Could we be nearing a point of decision between inflation and deflation for the medium-term?

Posted 01 August 2021 - 10:51 AM

Could we be nearing a point of decision between inflation and deflation for the medium-term?

Posted 01 August 2021 - 01:06 PM

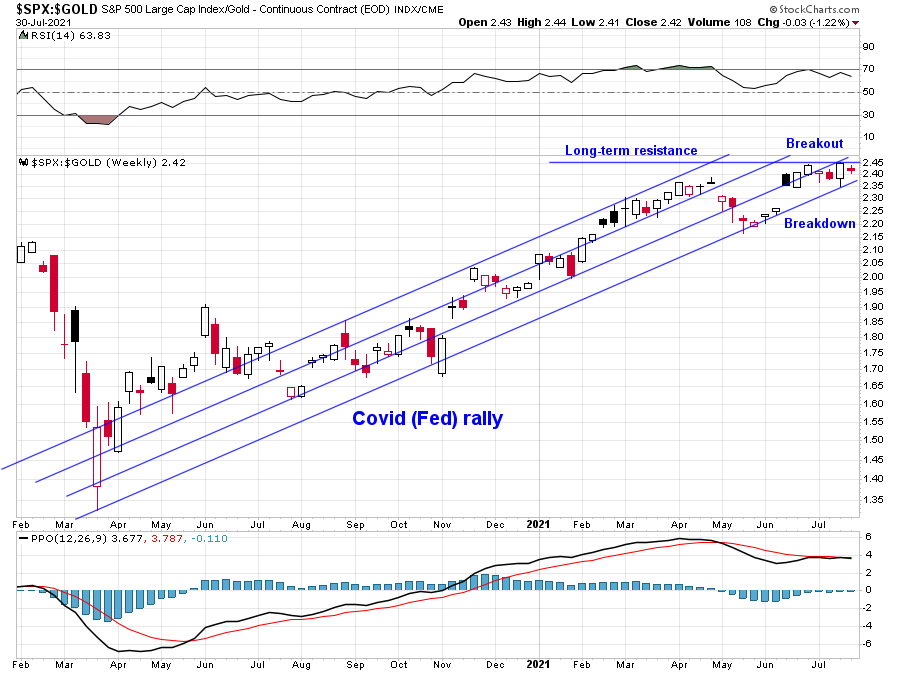

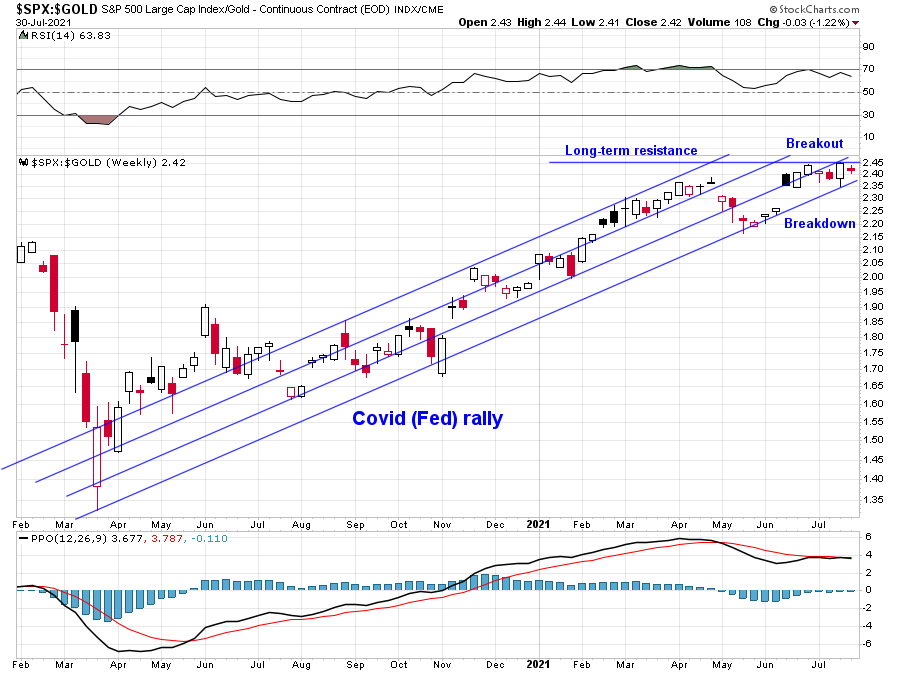

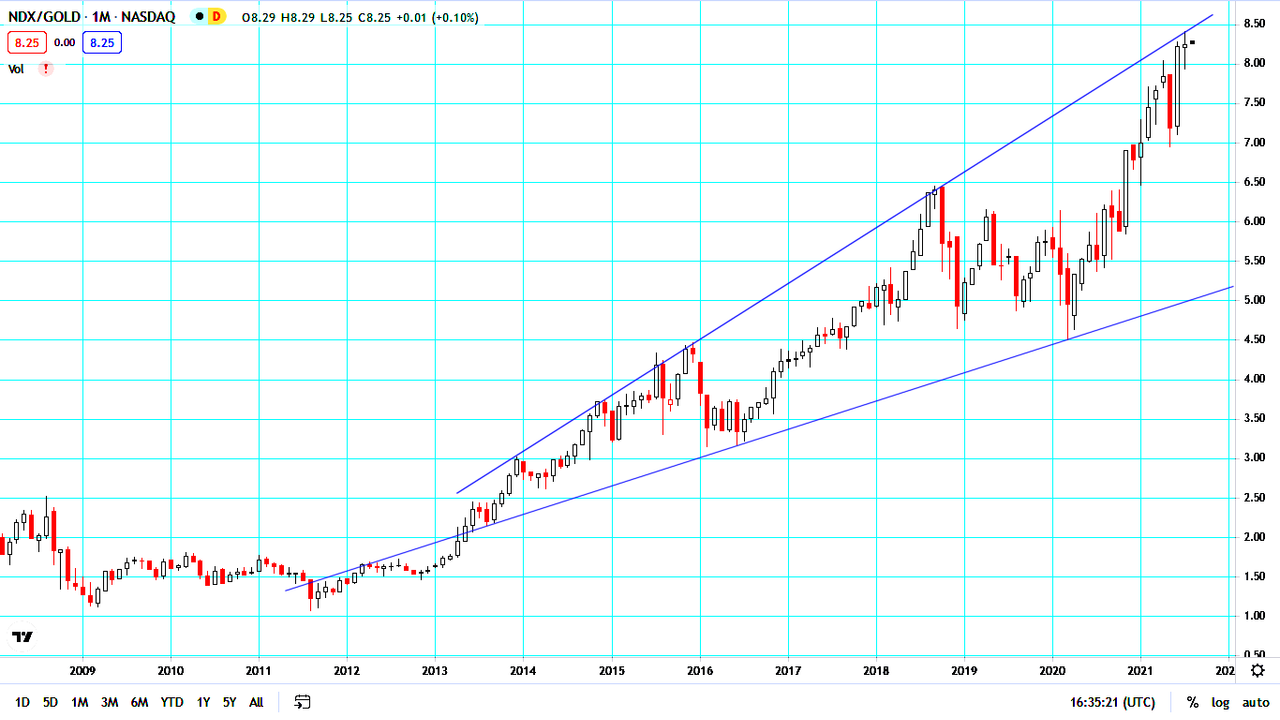

What's really interesting is the somewhat longer stock market divided by gold shown below that peaked in 1999 and is currently struggling to retake a 38% retracement of the fall since that summit. All those funny money stock market gains that the FED fabricated melt away under the weight of cold, unprinted real money. The current big question is whether the recent climb can retake the recent 2018 top. The SPX/Gold that you plot appears to be a lot closer to that goal unless a double top is in the cards this summer. The weekly trend lines that you show in your top plot should be an excellent way to stay on the right side of this pair.

Regards,

Douglas

Edited by Douglas, 01 August 2021 - 01:15 PM.

Posted 01 August 2021 - 08:47 PM

I don't think that we should dismiss the change that crypto currency has brought to the table in the "Old School" comparisons.

I don't know where this goes, but it sure seems like gold can't get it's foot in the inflation door for now.

The Pony Express disappeared when the locomotives began to roll.

Our local #1 radio station used to have a Sunday gold show but now has a Crypto hour, but nothing anywhere about Gold.

Exciting, mysterious times for sure.

Edited by Rogerdodger, 01 August 2021 - 08:53 PM.

Posted 02 August 2021 - 02:15 AM

Rodgerdodger, as a certified old fart, I just don't understand the appeal of crypto currency for long term storage of wealth replacing gold. I completely understand crypto's utility as a secure medium of exchange in financial transactions like the US dollar, but just like the dollar, it does not appear to me to be a good long term store of wealth. You own physical gold because somewhere in the back of your head you are concerned that some dark day, it will really hit the fan. That gold is not an investment, it's an insurance policy.

