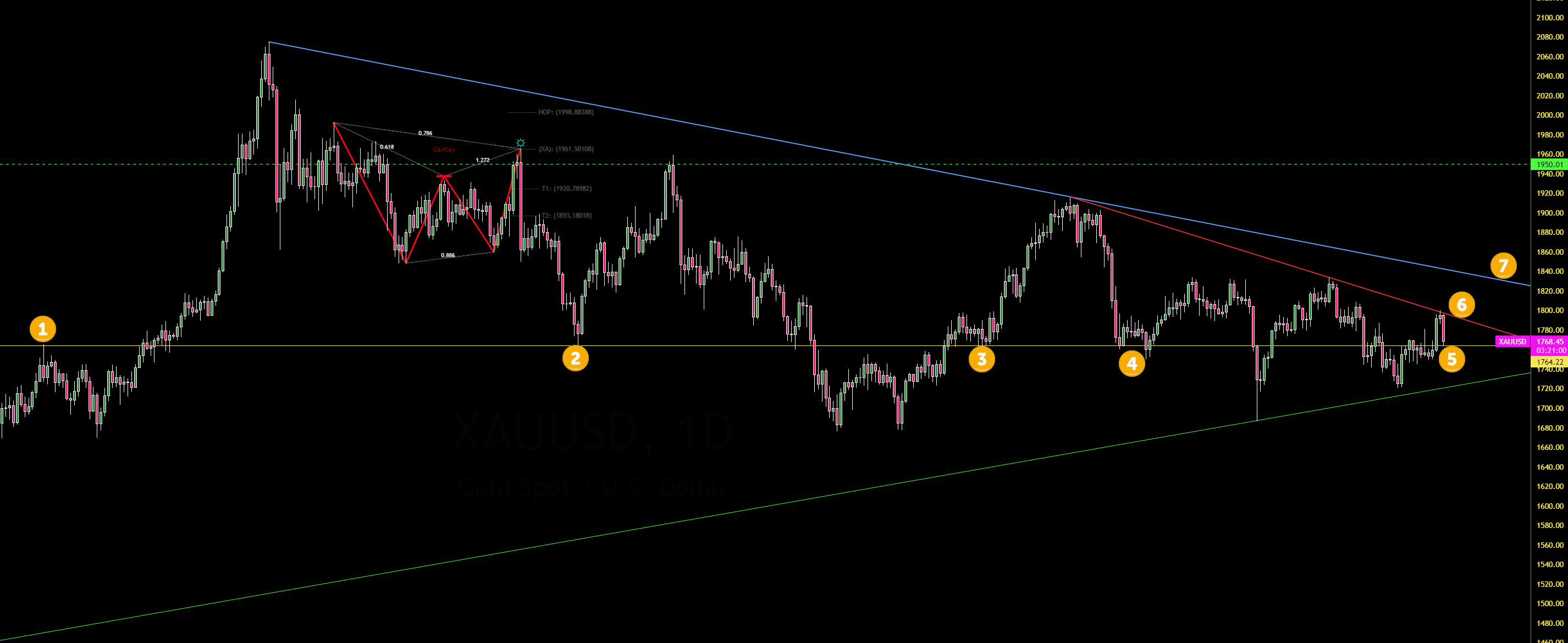

how about this chart on gold... this is how I see it...

1 2 3 and 4 are cittical swing points that form a support now.. this level must hold for bulls

at 5 gold recently had a breakout north from this resistance... but now this should be support on todays retest... this is classic wyckoff.. the support should hold

number 6 is the red line the first near term battle line that must be cracked for bulls confidence.

and then number 7 is the ultimate battle line where bulls can breathe much easier...