Gas price yesterday $4.59

Gas price today at the same gas station $4.75

It will be $5+ even before summer has begun.

I expect inflation to stay high during whole summer.

$100 to fillup a mid-size car is not something Americans are used to.

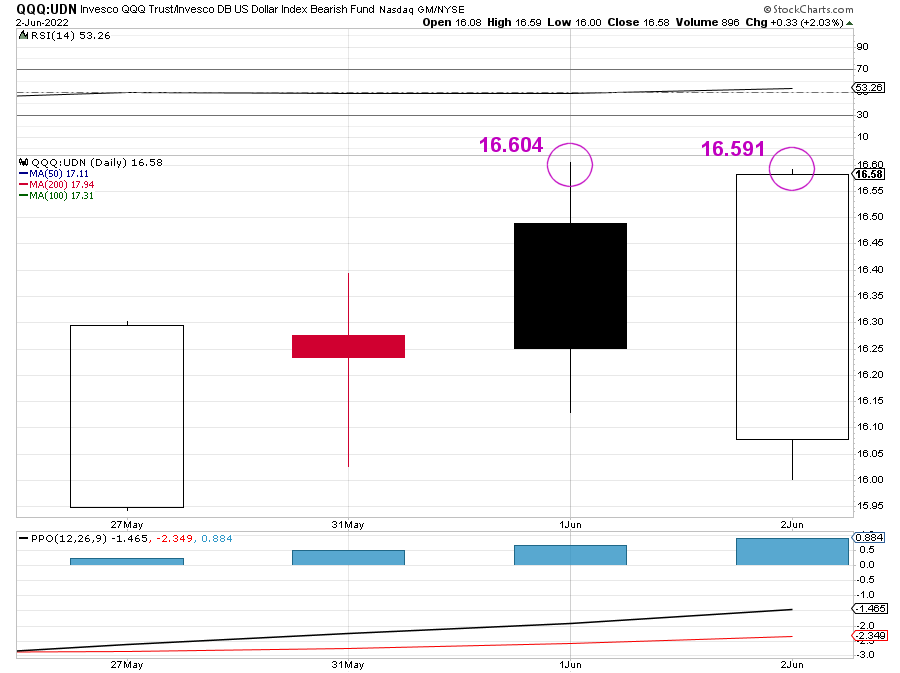

But the market is not ready to rollover and crash.

Summer rally should keep ST bullish.

I expect more bullish than bearish through June.

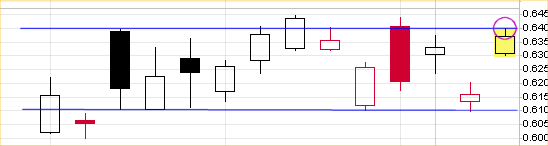

Crude at possible big inflection point today.

Thus far not able to get a daily CLOSE above 116. Until that happens, possibility the late May high was all she wrote.

But if it blasts above 116, then who knows how high it might gush....

Huge pivot set a backtest of 110 yesterday, so as long as that holds, bulls get benefit of doubt.

But if we were to see a sharp move lower here below 110, instead of blastin' out over 116, then bears back on offense...

Below 113 would likely be first hint that bulls might not have the power to push it over 116.

If it is going to take out 116, then should happen today or tomorrow latest I would think,

Edited by K Wave, 03 June 2022 - 06:40 AM.