uh oh and wow! not good.

https://www.yahoo.co...-130730190.html

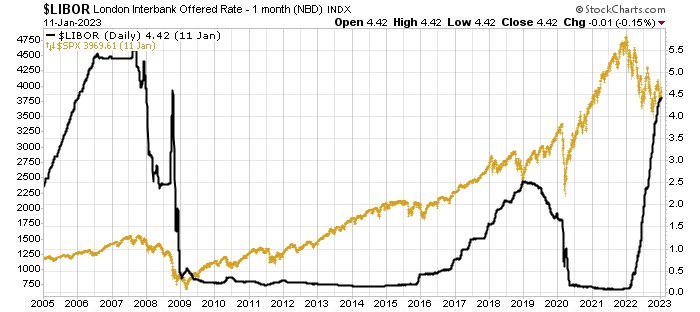

Bloomberg) -- One of the world’s most important short-term lending benchmarks has climbed back to a level last seen before the onset of the global financial crisis in 2008.

-

The three-month London interbank offered rate for dollars climbed 1.5 basis points on Thursday to 4.82971%, exceeding the peak of 4.81875% it reached in October 2008 when credit markets were in disarray following the shock collapse of Lehman Brothers Holdings Inc. The last time it was higher was in 2007.