This has been a strong uptrend, but those minor pull backs that last anywhere from 3 hours to 3 days don't scare anyone anymore.

Bears have been making good arguments. As always, they are logical and wrong.

I think we have a perfect combination for a parabolic advance:

Valuations -- Extremely expensive (98 percentile of all readings over the last 140 years). That allows bears to speak and everyone else to buy.

Sentiment -- Majority is very bullish. More people are buying. Contrarian analysis only works at picking bottoms, and once a generation at picking a top.

Internals -- Strong.

Money Supply -- Historic levels. Too much money out there and more coming.

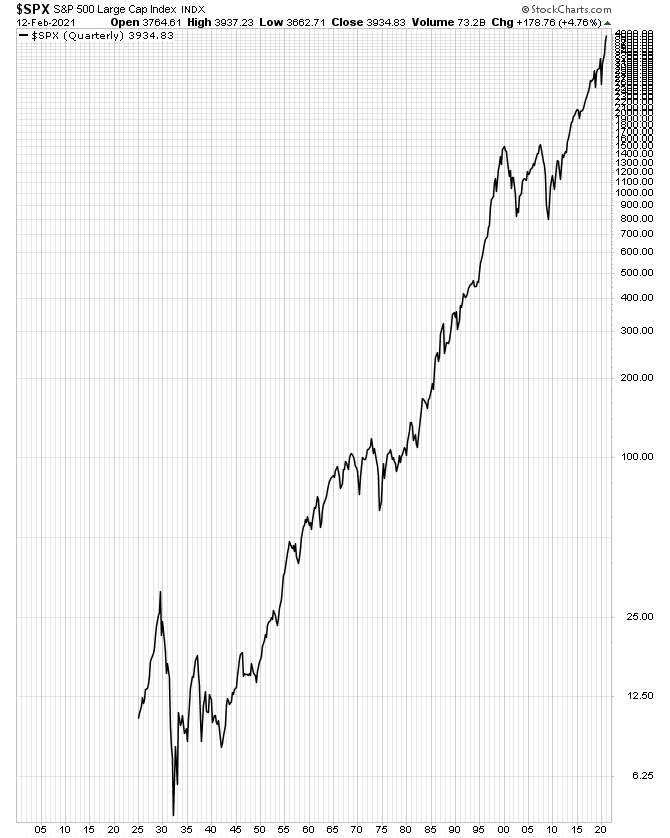

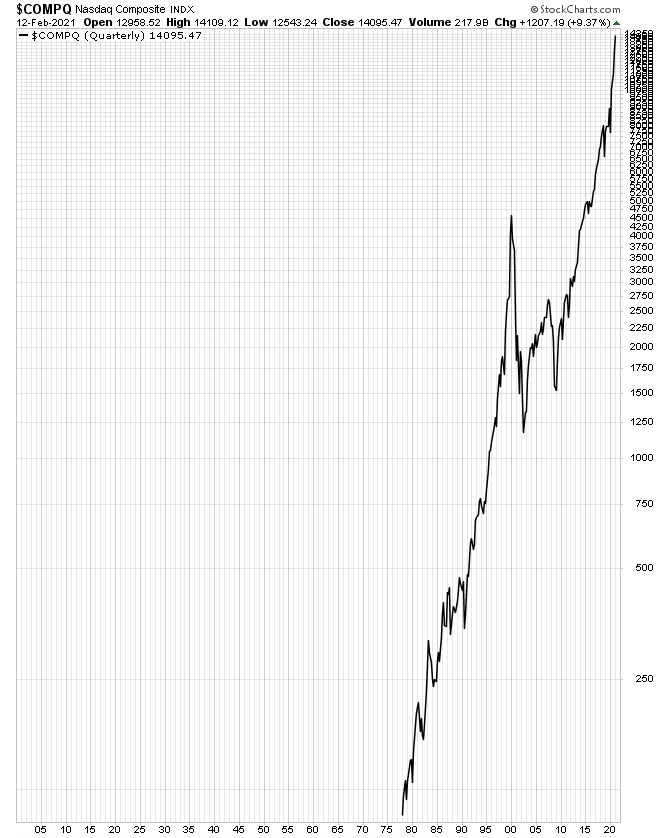

Technicals -- clear uptrend.

New Traders -- a lot of new young traders just came in to the market. It is reminiscent of mid 90s when the internet brought millions of new traders and they send everything to the stratosphere.

Economy -- Pretty bad, which is good for the market. The best rallies occur when people are suffering.

Time for this uptrend to go faster, because those ST pull backs are simply annoying.