Rested & ready to go for Q2 !!

Still think SPX 4400 before the BIG DECLINE begins in Q2

Jason GoepfertPublished: 2021-07-02 at 08:00:00 CDT

Jason GoepfertPublished: 2021-07-02 at 08:00:00 CDT

This year has marked one of the few times in history that both stocks and commodities have rallied at least 14% through this far into a year. In fact, it's the best year for both assets, edging out 1976.

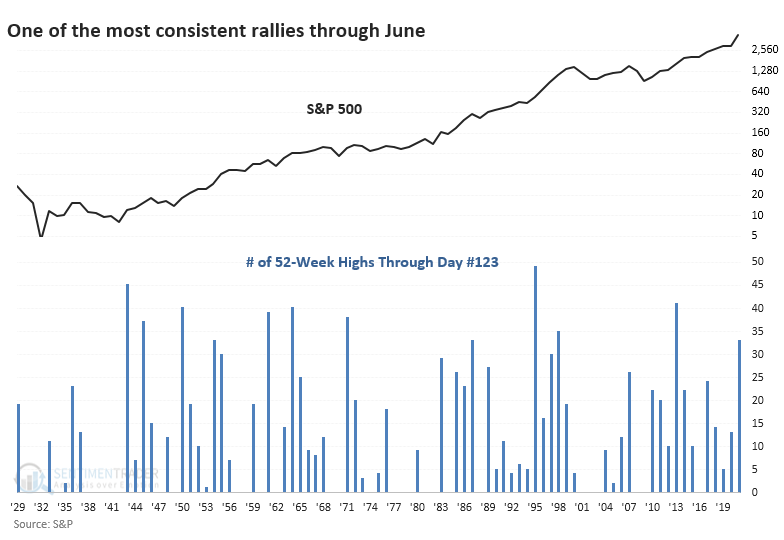

For stocks, in particular, it's been one of the best, most consistent, and most persistent rallies year-to-date in its history. Through the end of June, the S&P 500 has rallied more than 14%, ranking in the top 85% of all years since 1928.

It's also been one of the most consistent years. The S&P has scored 34 record highs for the year already, ranking in the top 88% of all years.

And it has been a very persistent rally. The S&P has now gone more than 150 sessions since the index was more than 5% off of its peak. That streak ranks in the top 93% of all years since 1928.

Momentum is a strong force and doesn't usually roll over easily. If we look at the strongest, most consistent, and most persistent years through June, this year ranks among the best.

The risk/reward for the last half of the year was decent after the other "best" years. There were almost no large declines in the months ahead, but gains also tended to be limited. That's a combination of a lot of buying power potentially already used up, along with what has frequently been a summer soft spot.

https://www.sentimen...quite-like-this