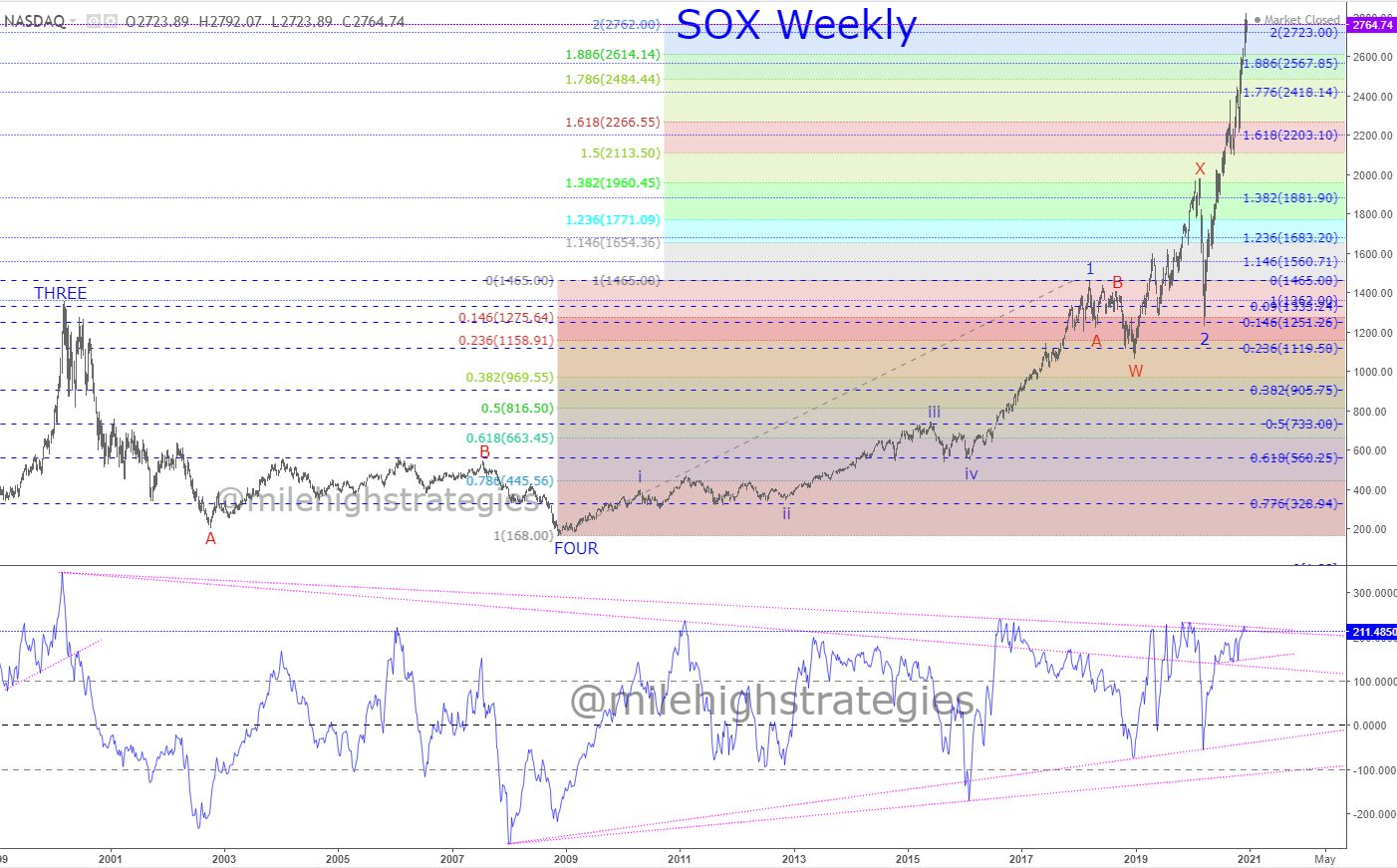

SPX WEEKLY ANDREW'S FORK UPDATE...

With yesterday's closed just above the Wave-2 150% channel UTL, I thought perhaps the upward continuation signal was made, though warned that it could be a fake-out, and needed to continue upward to prove itself...

