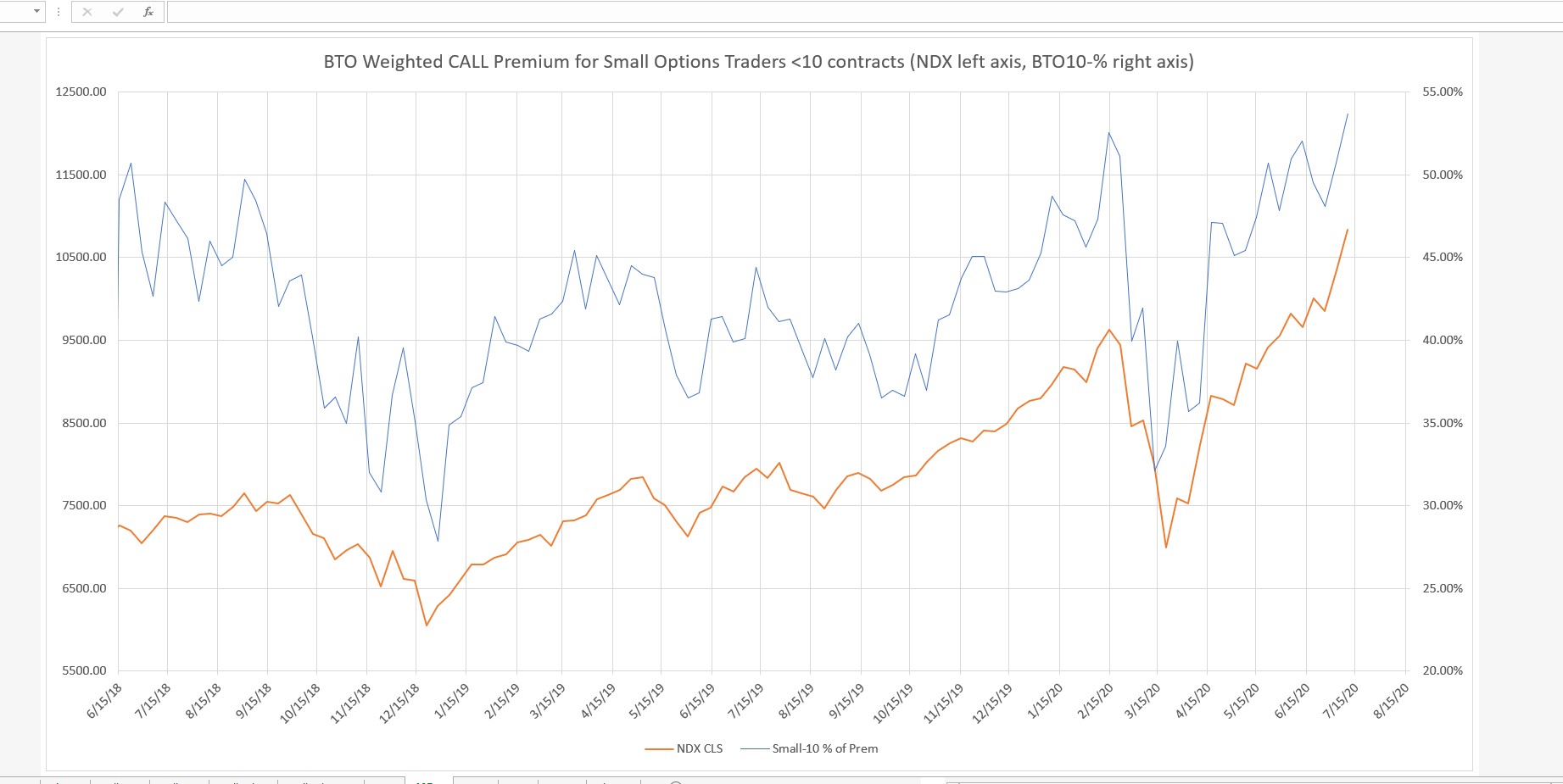

Number of contracts traded spiked up again this week to 12 million. Same as June 5th report, but not as high as 14.6 million on June 12th. However, this report clearly shows that Dealers have started to significantly increase the premium cost for these purchases and the small traders are paying it. The chart shows the weighted % of the cost of a contract which is the premium divided by the number of contracts. This weeks value is 53.75% and the peaks in late 2007 were 58% and in 2000 60-65%. Good heads up indicator at tops and bottoms, so context is relevant. Not shown, but the CBOE CPC/VIX FEAR meter is not confirming the CPCE/VXST advance with a large spread developing. RSP, IWM, MDY ETFs all down for the week. Since the June 8th SPX top tick close, the last 23 trading days have seen on average 200 SPX issues closing above the open, and 300 below the open, and Chaikin statistics usually provide a chart view of this behavior. We will see if the market catches it's breath by Friday.