Good week, ended with a losing Friday.

I lean towards this market forecast but think it will be difficult to move substantially above ES 4400

See link below:

Market Stumbles But Rallies Back

Last week, we discussed the market hit new highs with the index getting back to more extended and overbought conditions. To wit:

“The technical backdrop is not great. With the market back to 2-standard deviations above the 50-dma, conviction weak, and investors extremely bullish, the market remains set up for additional weakness.

However, we are in the first two weeks of July, which tends to be bullishly biased. After increasing our equity exposure previously, we will give the market the benefit of seasonality for now.”

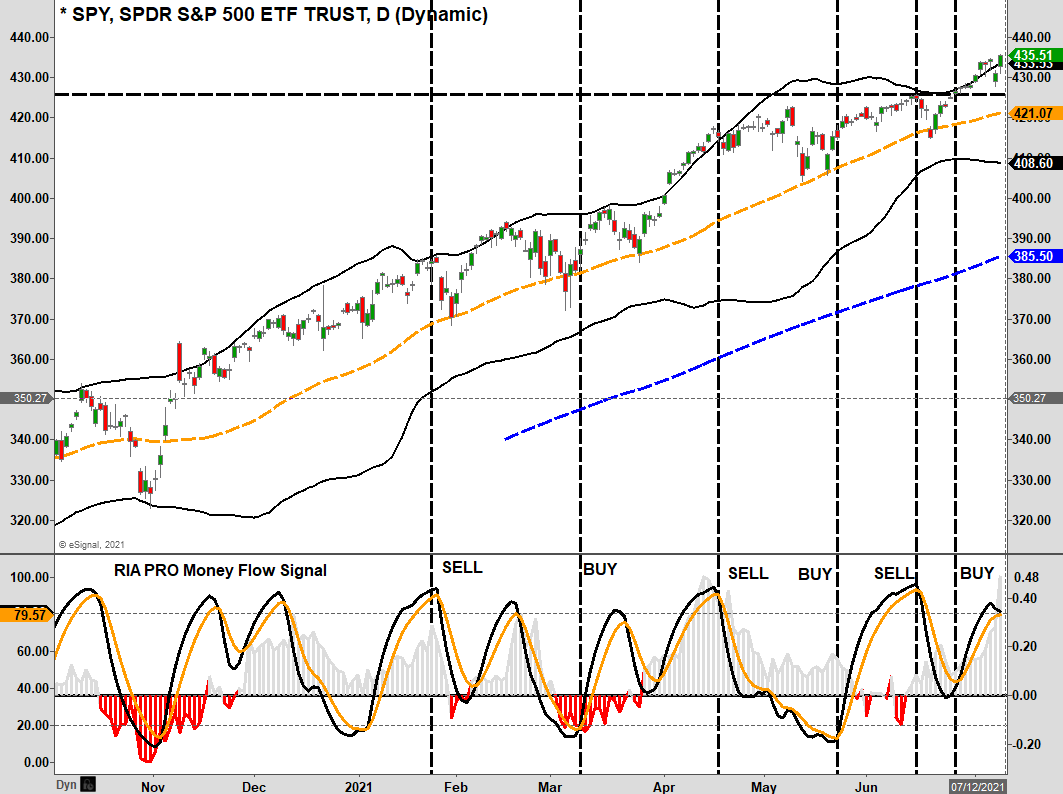

While market volatility did pick up this past week, the index held its breakout support levels and closed at a new high. Such keeps the bullish bias intact. However, as shown, the money flow signals are now back to more elevated levels, which will provide resistance to higher prices short term.

We are still within the seasonally strong period of July, which tends to last through mid-month. However, August and September are typically more challenging for returns. As we stated last week:

“The bulls are indeed in charge of the markets currently, but the clock is ticking.”

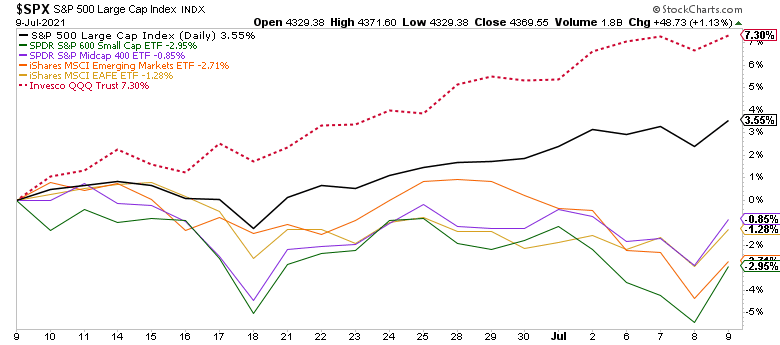

The market is also weak from a breadth perspective. While large-cap stocks have done better as of late, the rest of the markets have not.