The SPX weekly chart with my Andrew's Fork setup is in about the same boat, with the price closing the week essentially at the confluence of the orange and blue tines, giving the same non-signal as the Wave-2 channel chart for the week...

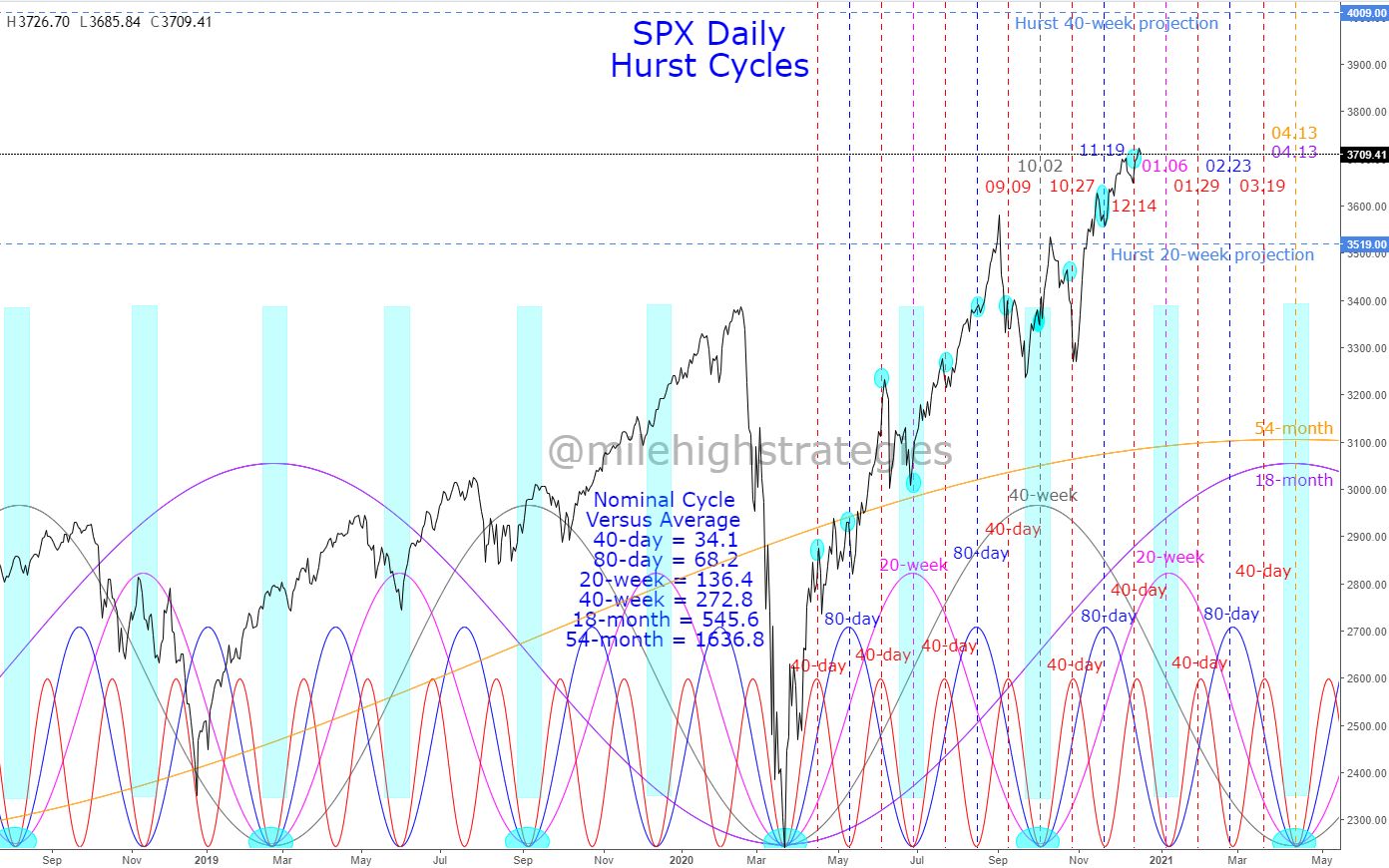

A pretty decent cycle guy I hear from now and then has called for a cycle high for yesterday or today, and my work needs Monday to continue upward, or a reversal to short would occur... watching.