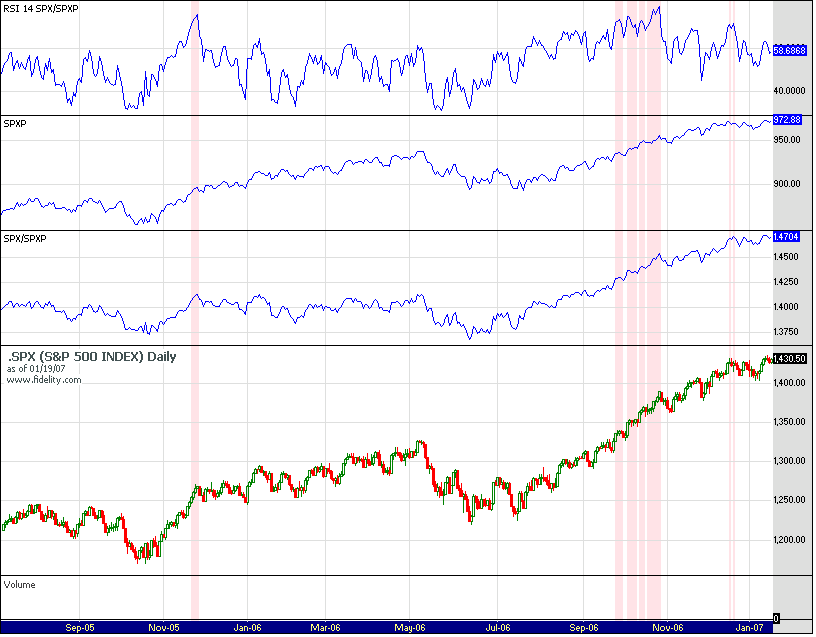

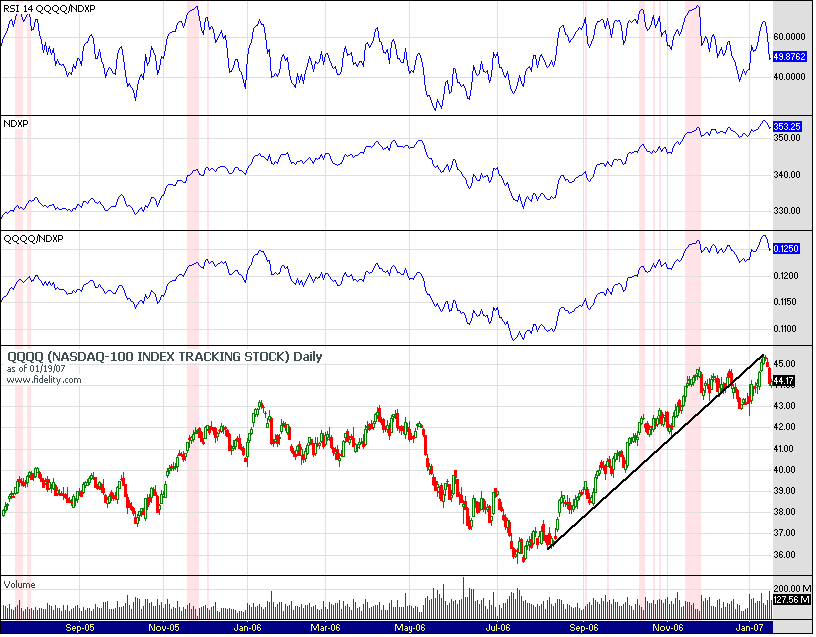

The value I call the SPXP and NDXP are created by taking the cumulative sum of the percentage gain of each stock in the index.

For instance, for the NDX, there are 100 stocks. The percent gain is (today's close - previous day's close)/previous day's close. This is repeated for each stock in the index, then summed up. Hence its an equal price weighted index.

The QQQQ/NDXP is merely as it states, a division of QQQQ/NDXP, and RSI14 is the RSI14 of that ratio. The bars are colored red if it exceeds 70.