Traders Tax there again

#11

Posted 09 March 2009 - 11:57 AM

#12

Posted 14 March 2009 - 11:54 AM

Edited by Alton, 14 March 2009 - 12:02 PM.

#13

Posted 14 March 2009 - 10:22 PM

When I posted earlier today, I would have sworn I heard Representative DeFazio chime in with "churn" at two trades a day. Actually he never said what his idea of "churning" was, despite being asked. So...in the post immediately above, I retract the first half of the fourth sentence in the paragraph which begins "Another level of harm...." The last part of the fourth sentence, beginning with, "I believe" is just my opinion, and I still think it's valid. Perhaps the interviewer felt the same way.

Fox Business News: Interview with Congressman Peter DeFazio

<<http://www.foxbusine...earch|defazio>>

I don't know the reason, but this video seems to display properly for me only on Internet Explorer. If you have trouble viewing it, it's worth some effort. If you're seeing it for the first time and think the congressman scored some points, please reread the above post on the unfair aspects of the proposed tax.

Alton 3-14-09

PS - A constant irritant is Representative DeFazio's statement that the tax in 1932 did no harm. How can he possibly know what would have happened without the transfer tax? Ah well.

#14

Posted 17 March 2009 - 09:14 PM

Edited by skott, 17 March 2009 - 09:15 PM.

#15

Posted 21 March 2009 - 02:47 PM

Nasty. The congressman may be well meaning, but it seems to me he's using underhanded semantics.

Alton 3/21/09

PS - I may have some new information to post here tomorrow after the change to the new servers. Hopefully the thread will stay pinned here.

#16

Posted 22 March 2009 - 08:46 PM

Suppose a drug company claims a 100 percent cure rate for "what ails you" but we discover the astonishing rate applies to only 1 percent of their customers. Suppose an investment guru claims a 15% return each and every year (think B. M.) and we find it to be untrue. How do we punish these false claims?

Now suppose it's a congressman pushing a tax bill in 2009. Part of the justification, and much of the rhetoric used to promote the bill are the contents and results of a prior tax bill, specifically the "Revenue Act of 1932." What do we do if we find the claims are false?

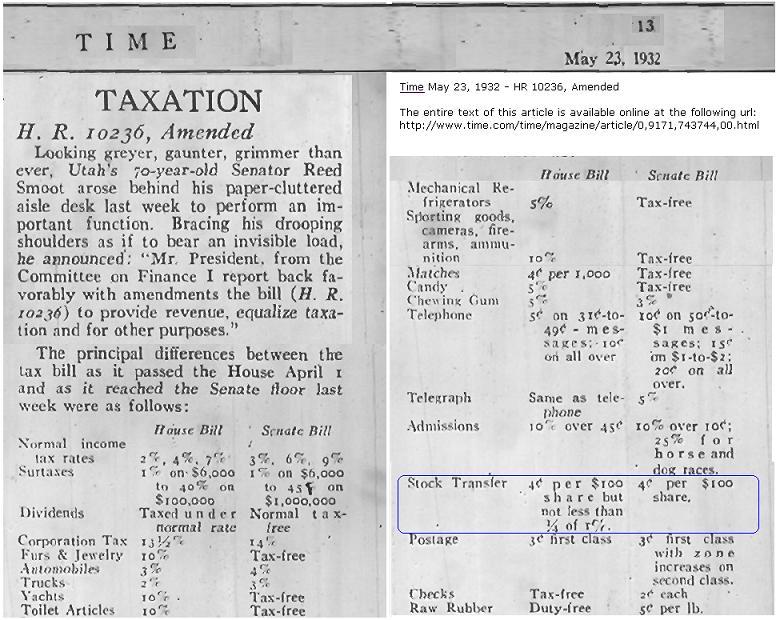

In an interview on FoxBusiness.com (3/4/09) Representative Peter Defazio (referring to notes) states "...1932, when Congress doubled the then tax of .2 to .4 percent." This occurs 1 minute 15 seconds into the video. Link In fact, in 1932 there were two versions of the Revenue Act, one from the House and the other from the Senate. The following image is part of a TIme magazine article from May 23, 1932.