If it really hits the fan, which I am concerned may now now be all but inevitable given the crazy FED printing super bubbles, you will need to have buried any of your wealth in your back yard which you hope to keep. If it ain't in your hands and portable, you won't own it, and even then you better have strong hands. If it's in a bank safety deposit box or not portable like land, it may be confiscated. Just ask any Miami based Cuban. If it's deposited in a bank or brokerage account, it will be heavily taxed to bailout the unworthy. If it's fiat, it will be printed into worthlessness a la Weimar Republic. You can't bury crypto currency in your back yard. While it is portable, it could be accessed by others with superior computer skills or made inaccessible by internet controls implemented in a time of crisis as is currently happening in China. Crypto like any other deposit will probably be taxed or confiscated by one nefarious means or another. Just see the new IRS changes to the 1040 concerning it.

Of course, all this financial reckoning may not happen for years and that may provide plenty of time to make a lot of money from crypto currency trading. I just don't see it as a secure long term wealth storage vehicle replacing gold. Maybe my financial apocalyptic paranoia is completely unfounded and a new paradigm of MMT magic money is not the inevitable catastrophe that I fear.

Please, any crypto fans out there who are clearly more knowledgeable about this than me, please shoot holes in my arguments above why crypto can be a secure long term wealth storage mechanism to protect against disaster. Although I'm as old as dirt, I am never too old to learn a thing or two.

Regards,

Douglas

Edited by Douglas, 02 August 2021 - 02:18 AM.

Posted 02 August 2021 - 11:12 AM

Although the broader market may have already broken above the downtend channel, it appears to have some serious work remaining directly overhead. For an ancient relic having no relevance to modern life, the shining metal somehow still makes for some interesting ratio charts.

Posted 02 August 2021 - 12:00 PM

This one is linear rather than log - probably meaningless.

Posted 02 August 2021 - 12:30 PM

you will need to have buried any of your wealth in your back yard which you hope to keep. If it ain't in your hands and portable, you won't own it, and even then you better have strong hands. If it's in a bank safety deposit box or not portable like land, it may be confiscated.

That's why I have long advocated burying bottles of Vodka in your back yard. ![]()