What is the practical difference.....

#1

Posted 22 January 2007 - 01:09 PM

It's the illiquidity, stupid !

#2

Posted 22 January 2007 - 01:14 PM

between 'buy and hold' and 'buy and hold on margin' ?

LMAO

margin means you have a stop

ed rader

#3

Posted 22 January 2007 - 01:20 PM

between 'buy and hold' and 'buy and hold on margin' ?

LMAO

margin means you have a stop.

ed rader

LOL that's as true as it gets.

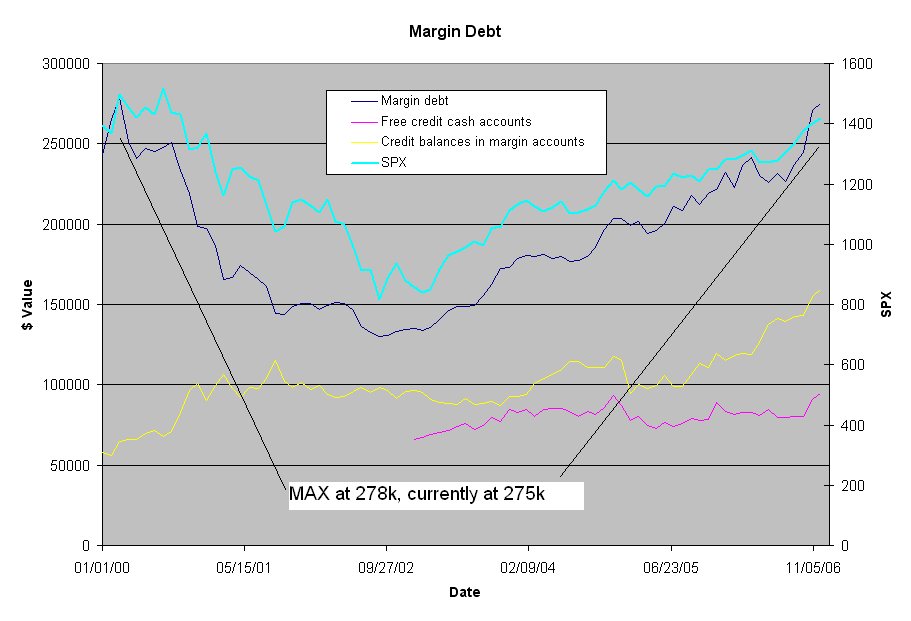

And december's margin debt came in too...

#4

Posted 22 January 2007 - 01:55 PM

#5

Posted 22 January 2007 - 04:11 PM

Additionally, the vast majority of folks who own an asset of any sort, won't be affected in a meaninful sense if it declines in value by 20%. The average Joe isn't trading his house on margin. He only gets a forced liquidation if he doesn't pay the mortgage, and even then he often can work something out.

"For the seventh straight year, foreclosure filings hit record highs not only here but in all of Ohio and Kentucky.

Record foreclosures were also a national phenomenon, and Ohio, Indiana and Kentucky were at the front. Through Sept. 30, Ohio led the nation with 3.32 percent of its home loans in foreclosure, according to the Mortgage Bankers Association.

Indiana was second at 2.9 percent; Kentucky, fifth at 1.76 percent. The national average was 1.05 percent.

Economists, lenders and consumer advocates blame the upswing on a stew of culprits: an unemployment bubble in the Midwest, an unquenching thirst for consumer debt, and mortgage scams on low-income homebuyers."

Midwest foreclosures soar

Sounds like some of Mark and IT's neighbors haven't gotten the good news about the economy yet . . .

#6

Posted 22 January 2007 - 05:08 PM

Additionally, the vast majority of folks who own an asset of any sort, won't be affected in a meaninful sense if it declines in value by 20%. The average Joe isn't trading his house on margin. He only gets a forced liquidation if he doesn't pay the mortgage, and even then he often can work something out.

"For the seventh straight year, foreclosure filings hit record highs not only here but in all of Ohio and Kentucky.

Record foreclosures were also a national phenomenon, and Ohio, Indiana and Kentucky were at the front. Through Sept. 30, Ohio led the nation with 3.32 percent of its home loans in foreclosure, according to the Mortgage Bankers Association.

Indiana was second at 2.9 percent; Kentucky, fifth at 1.76 percent. The national average was 1.05 percent.

Economists, lenders and consumer advocates blame the upswing on a stew of culprits: an unemployment bubble in the Midwest, an unquenching thirst for consumer debt, and mortgage scams on low-income homebuyers."

