For those of you interested, you can get FREE cumulative A-D data from here:

Free A-D data

As I said before, I had constructed an S&P 500 ONLY cumulative A-D data, and compared it to the S&P. But since S&P components changed, I wasn't sure if the data was representative.

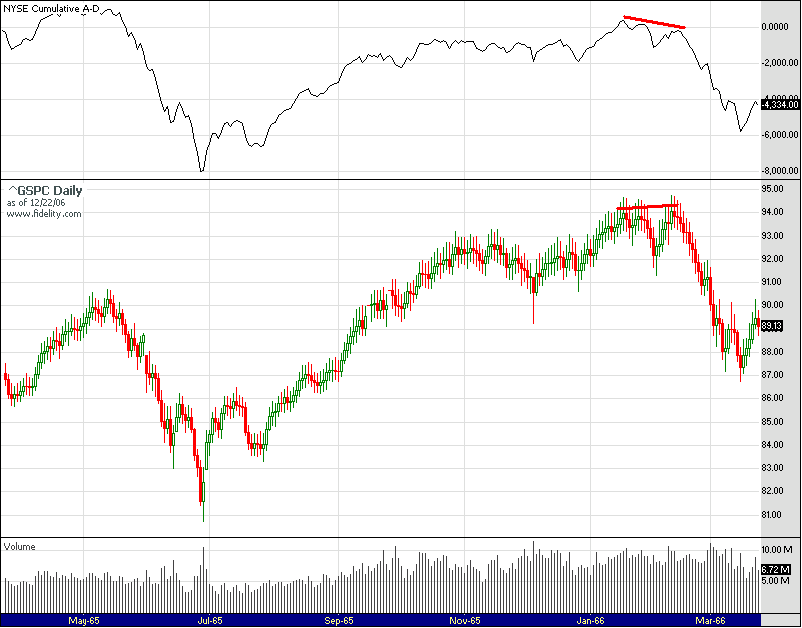

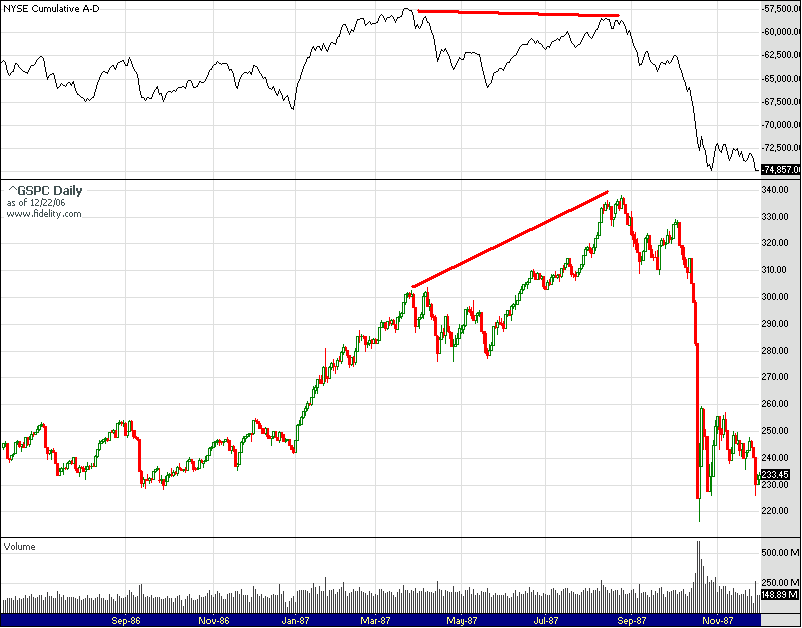

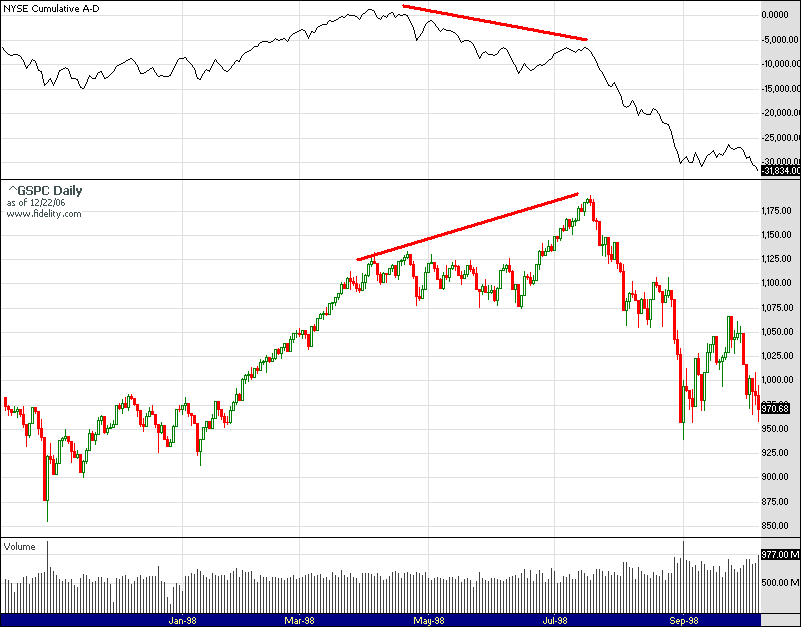

Now I have my hands on some historical cumulative A-D data for NYSE and decided to chart it against the S&P.

The cases I'm presenting are: 66, 87, 94, and 98. As you can see, in some cases, the cumulative A-D did show a divergence with price. In some cases, it did not. If an IT top is to be made here, or even a fast decline is to start here, there are historical precedence where they have been made without any signals given by cumulative A-D of NYSE issues.