Haven't seen an ASTRO for a while:

Posted 08 August 2021 - 07:37 PM

Haven't seen an ASTRO for a while:

Posted 08 August 2021 - 07:48 PM

So far, the market remains stable but could be overlooking an important point. Raghuram Rajan for Project Syndicate made a notable statement.

“Inflation readings in the United States have shot up in recent months. Labor markets are extremely tight. In one recent survey, 46% of small-business owners said they could not find workers to fill open jobs, and a net 39% reported having increased their employees’ compensation. Yet, at the time of this writing, the yield on ten-year Treasury bonds is 1.24%, well below the ten-year breakeven inflation rate of 2.4%. At the same time, stock markets are flirting with all-time highs.”

As he notes, something does not add up. With these current conditions, the Fed should tighten policy, reduce accommodation, and “reload their ammo” for the next downturn.

Instead, the Fed keeps pouring gasoline on the bonfire.

https://realinvestme...e-fed-08-06-21/

Posted 08 August 2021 - 07:54 PM

Carl:

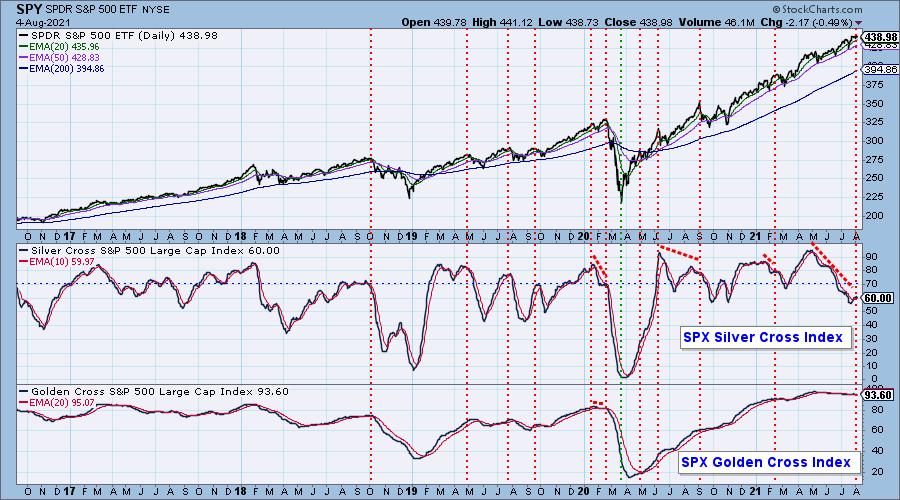

This leads me to a third breadth indicator, the Silver Cross Index (SCI), which was invented here, so we think it's pretty good. Most people have heard of the Golden Cross, which is when the 50-day moving average crosses up through the 200-day moving average. The Golden Cross implies a very positive long-term outlook for the stock or market index. We have always viewed the upside crossover of the 20EMA versus the 50EMA, a Silver Cross, as a positive omen for the intermediate-term, and so we developed the SCI, which expresses the percentage of stocks in the SPX that have a Silver Cross.

The chart below shows the SCI along with its sister, the Golden Cross Index (GCI), which is the same as the SCI except it tracks the percentage of upside 50/200EMA crossovers in the SPX. But back to the SCI, which gives us a more accurate, more enduring assessment of market breadth, and it is a superior breadth indicator. When the 20EMA is above the 50EMA, it tells us that the stock has been persistently bullish over an extended period. When the SCI drops, we know with certainty that negative 20/50EMA crossovers are taking place, and that participation is fading. The result is that any market advance is being undermined.

Since May, the SCI has been dropping steadily and by a lot. Yes, we can see steeper and deeper SCI declines, but none that have happened while the market was moving up. At this point, only about sixty percent of SPX stocks are participating in the market advance. This can happen because the larger-cap stocks are holding the index aloft, but it is a less desirable condition, carrying considerable danger.

At DecisionPoint.com, we have SCIs and GCIs on 22 market and sector indexes.

https://stockcharts....cators-766.html

Posted 09 August 2021 - 07:10 AM

GOLD seems to be exciting many, also losses by many....

Posted 09 August 2021 - 07:13 AM

A minor GOLD plunge in recent times:

Posted 09 August 2021 - 07:28 AM

Posted 09 August 2021 - 08:22 AM

My profit stop was hit after the night session open for a 1 point profit but I started selling into the night with an average sell at 4323 going into the cash open. Still say we could see a turn here at any time as the market is running on fumes and very overbought with sentiment in options remaining at extreme levels!

Posted 09 August 2021 - 08:33 AM

I follow Helene. I'd say that big sentiment shifts are often a short-term fade. The Twitterati are probably a pretty good fade, though less so in a super liquidity environment.

Great first week of August, will be risk-off for most of the rest of August unless markets make new ATHs

Saturday Poll The next 100 points for the S&P?UP53.5%DOWN46.5%2,574 votes·Final results

Saturday Poll The next 100 points for the S&P?UP53.5%DOWN46.5%2,574 votes·Final results

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

Posted 09 August 2021 - 08:41 AM

Awwwww nice even round number of short 4425, gotta love it profit stop of 4424 for now, sell above!! btw thanks d always love your reads very interesting.....

Posted 09 August 2021 - 08:49 AM

Guess I should have taken the 5 point profit. With the levels of the market may be an idea to switch to that but we'll see. Profit stop hit for a 1 point profit and starting my sell build at 4425, do love my round numbers....