$SPX Hurst Analysis

#11

Posted 07 March 2009 - 11:20 PM

#12

Posted 08 March 2009 - 01:20 AM

You've spent a lot of time and effort on some elegant charts posted to this board, much appreciated. With regards to earlier posts on this thread, you seem to be following Bob's phasing and that is the one that makes the most sense to me as well. Bob defended his phasing against alternate phasings offered by others quite cogently and I have been not heard compelling agruments otherwise.

So you may find it interesting that these are the seven Hurst 4.5 year lows according to Bob (I'm not sure if this was a personal communication or a previous post):

Aug 1982

Sept 1986

Oct 1990

April 1994 (1st week, only 42 months)

Oct 1998

March 2003

August 2007

He argued that the 1987 crash was a cycle straddle.

The relevance of this is that you would end up reconfiguring your 80wk lows and would not have the 87 and 89 wk long ones. 81wks is the longest since 1982, fitting as this is the largest swiftest drop since then.

Here is a linear chart of the NYA with the 4.5yr lows in black and the 80 wk lows in purple. The 80wk lows before 1994 are not necessarily Bob's, but where I have placed them visually. Also note that the bounce on Friday, yesterday March 6 2009, came right off the 27 year trendline going back to 1982 with 4 and now 5 valid touchpoints. This is also the turn date you mentioned in your Feb 2 post. I think the evidence strongly favors the 80wk low to have been this Friday.

http://stockcharts.com/h-sc/ui?s=$NYA...&listNum=10

If we can't get a rally starting this week, I think this bodes very poorly for the long term future...

Echo/Slinky

#13

Posted 13 March 2009 - 07:24 PM

#14

Posted 14 March 2009 - 07:03 PM

Normally you would be correct that with a severely left translated 80wk cycle off the 4.5yr low, we should keep going down into the next 4.5 yr low in 1012. But what has happened here with this decline is anything but normal and certainly not only influenced by cyclical action. This is what Hurst referred to as a pseudotrend--a powerful fundamental influence that overrides the normal cyclical action. How do I know that? The last 4.5yr cycle from the 2003 lows was severely RIGHT translated and looked powerfully bullish. Hitting a top just a few months after the 4.5yr low August 2007 suggests that SOMETHING BIG HAPPENED--we now know what that is. Once this fundamental influence abates, the natural underlying cyclical action could cause a kind of snapback rebound in the markets. If this were to occur, the next 4.5yr low could actually end up at much higher price levels than today. This, of course, assumes that the fundamental influence of the current financial crisis does abate and without larger longlasting effects.

This is how I look at it.

Echo

#15

Posted 14 March 2009 - 11:28 PM

Edited by SilentOne, 14 March 2009 - 11:30 PM.

#16

Posted 25 March 2009 - 09:06 PM

Today was a 12/14 day (2.5 week) Hurst cycle low. If you hesitated, you likely missed the best buy for that low, same as the 3/4 day low that tested $SPX 705 and the 7 day (1.25 week) cycle low that tested 745. One can argue that Friday's low was a 12/14 day low, but it was quite early.

Let me go back and link a post I made regarding the 80 week low that was likely to occur.

$SPX 80 week lows, 82nd week off the Aug. 2007 low

So as stated then, we are up for a minimum of 7 - 8 weeks and possibly longer, and along the way we are generating higher targets with each passing week. Sounds like a major bear market rally to me. Know this for what it is.

