Anyone invest in PFFD for income? Pros/cons??

Thanks

Posted 16 January 2022 - 01:06 PM

Anyone invest in PFFD for income? Pros/cons??

Thanks

Posted 16 January 2022 - 02:06 PM

cp1, I assume the PFFD you are referring to is the preferred stock ETF which shows a current yield around 5.18%. In the little over 4 years that it has existed, it has only appreciated a few percent while a broad market index ETF like SPY which has a yield of 1.23% has appreciated something like 75%. That's giving up a lot of appreciation for only a small increase in income. It would be fairly straight forward to generate that 5.18% using a simple call writing strategy against a long SPY position or even a SPY put writing strategy against cash if you think (like I do) that it is currently overpriced. I'm curious, why have you zeroed in on PFFD for income? As a retired certified old fart suffering from FED interest rate suppression, I'm also constantly on the lookout for easy to milk income cows.

Regards,

Douglas

Posted 16 January 2022 - 04:19 PM

Yes, I am referring to the preferred stock ETF. I am not retired yet but plan to within the next couple of years. I do have my eggs in various baskets. Trying to have a basket of dividend income assets. I already own ABBV, SDIV, IBM, KO, IP, T and GIS. I automatically reinvest the dividends since I don't need the income today.

I appreciate your feedback Douglas. I am also looking for any suggestions from the experts on this board.

Posted 17 January 2022 - 08:34 AM

I did a quick check on PFFD and found that 87% of the holdings are in utility issues, with 7% in healthcare and 6% industrial issues.

Don't know if that was what you were actually looking for based on the thread.

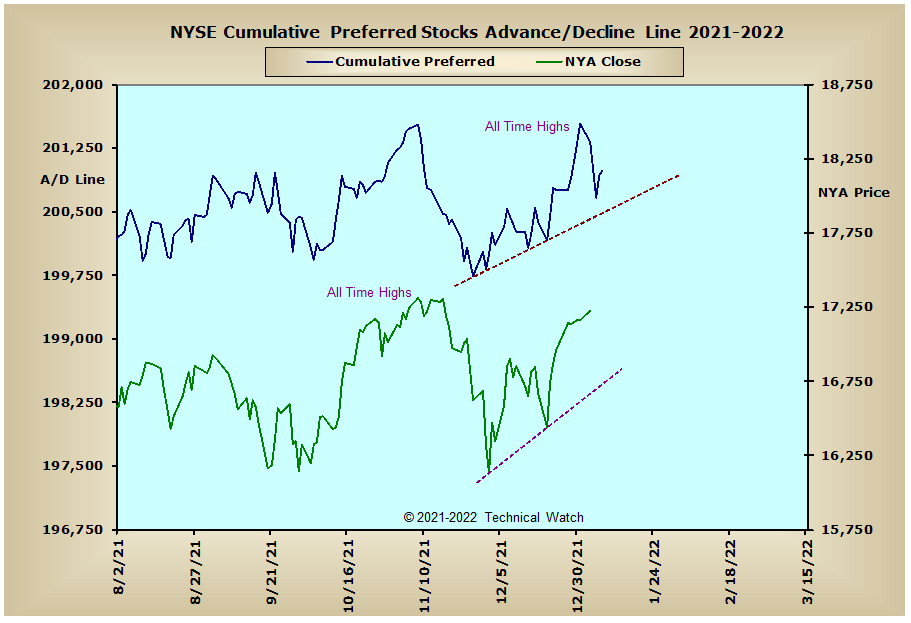

However, below is the NYSE Preferred stock advance/decline line through January 7th that might provide the insight you're looking for.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

Posted 17 January 2022 - 10:31 AM

Thanks Fib...appreciate the info.

Posted 18 January 2022 - 10:52 PM

Posted 20 January 2022 - 06:35 PM

Try VRP instead.

Good one...thanks.