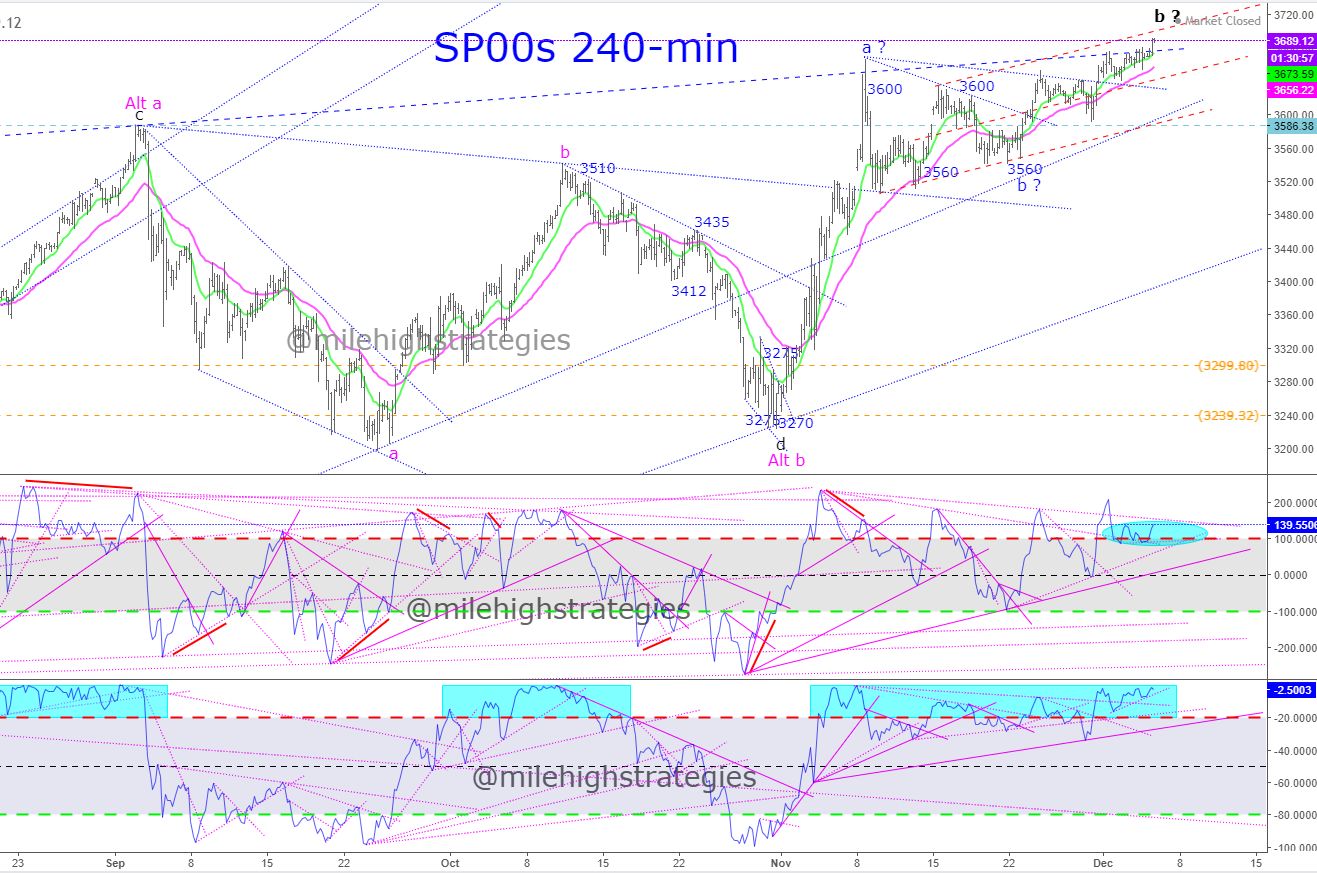

When the market doesn't react at a clear resistance point (within a fairly short period of time), the trade is no longer "Low-Hanging Fruit" and the first loss is likely the best loss to take.

The same is true with regard to support.

To, today, we ran up to pivot resistance and the hourly BB, and blew right through. Shorting is fighting a head wind right now.

Mark