Thanks for the heads up on this indicator. I like indicators that give me a heads up on something being up. This seems to be that.

So, what do you make of the current double-pump?

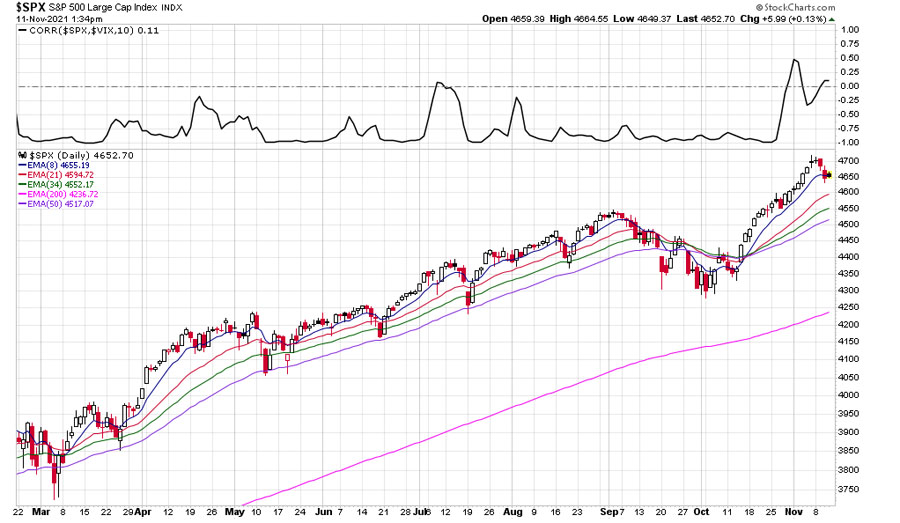

Roger, SPX:VIX?

#1

Posted 11 November 2021 - 01:38 PM

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#2

Posted 11 November 2021 - 03:34 PM

You are asking me about a chart that I stole from Tom McClellan? LOL!

I guessed that the first spike may have been buying protection for the FED announcement that week.

Now, I'm a bit more cautious than my normal Scottish self.

July and September 2020 had similar double bumps and then dropped 10%ish, nearly 400 SPX points.

2017 also had similar looks but the market kept surging before "correcting" or "crashing" at the end of January 2018.

It took 5 months just to get back to break even.

Sentiment seems highly bullish.

CNN indicators are over 80 bullish (greedy).

So I flipped a coin...

and my wife grabbed it.

I can't win for losing. ;-)

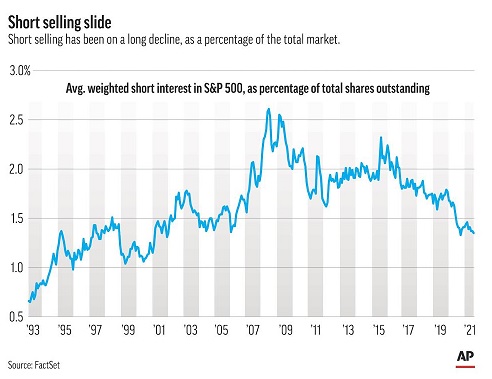

PS: Disappearing shorts: As stocks soar, skeptics surrender...

Edited by Rogerdodger, 11 November 2021 - 03:56 PM.

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#3

Posted 11 November 2021 - 04:08 PM

AAII 2:1 Bulls.

M

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#4

Posted 11 November 2021 - 04:59 PM

You are asking me about a chart that I stole from Tom McClellan? LOL!

I guessed that the first spike may have been buying protection for the FED announcement that week.

Now, I'm a bit more cautious than my normal Scottish self.

July and September 2020 had similar double bumps and then dropped 10%ish, nearly 400 SPX points.

2017 also had similar looks but the market kept surging before "correcting" or "crashing" at the end of January 2018.

It took 5 months just to get back to break even.

Sentiment seems highly bullish.

CNN indicators are over 80 bullish (greedy).

So I flipped a coin...

and my wife grabbed it.

I can't win for losing. ;-)

PS: Disappearing shorts: As stocks soar, skeptics surrender...

Daily money flow on the SPX looks eerily similar to the Jan 26, 2018 top. Tomorrow should be similar to Feb 1, 2018, that means next week should see some fireworks like down, up, down or a-b-c into the 22nd, my best guess: an 11-16% correction coming, not a bear market though...![]() astros are also socio-politically negative for next week...Mars t-squaring the Saturn/Uranus triple square Nov 10-17 and the lunar eclipse on the 19th, the longest since 1440 CE. Looks good for traders!

astros are also socio-politically negative for next week...Mars t-squaring the Saturn/Uranus triple square Nov 10-17 and the lunar eclipse on the 19th, the longest since 1440 CE. Looks good for traders!![]()

#5

Posted 11 November 2021 - 06:22 PM

This is the ime of the year when the market "grinds' higher until everybody can dump in the New Year. CPI was the big news and yesterday's low was held today, the obligrory exhale upwards materialized, stopping dead on the 9 sma, since my system is already on a sell, we have to recapture the 9, 16148 on the NQ's Dec. or higher, or we head down to the 20 at 15810. So far they are still giving Gentleman Jay's "Transitory" theme the nod. (JMHO)

#6

Posted 11 November 2021 - 06:25 PM

This is the ime of the year when the market "grinds' higher until everybody can dump in the New Year. CPI was the big news and yesterday's low was held today, the obligrory exhale upwards materialized, stopping dead on the 9 sma, since my system is already on a sell, we have to recapture the 9, 16148 on the NQ's Dec. or higher, or we head down to the 20 at 15810. So far they are still giving Gentleman Jay's "Transitory" theme the nod. (JMHO)

hmmm???/ Did I just uncontrollably lurch in to the truth? Gentleman Jays "Transitory" will keep us range bound in a new trading range? That Jay!! he's so smart!! (jmho)

#7

Posted 11 November 2021 - 07:31 PM

You are asking me about a chart that I stole from Tom McClellan? LOL!

I guessed that the first spike may have been buying protection for the FED announcement that week.

Now, I'm a bit more cautious than my normal Scottish self.

July and September 2020 had similar double bumps and then dropped 10%ish, nearly 400 SPX points.

2017 also had similar looks but the market kept surging before "correcting" or "crashing" at the end of January 2018.

It took 5 months just to get back to break even.

Sentiment seems highly bullish.

CNN indicators are over 80 bullish (greedy).

So I flipped a coin...

and my wife grabbed it.

I can't win for losing. ;-)

PS: Disappearing shorts: As stocks soar, skeptics surrender...

Daily money flow on the SPX looks eerily similar to the Jan 26, 2018 top. Tomorrow should be similar to Feb 1, 2018, that means next week should see some fireworks like down, up, down or a-b-c into the 22nd, my best guess: an 11-16% correction coming, not a bear market though...

astros are also socio-politically negative for next week...Mars t-squaring the Saturn/Uranus triple square Nov 10-17 and the lunar eclipse on the 19th, the longest since 1440 CE. Looks good for traders!

The all in buy signal I was waiting for !

#8

Posted 12 November 2021 - 11:34 AM

Concur!!

#9

Posted 15 November 2021 - 09:44 AM

My cycle has moved out 1 trading day, . I see two lows ahead: 11/17-18 and 11/23 and a major top on Dec 23. I see a major top today and the 19th of Nov. A flash crash is due this week and also next week. Top due Dec 1, low Dec 6, top Dec 9, low Dec 14, top Dec 23. A total 15-16% down move off the top on SPX possible in the coming days! Current cycle similar to Jan 26-Feb 9, 2018. Astros say this one (flash crash) should be caused by over speculation combined with Geo-Political Instability gyrations.

#10

Posted 15 November 2021 - 12:43 PM

Really -15% in a couple days, that'd be quite the correction. 2-3% I could see but that seems a bit stiff, you really going to stick to that???