This GRANTHAM guy is very popular this weekend and past week.

- Most of the time, perhaps three-quarters of the time, major asset classes are reasonably priced relative to one another.

- The real trouble with asset allocation, though, is in the remaining times when asset prices move far away from fair value.

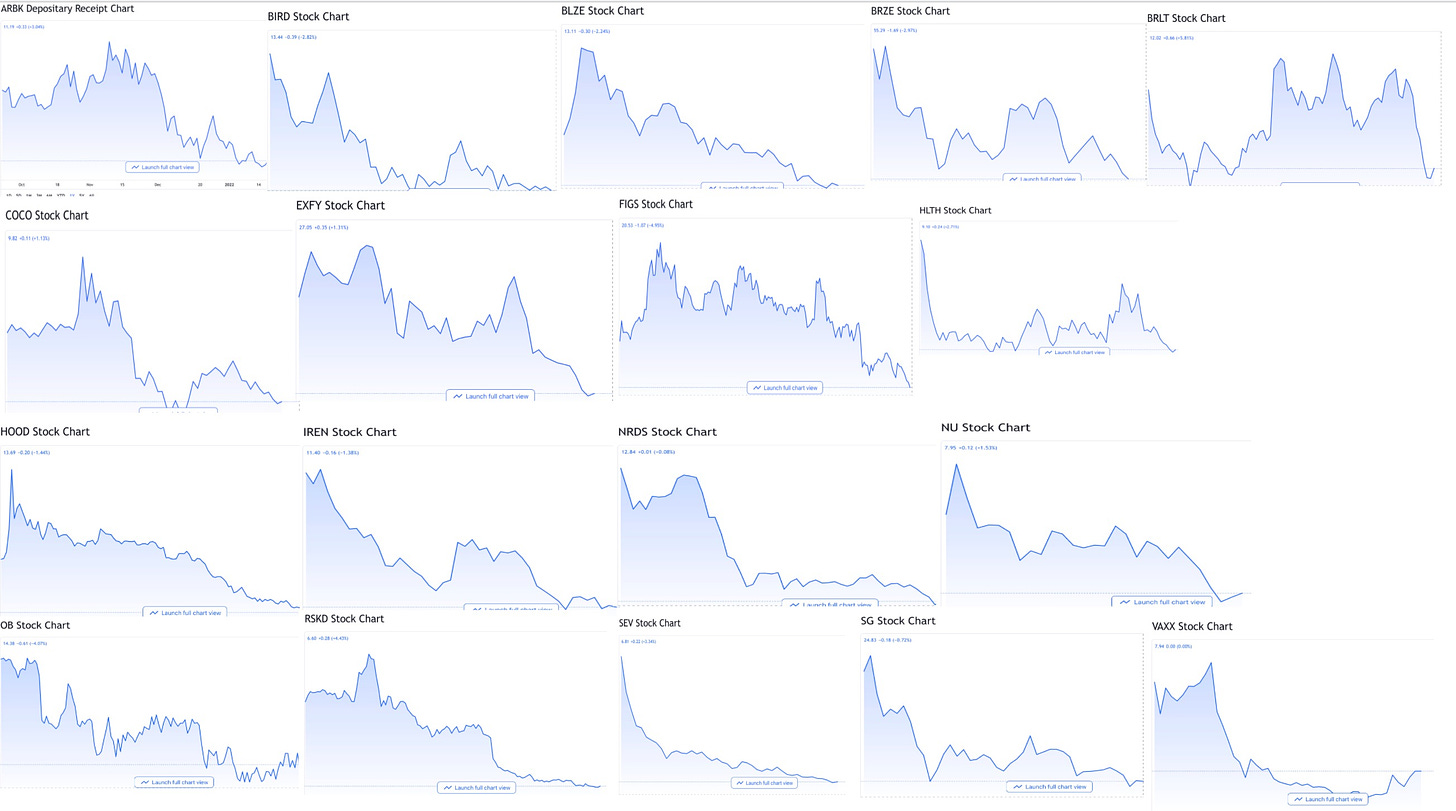

- I am doubling down, because as prices move further away from trend, at accelerating speed and with growing speculative fervor, of course my confidence as a market historian increases that this is indeed the late stage of a bubble.

- This time, more than in any previous bubble, investors are relying on accommodative monetary conditions and zero real rates extrapolated indefinitely.

The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.

These great bubbles are where fortunes are made and lost – and where investors truly prove their mettle. For positioning a portfolio to avoid the worst pain of a major bubble breaking is likely the most difficult part. Every career incentive in the industry and every fault of individual human psychology will work toward sucking investors in.

But this bubble will burst in due time, no matter how hard the Fed tries to support it, with consequent damaging effects on the economy and on portfolios. Make no mistake - for the majority of investors today, this could very well be the most important event of your investing lives. Speaking as an old student and historian of markets, it is intellectually exciting and terrifying at the same time. It is a privilege to ride through a market like this one more time.

https://seekingalpha...for-last-dance?