Mike Burk's seasonality has been helpful.

Last week it was: Coming week: "Negative by all measures." as the SPX finished down 86 points

But this coming week? Forget Seasonality?

The good news is:

The buy the dip crowd is alive and well.During the rally of a week ago we saw the highest volume in over 2 years.

Conclusion

Last week new lows returned to dangerously high levels.

Seasonality for next week is positive, however I think the buy the dip crowd had its day.

Other views:

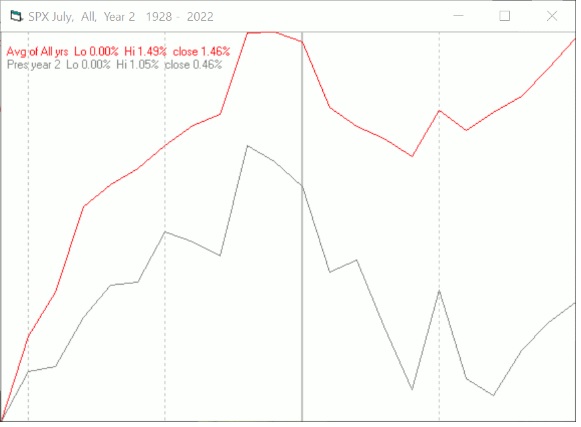

July stock market seasonality:

- July is up only 48% of the time, tied with September for the worst month.

- The average return for July is 0.38%.

- July 2nd is historically the 5th worst day of the month.

- July is up 3 years in a row, tied for the longest streak over 50 years. ...

- The worst July return ever was -7.9% in 2002, the second best max drawdown for any month.

Edited by Rogerdodger, 02 July 2022 - 09:30 PM.