The critical point is there has been a definite rotation out of the “reflation trade” (small, mid, emerging, and international markets) into the large-cap names (primarily technology),which is the “deflation trade.”

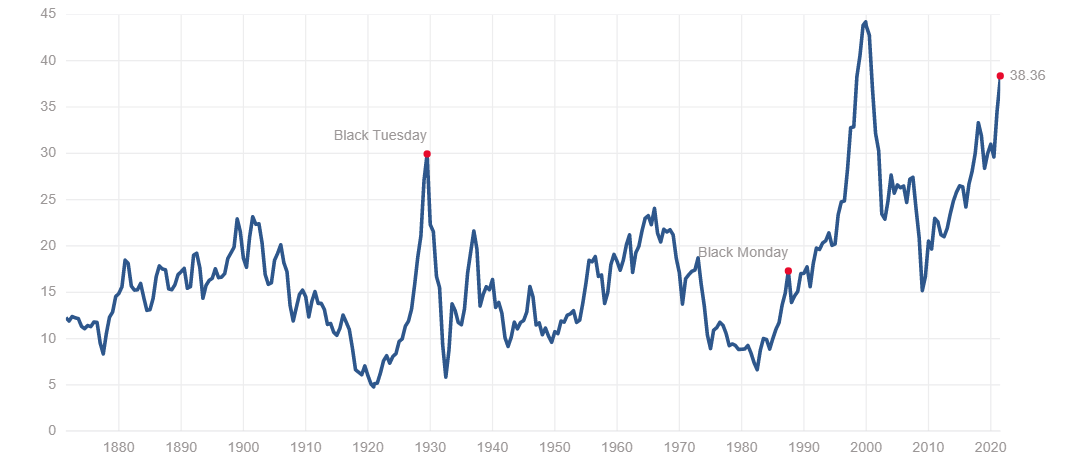

As we will discuss, the reflation trade ran well ahead of reality. Over the next couple of months, the test will be to see if earnings can support the surge in prices and valuations.

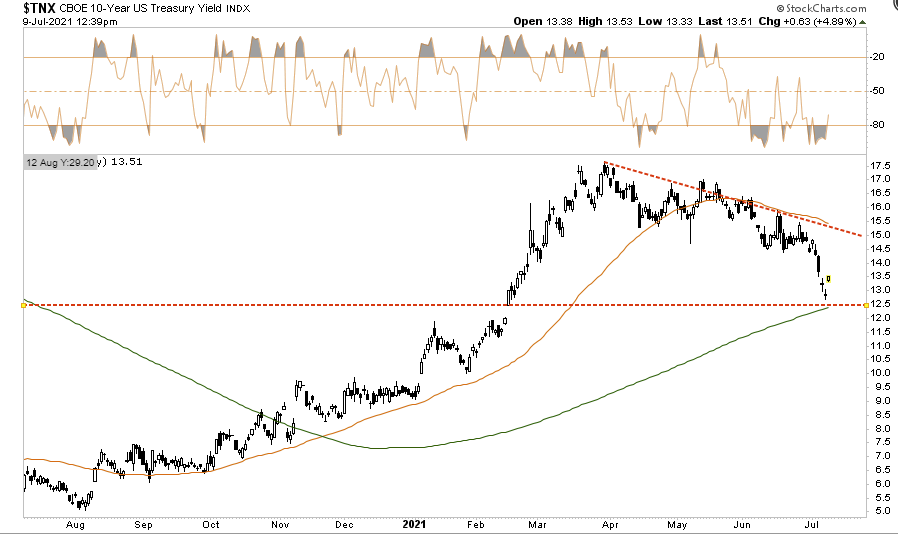

We will discuss the “yield warning” momentarily. However, in the short term, yields have gotten very overbought. We suspect we could see a retracement in yields short-term, but such will likely be an opportunity to increase bond exposure in portfolios as we head further into the year.

As shown, previous overbought conditions (indicators get inverted concerning yields) lead to retracements to resistance. Currently, a retracement to 1.5% would be likely. Ultimately, a break below 1.25% will suggest much lower yields are coming.

From a positioning standpoint, we increased our bond duration several weeks ago. However, while we want to increase our exposure eventually, we need to wait for the short-term overbought condition to reverse.

Longer-term, as we will discuss next, we believe yields are potentially headed lower as economic growth and inflationary pressures wane.

https://seekingalpha...-trade-unravels