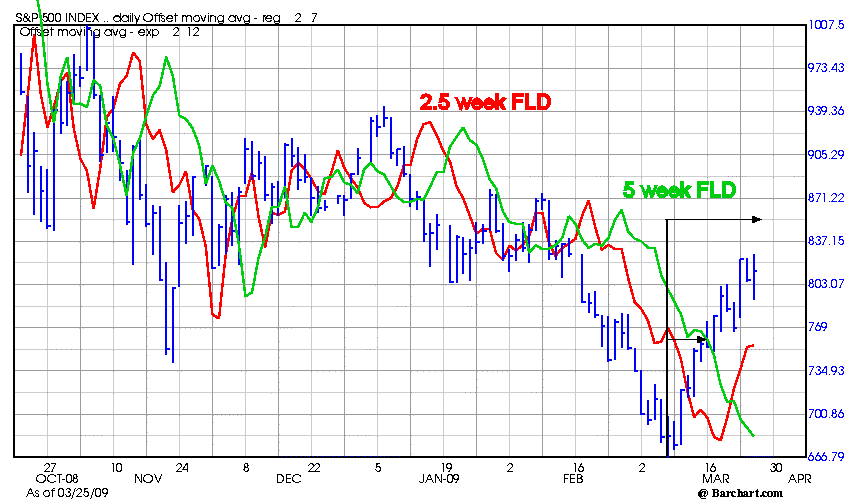

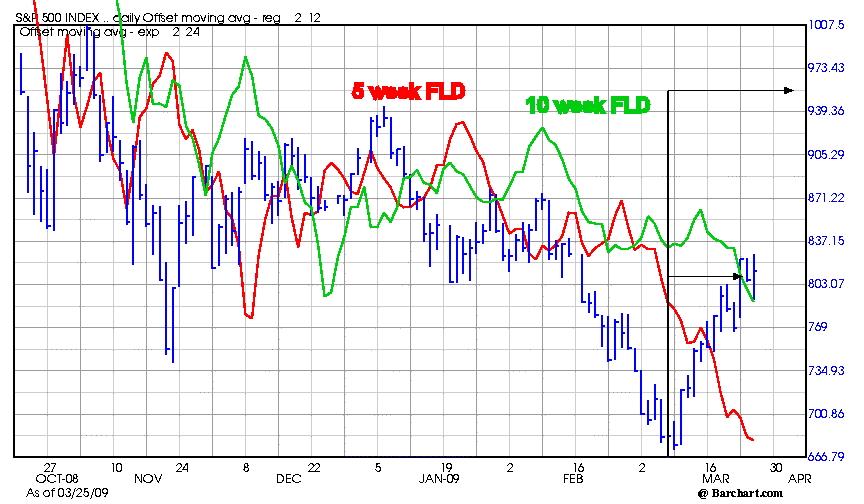

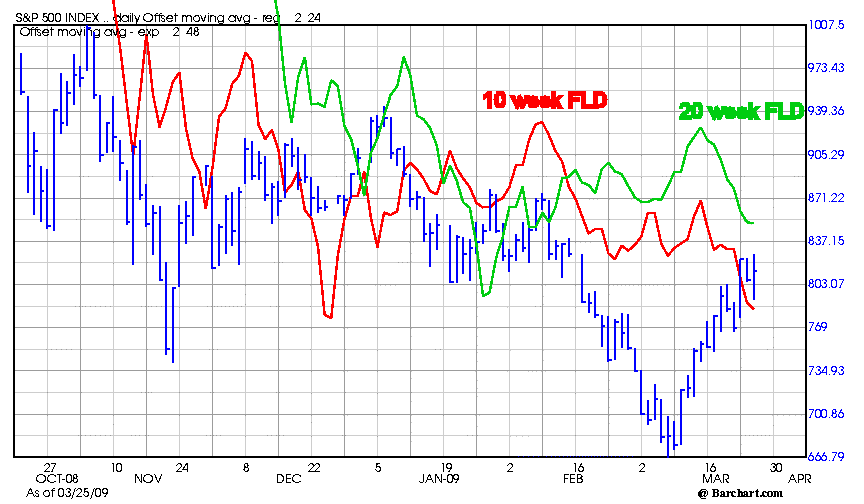

Now given that view and the fact that we are likely to climb a minimum 7 - 8 weeks and possibly more, here are the FLD targets that have been generated thus far. Also note the cascade position of the FLDs and how they are stacked so that one target in one timeframe generates a higher target in the next larger timeframe.

The 2.5 week FLD was easily met at $SPX 775.

The 5 week FLD target (above) is approx. $SPX 855 and this should occur within the next week to 10 days or so.

A 10 week FLD target (above) was generated as well targeting $SPX 950 - 960. This should occur within the current 10 week cycle and possibly by late April some time. The 20 week is also coming into play but let's worry about that when we get there.

cheers,

john

Edited by SilentOne, 25 March 2009 - 09:15 PM.

#17

Posted 02 April 2009 - 08:50 AM

Edited by SilentOne, 02 April 2009 - 08:52 AM.

#18

Posted 14 May 2009 - 10:25 AM

Edited by SilentOne, 14 May 2009 - 10:35 AM.

#19

Posted 12 July 2009 - 02:26 PM

Edited by SilentOne, 12 July 2009 - 02:30 PM.

#20

Posted 12 July 2009 - 03:49 PM