With the April inflation data about to be released over the next two sessions, it's interesting to note that we currently have (McClellan) "Summation Failure" warnings in effect in several market areas that could cause a "crash like" sequence in the equity markets over the next few sessions. Weakest areas remain with the small caps, mid caps and the secondary NASDAQ marketplace in that order, with the large caps having the best chance of market buoyancy on any near term bearish ambush. The price of gold looks ready now to make a concentrated effort to move into new all time high territory which would then suggest that interest rates will be moving lower on a short term trending basis. Bottom line here is that there has been a whole lot of pushing and pulling going on for the last several weeks here in the United States markets, but the good news is that we're about to get a decisive decision on which side will be in control of price movement for the rest of the month of May and into the beginning of June by the end of the week.

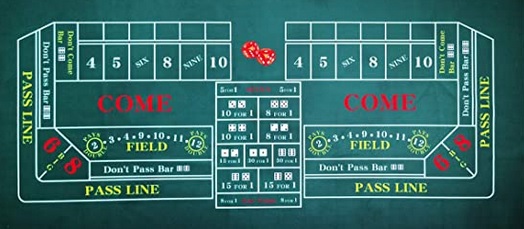

Place your bets.

Fib