Dems are facing election damage from interest rate rise. The economy is probably already in a recession. Next move? Powell pivots.

Posted 04 October 2022 - 01:11 AM

Dems are facing election damage from interest rate rise. The economy is probably already in a recession. Next move? Powell pivots.

Posted 04 October 2022 - 02:24 AM

Posted 04 October 2022 - 07:14 AM

Dems are facing election damage from interest rate rise. The economy is probably already in a recession. Next move? Powell pivots.

Not sayin' impossible, but based on Fed very long history of idiots since Volcker, they rarely stop before they catch the 2 year.

Now perhaps a market crash type move of some sort could get get that 2 year rate fallin' fast by November down to 3.25.

Looking at the very extended 2 year rate chart, seems not impossible.

But other than that, may be wishful thinking on a Nov pivot.

Fed meeting after that, definitely possible.

Either way, it is not the Fed dictating things, it is Mr. Market.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 04 October 2022 - 07:44 AM

Hahaha thats hilarious but true, they are sooooo out of touch however looking at commodity prices I'm questioning where the inflation is...

Posted 04 October 2022 - 08:11 AM

LOL!

Posted 04 October 2022 - 09:54 AM

When is the next FED meeting to decide rates? Before or after Nov 8th election?

Posted 04 October 2022 - 11:17 AM

When is the next FED meeting to decide rates? Before or after Nov 8th election?