Midwest foreclosures soar

Sounds like some of Mark and IT's neighbors haven't gotten the good news about the economy yet . . .

Yep, unbelievable!

IT

#7

Posted 22 January 2007 - 10:43 PM

Additionally, the vast majority of folks who own an asset of any sort, won't be affected in a meaninful sense if it declines in value by 20%. The average Joe isn't trading his house on margin. He only gets a forced liquidation if he doesn't pay the mortgage, and even then he often can work something out.

"For the seventh straight year, foreclosure filings hit record highs not only here but in all of Ohio and Kentucky.

Record foreclosures were also a national phenomenon, and Ohio, Indiana and Kentucky were at the front. Through Sept. 30, Ohio led the nation with 3.32 percent of its home loans in foreclosure, according to the Mortgage Bankers Association.

Indiana was second at 2.9 percent; Kentucky, fifth at 1.76 percent. The national average was 1.05 percent.

Economists, lenders and consumer advocates blame the upswing on a stew of culprits: an unemployment bubble in the Midwest, an unquenching thirst for consumer debt, and mortgage scams on low-income homebuyers."

Midwest foreclosures soar

Sounds like some of Mark and IT's neighbors haven't gotten the good news about the economy yet . . .

Yep, unbelievable!2-3% of mortgages are in foreclosure. If this keeps up TOL is going to go back under 31.

IT

Ohio = 3.32%. If you don't think that's significant, you're even more foolish than I imagined.

#8

Posted 23 January 2007 - 08:40 AM

You really don't get it do you? Bad news on the economy will NOT mark the top. It's the good news that will mark the top.

Is there more in the way of bad news on housing? Sure. There are a lot of stupid loans that need to be unwound. It's immoral, too, what some have done. Will it be "debaclegeddon"? Not likely. I'll just be part of the whole recession, whenever that comes. If you're looking for clues, watch the market.

Mark

Additionally, the vast majority of folks who own an asset of any sort, won't be affected in a meaninful sense if it declines in value by 20%. The average Joe isn't trading his house on margin. He only gets a forced liquidation if he doesn't pay the mortgage, and even then he often can work something out.

"For the seventh straight year, foreclosure filings hit record highs not only here but in all of Ohio and Kentucky.

Record foreclosures were also a national phenomenon, and Ohio, Indiana and Kentucky were at the front. Through Sept. 30, Ohio led the nation with 3.32 percent of its home loans in foreclosure, according to the Mortgage Bankers Association.

Indiana was second at 2.9 percent; Kentucky, fifth at 1.76 percent. The national average was 1.05 percent.

Economists, lenders and consumer advocates blame the upswing on a stew of culprits: an unemployment bubble in the Midwest, an unquenching thirst for consumer debt, and mortgage scams on low-income homebuyers."

Midwest foreclosures soar

Sounds like some of Mark and IT's neighbors haven't gotten the good news about the economy yet . . .

Why do you think 3% of all Ohio mortgages is especially significant? Did you study the percentage of the total money owed on mortgages? The % relative to the value of the total residental realestate?

I mean, if you're gonna play economist, you ought to do the basic work. Show some rigor in your discipline!

Hint: the 3% represents about 1.75% (off the top of my head) of the average mortgage value. This is a function of turning part of the mortgage industry to "rent-to-own".

Mark

Additionally, the vast majority of folks who own an asset of any sort, won't be affected in a meaninful sense if it declines in value by 20%. The average Joe isn't trading his house on margin. He only gets a forced liquidation if he doesn't pay the mortgage, and even then he often can work something out.

"For the seventh straight year, foreclosure filings hit record highs not only here but in all of Ohio and Kentucky.

Record foreclosures were also a national phenomenon, and Ohio, Indiana and Kentucky were at the front. Through Sept. 30, Ohio led the nation with 3.32 percent of its home loans in foreclosure, according to the Mortgage Bankers Association.

Indiana was second at 2.9 percent; Kentucky, fifth at 1.76 percent. The national average was 1.05 percent.

Economists, lenders and consumer advocates blame the upswing on a stew of culprits: an unemployment bubble in the Midwest, an unquenching thirst for consumer debt, and mortgage scams on low-income homebuyers."

Midwest foreclosures soar

Sounds like some of Mark and IT's neighbors haven't gotten the good news about the economy yet . . .

Yep, unbelievable!2-3% of mortgages are in foreclosure. If this keeps up TOL is going to go back under 31.

IT

Ohio = 3.32%. If you don't think that's significant, you're even more foolish than I imagined.

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter