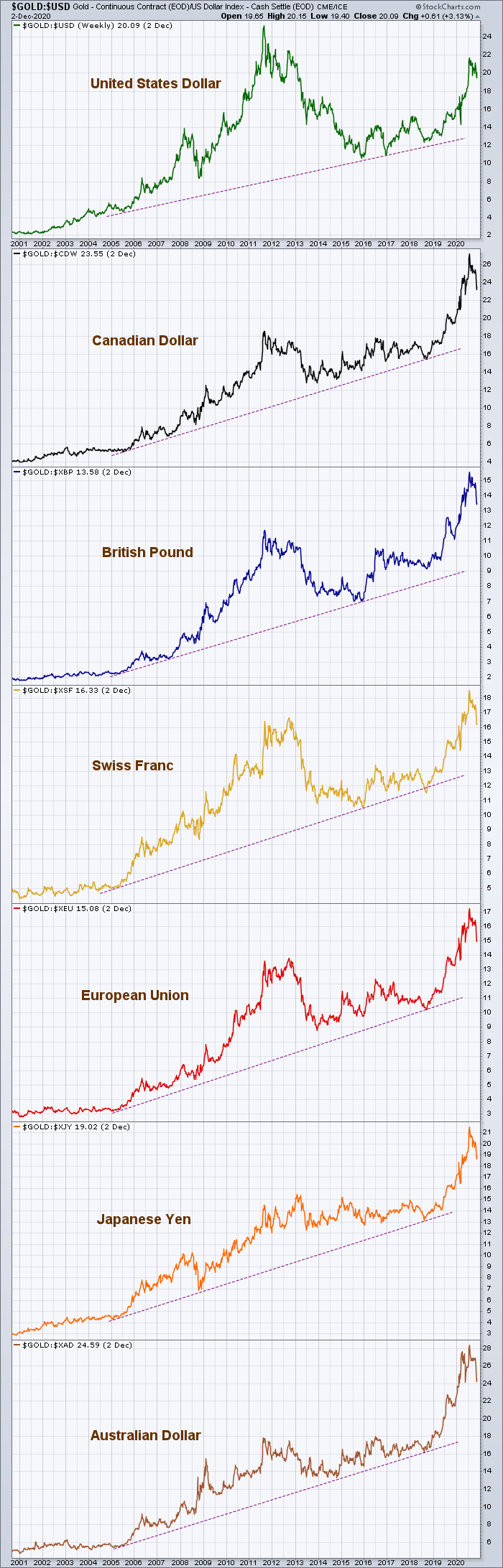

It depends on what you price them in. In Euros they may have turned a corner heading down. The Euro appears to have broken an 11 year down trend relative to the dollar. With twin pumpers at the FED and Treasury, funny money may flow like green water making the dollar value of US stock indexes rise and simultaneously fall in Euro terms. Your financial success in the US market may just depend on which side of the pond you plan to spend your winnings. My currency of necessity, the Pound, is also knocking on the door of the top of a similar very long trend line. BREXIT may impact its breakout attempt, but the Euro appears to have already successfully breached the wall.

Regards,

Douglas