Nov 1-2

Posted 04 October 2022 - 01:15 PM

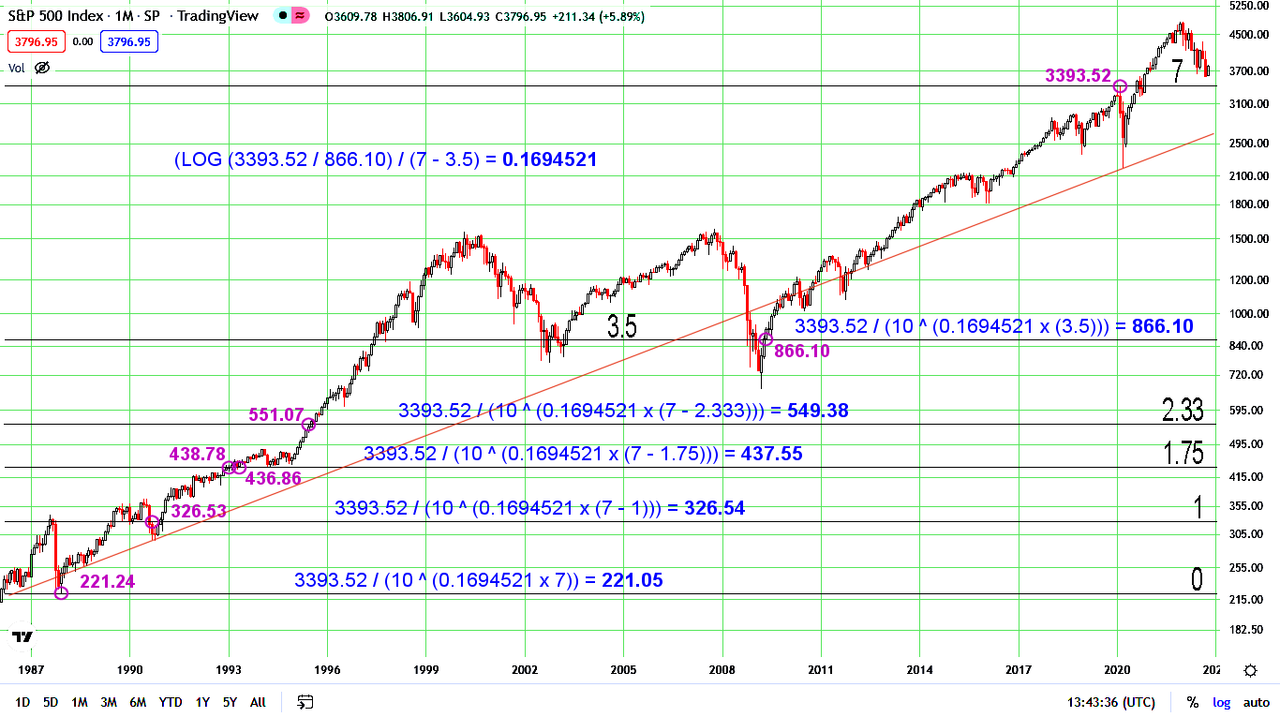

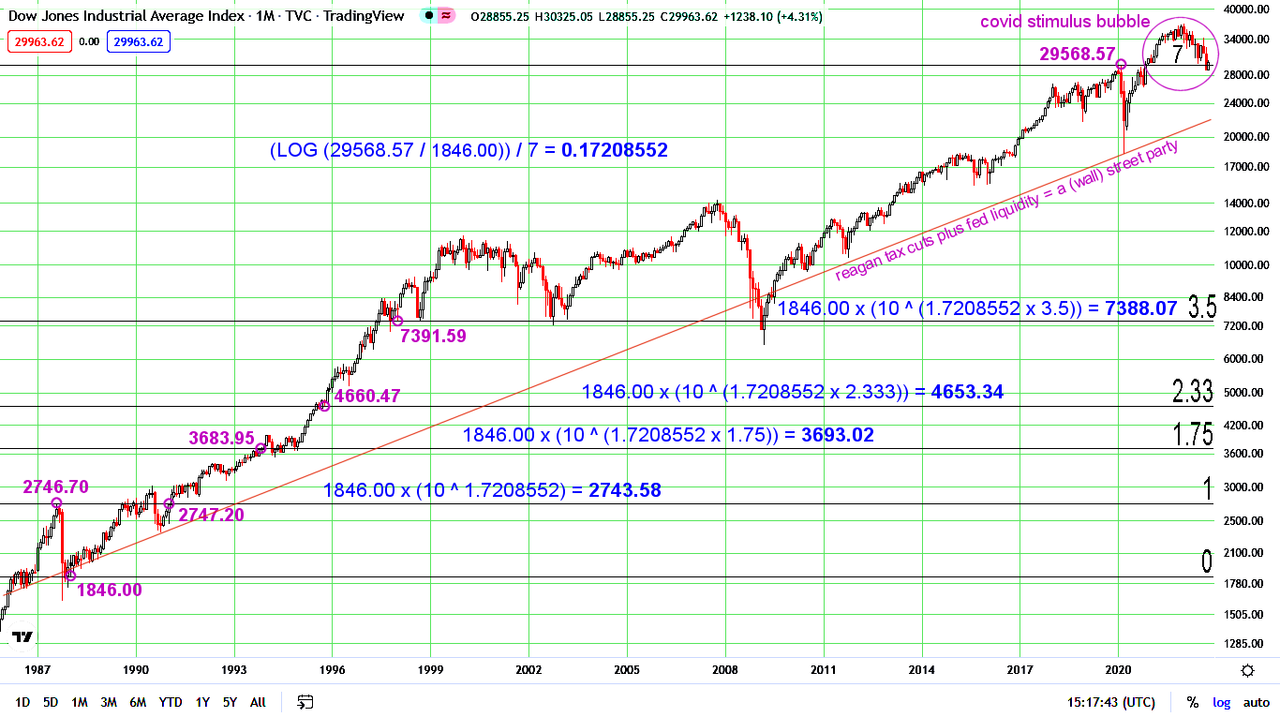

Our current blissful state of affairs appears to be the culmination of 32 years of guns-and-butter trickle-down ray-gun era economics. The crash of Oct 87 was simply taking measurement for the next 30+ years of "growth". The second and very significant tax reform act was signed into law in Oct 86. On Oct 20, 87 Greenspan (in)famously stated “The Federal Reserve, consistent with its responsibilities as the Nation's central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system”. The rest is unsurprising history. The teminal price for the monthly count that kicked-off in late 87 was finally tagged on Feb 12, 2020. It's a shame (and amazing coincidence) that the virus came along when it did, justifying the printing of zillions in fiat throughout the world and forestalling the natural course of events. Instead of a much needed financial reset, the world's population is condemned to an indeterminate future of inflationary hell, for the provision of debt nullification and asset valuation readjustment via fiat debasement. Will the peoples never wise (and rise) up against the purpetual abuses resulting from central banksters having absolute control over their currency?

Posted 05 October 2022 - 01:33 PM

Posted 06 October 2022 - 11:31 AM

To my thinking these charts suggest that the secular bear market began in late '87, and would likely have ended in a bloodbath in 2020 if not for the government and fed's (f'd-up) response to the virus. And (again, in my mind), it logically follows that Fauci may be honest and correct in downplaying the 'lab leak theory', since that theory implies a laboratory accident. This leaves me wondering as to why he might believe that no accident took place.