The above image contains only two paragraphs and a table from the text. In the online version of the article (Link) the columns in the table don't align. In the boxed area showing "Stock Transfer" proposals, neither of the legislative bodies proposed a tax as high as the .4 percent (40 cents per $100) Rep. DeFazio mentioned.

Which version of the tax was implemented? There were thirteen hours of non-stop negotiating between House and Senate leaders. The Time issue (Link) of June 13, 1932, states, "In the trading across the table, Utah's grey old Reed Smoot, Chairman of the Senate Finance Committee... won... a cut in the stock transfer tax...." So the Senate version prevailed on that particular aspect. As presented in the May table, the tax rate was 4 cents per $100 share. And that is .04 percent, not the .40 percent Congressman Defazio claimed in the interview. That's a huge difference.

So what do you do about false advertising? As you answer this for yourself, don't think of what has (or hasn't) been done in the past. In 2009 we seem to be demanding a new standard for accountability in many areas. I believe this should include our politicians.

Alton - 3/22/2009

PS - A reminder here that other Congressmen have signed on as cosponsors of HR 1068. Think of them as misinformed.

Sponsor:

..Rep. Peter DeFazio [D-OR]

Cosponsors:

..Rep. Fortney Stark [D-CA]

..Rep. Rosa DeLauro [D-CT]

..Rep. Donna Edwards [D-MD]

..Rep. Lynn Woolsey [D-CA]

..Rep. Barbara Lee [D-CA]

..Rep. Peter Welch [D-VT]

..Rep. Michael Capuano [D-MA]

..Rep. Betty Sutton [D-OH]

..Rep. David Wu [D-OR]

Note: The cosponsor information is current only as of 2009-03-07 and can be found at govtrack.us.

Edited by Alton, 22 March 2009 - 08:56 PM.

#17

Posted 22 March 2009 - 10:20 PM

#18

Posted 23 March 2009 - 12:54 PM

I mentioned to Monk in a message last night that I hesitated before including the list of cosponsors of the House bill in the earlier post. I was not trying to show their party, and regret not editing out the notations. I was simply trying to show that Rep. DeFazio is not acting alone. If we start talking about political affiliation, the thread will evolve into mudslinging, and the topic could be banned. So, let's please try to leave out discussion of partisanship.

I think traders (and most investors) of all parties are with us.

Alton 3-23-09

PS - Lest anyone try to argue that postage (for example) was 3 cents in 1932, but is 42 cents today (using that as justification for a higher tax on stock transfer) remind them that equities which increase in value are subject to stock splits. There's no equivalent altering of value for postage or any commodity that I know.

I mentioned to Monk in a message last night that I hesitated before including the list of cosponsors of the House bill in the earlier post. I was not trying to show their party, and regret not editing out the notations. I was simply trying to show that Rep. DeFazio is not acting alone. If we start talking about political affiliation, the thread will evolve into mudslinging, and the topic could be banned. So, let's please try to leave out discussion of partisanship.

I think traders (and most investors) of all parties are with us.

Alton 3-23-09

PS - Lest anyone try to argue that postage (for example) was 3 cents in 1932, but is 42 cents today (using that as justification for a higher tax on stock transfer) remind them that equities which increase in value are subject to stock splits. There's no equivalent altering of value for postage or any commodity that I know.

Edited by Alton, 23 March 2009 - 01:02 PM.

#20

Posted 01 April 2009 - 11:00 PM

"..Rep. Peter DeFazio [D-OR]

Cosponsors:

..Rep. Fortney Stark [D-CA]

..Rep. Rosa DeLauro [D-CT]

..Rep. Donna Edwards [D-MD]

..Rep. Lynn Woolsey [D-CA]

..Rep. Barbara Lee [D-CA]

..Rep. Peter Welch [D-VT]

..Rep. Michael Capuano [D-MA]

..Rep. Betty Sutton [D-OH]

..Rep. David Wu [D-OR]"

D=Democrat

R=Republican

what does the "D" mean?

thx in advance

monk

Edited by jdjimenez, 01 April 2009 - 11:01 PM.