Edited by xD&Cox, 14 February 2007 - 08:15 PM.

3 things that bother me....

#1

Posted 14 February 2007 - 08:06 PM

#2

Posted 14 February 2007 - 08:25 PM

#3

Posted 14 February 2007 - 08:47 PM

http://www.zimbio.co...Veyron Crashing

#4

Posted 14 February 2007 - 09:46 PM

I believe there are these three non-scientific but considerably disturbing facts that are bothersome for someone as short as I am:

1- The last 3 month's pattern on Nasdaq looks like a carbon copy of the last year's top that resulted with a breakdown in May 06. Why it bothers me? Because the market rarely repeats the same pattern consecutively. So perhaps one should normally expect this one to produce a different outcome ?

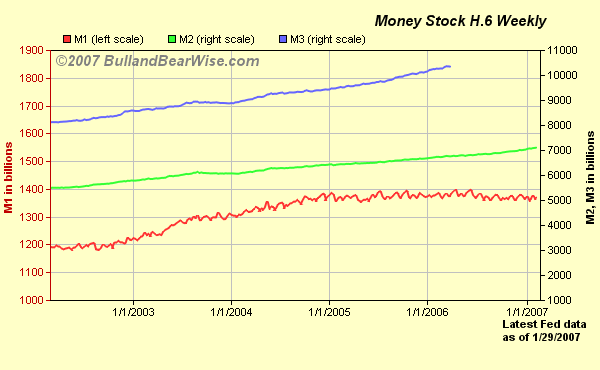

2- This Fed was proven to be worse than the one under Greenie's management. This one is very secretive, very manipulative and operative. Started with discontinuation of M3 reports, they have obviously and evidently been manipulating and interpreting fundamental data to give inaccurate vision on almost daily basis, as if they want every printed dime to work through the system.

But infact those with good memory, actually with normal memory will remember how they were talking the inflation down not so long ago. Have you seen CRB index lately? Well, make no mistake that New York Stock Exchange can keep going higher on this destructive cancerogen nutrition even Nasdaq and SOX plummet into the ground. Will there be an end to this?

3- S&P500 ETF, SPY which is the number one investment tool for ETF funds is at or around 2000 top. I have rarely seen an ETF reversing from the exact double top without running some stops or sucking more bulls into the system. It is always too good to be true.

So here I puked out the things that was bothering me for sometime now. As I said I am short and my long and intermediate term view havent changed at all. To repeat, I think the bull market is over or about to be over. I expect a bear market that will last minimum 9 months.

I think you're right to expect that stops will be run at obvious levels -- it always seems to work this way. Your published stops seem to near at hand for an IT strategy -- JMHO. Frankly, I think it's foolish to post stop levels. There are dozens of bots that patrol boards like this one and feed their data into stop-gunning models. This has been reported in various places and I have no reason to doubt it's true.

I am also short on an IT basis and focused on one story which I believe will determine the outcome.

Best of luck with your trades.

#5

Posted 14 February 2007 - 09:48 PM

discontinuation of M3 reports

I don't disagree with you in the slightest.

To date, no one has been able to describe the Fed might be influencing M3.

Everyone just assumes that it is happening. The Fed does not have the tools to "directly" influence M3.

James

#6

Posted 14 February 2007 - 10:11 PM

U.F.O.

Edited by U.F.O., 14 February 2007 - 10:13 PM.

~Benjamin Franklin~

#7

Posted 14 February 2007 - 10:47 PM

I think you're right to expect that stops will be run at obvious levels -- it always seems to work this way. Your published stops seem to near at hand for an IT strategy -- JMHO. Frankly, I think it's foolish to post stop levels. There are dozens of bots that patrol boards like this one and feed their data into stop-gunning models. This has been reported in various places and I have no reason to doubt it's true.

I am also short on an IT basis and focused on one story which I believe will determine the outcome.

Best of luck with your trades.

Giving stops are foolish but only if they are already placed. I dont think they will run the index based on some mental stop posted on public boards. But I strongly agree that they do run stops when they see them. Some people still place their stops on the book, and they become very visible when the market approaches them, I never place the stops. I go and cover when I feel.

James,

Fed also says that they have no influence on M3, however it is like a black box no one know their indirect effect either.

Liquidation of the dollar reserves by foreign central banks can not be the only reason for the weakness in Dollar imo. Meanwhile this unstoppable rise in commodity prices suggests their pump of liquidity as rampant as anything we haven't seen in the history.

#8

Posted 14 February 2007 - 10:55 PM

#9

Posted 14 February 2007 - 11:19 PM

Another subprime lender, ResMAE, files for bankruptcy

Tuesday February 13

Private firm says Merrill triggered crisis; plans asset sale to Credit Suisse

SAN FRANCISCO (MarketWatch) - Subprime lender ResMAE Mortgage Corp. filed for bankruptcy protection this week, the latest sign of stress in the market for low-end home loans.

ResMAE said it plans to sell most of its assets to Swiss bank Credit Suisse (NYSE:CS - News) for $19 million as part of its bankruptcy reorganization, according to the Monday filing.

ResMAE is the latest subprime lenders to descend into crisis. Mortgage Lenders Network USA had to be bailed out by Lehman Brothers (NYSE:LEH - News) earlier this year, while rival Ownit Mortgage Solutions filed for bankruptcy in late December.

New Century Financial (NYSE:NEW - News) shares have lost almost half their value this year. The lender said last week that it found errors in the way it accounted for subprime mortgages. Banking giant HSBC Holdings (NYSE:HBC - News) disclosed problems in its subprime business last week too.

ResMAE was started in late 2001 by Jack Mayesh, Edward Resendez and William Komperda, who had sold Long Beach Financial, another subprime lender they founded, to Washington Mutual (NYSE:WM - News) in 1999.

ResMAE grew quickly to become a top 20 subprime lender in the U.S. However, by early 2005, loan originations began to wane, knocking ResMAE's profitability. By cutting costs and lifting the interest rates it charged on loans, the company said it was able to make a small profit last year "despite the industry collapsing around it."

But then Merrill Lynch (NYSE:MER - News), which had become the largest buyer of ResMAE's loans, asked the company to repurchase more than $300 million worth of loans. That "enormous" repurchase request, which ResMAE disputes, triggered a liquidity crisis and forced the company to put itself up for sale. The repurchase demands "crippled ResMAE's operations by requiring the company to post enormous reserves, which dramatically reduced its capital and operating liquidity," the company said in its filing.

http://biz.yahoo.com/cbsm/070213/5d76d8ddb54449beafcbb50fc56d311d.html