Mark, you make a valid point when S/R are horizontal.

when in a rising wedge, I tend to scale in and exit my losing trades when the rising trend line is rejected.

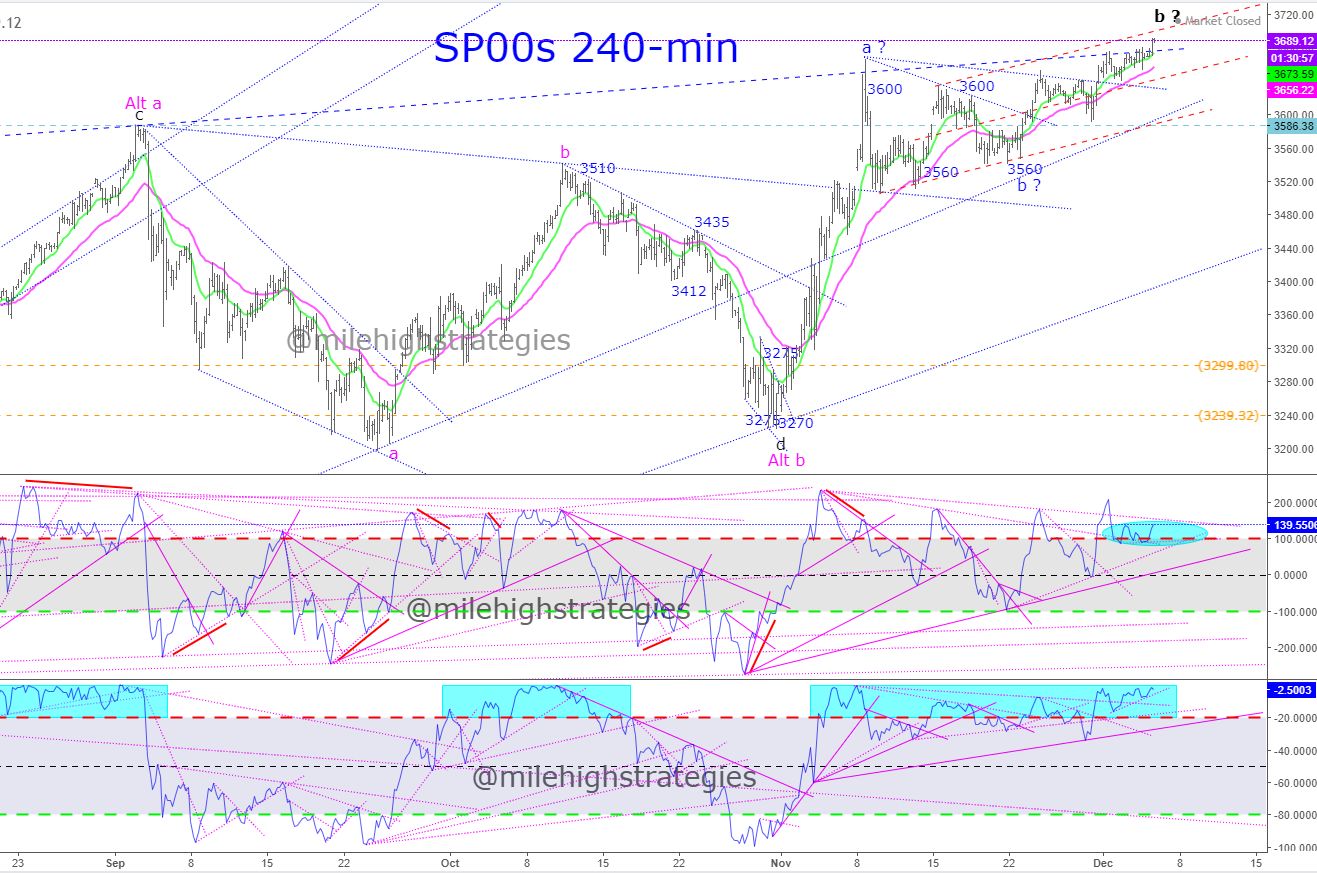

at present I am averaging 3685 price. And will be scalping long and short Monday

key for me, is not to overleverage. Money management is vital, but also accepting losses within a clear overstretched market.

With that said, loss management is by far , the most important.

Be patient with winning trades. Be very very impatient with losing trades

Edited by salam, 05 December 2020 - 08:08 AM.

I'm not sure what my future holds... But I know who holds it.