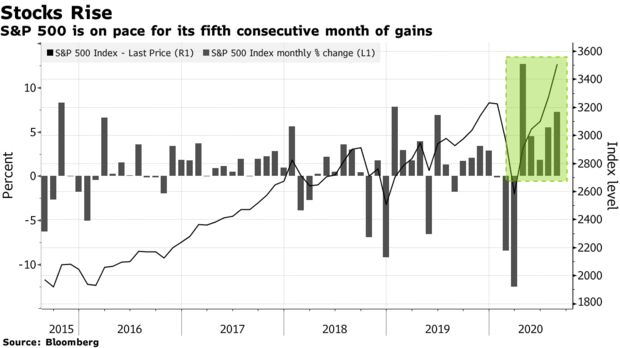

NO way! But, the IT LONG trend continues in what has to be the bubbliest of bubbles in modern times.

This bubble has fuel now and promised in the future and could continue since there appears to be massive hedging.

Last week was a rare down one but early large losses were reduced during Wed to Friday.

In our LT Portfolio we are adopting a new strategy:

BUY SPY PUTS as market rises and then buy stocks when market drops.

BUT, what if market never drops? It will, son, it bubbles always burst!

Made a few $$ with APPLE PUTS and still holding 5 n the LT Portfolio.

SPX 4K came from one of the last few remaining bears

Relentless squeeze in $SPX and $NDX to ever higher highs and bears are capitulating left, right and center. Short interest at 15 year lows, asset manager index parked north of 100, the complete elimination of down days in August, in short: The perfect bear set up.

Relentless squeeze in $SPX and $NDX to ever higher highs and bears are capitulating left, right and center. Short interest at 15 year lows, asset manager index parked north of 100, the complete elimination of down days in August, in short: The perfect bear set up.